Cyclical Trend

IPO Exposure

The Hottest Private Companies

In A Nutshell

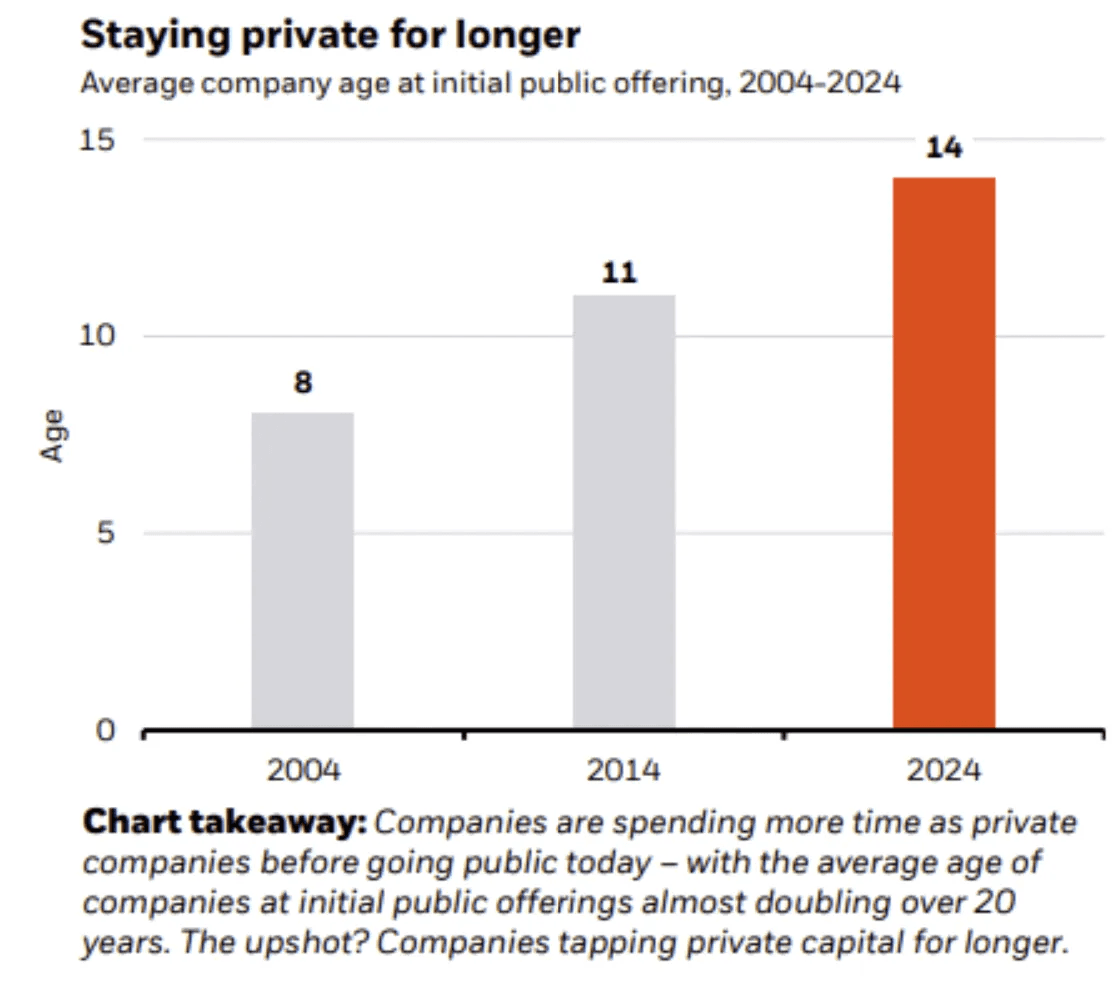

Private companies are staying private longer.

This trend has been clear for years. There is a massive amount of value locked in private markets. And it’s tough for retail investors, because most people can only invest once these companies finally IPO, and by then they’re already big. It doesn’t mean there’s no upside left, but much of it has likely already taken place.

There are a few simple reasons for this.

First, companies can raise a lot of money without going public. Today there is far more private capital. Large funds, sovereign wealth funds, private equity, and big corporations are all investing billions into startups and mature tech companies. A good company can raise $100M, $500M, or even more without listing its shares. In the past, funding rounds like this usually required an IPO. Now they can happen privately, so there’s less pressure to list early.

Second, going public is expensive and complex. IPOs require strict reporting, constant disclosure, and high legal and accounting costs. One mistake can lead to lawsuits or regulators getting involved. Staying private is often simpler. Management doesn’t need to worry about short-term stock price moves or quarterly earnings calls. They can focus on building their businesses.

