Lin

Jan 18, 2026

Weekly Market Update: Rotation

We’re not even 3 weeks into 2026, and it already feels like 3 months have passed.

A lot has already happened. Over the last decade the markets have started to move much faster now. News. Reactions. Pullbacks, rallies, rotations. Everything is compressed.

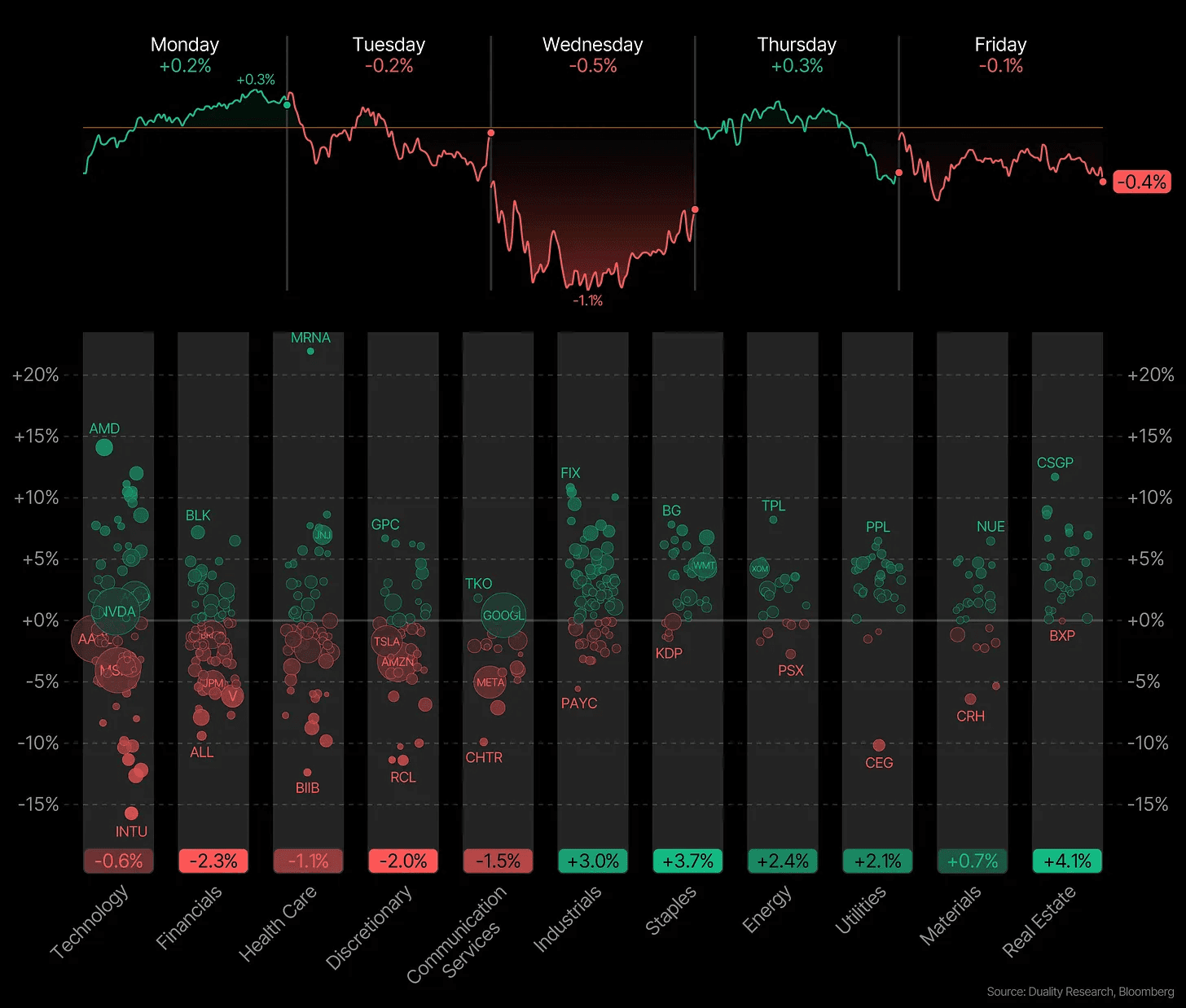