Third, late-stage private markets have turned into a kind of alternative stock market. Investors can buy and sell shares through secondary markets, so they can still make money without an IPO. Employees can also sell part of their equity before the company ever lists. That removes one of the main reasons to go public quickly, since people can now get partial liquidity earlier.

Hence, there’s been a new trend of private funds offering vehicles for public investors to invest alongside them. These are usually not great deals. They are expensive, and you don’t really know what you’re getting or what rights you have.

Another interesting development is tokenization. Robinhood has already offered selected investors access to tokenized shares of companies like OpenAI and SpaceX. It’s unclear how this will develop, but it is an interesting step.

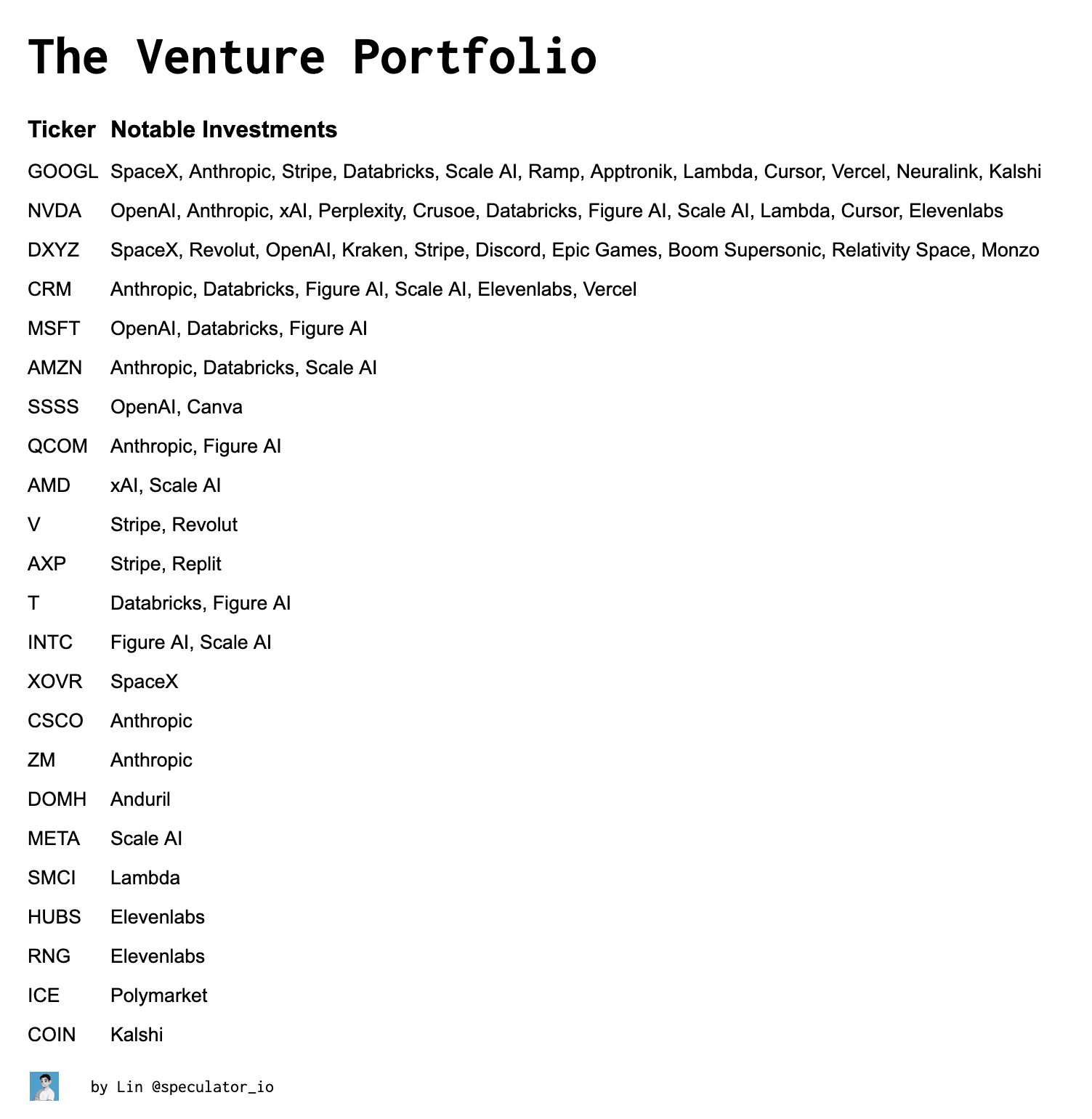

Luckily, many large tech companies have venture arms of their own. That gives retail investors a simple way to get exposure to sought-after private companies just by owning the highest quality tech companies. And what’s interesting here is that Google and Nvidia are some of the most active venture and successful venture investors. This makes them almost like pre-IPO funds hiding inside big tech stocks.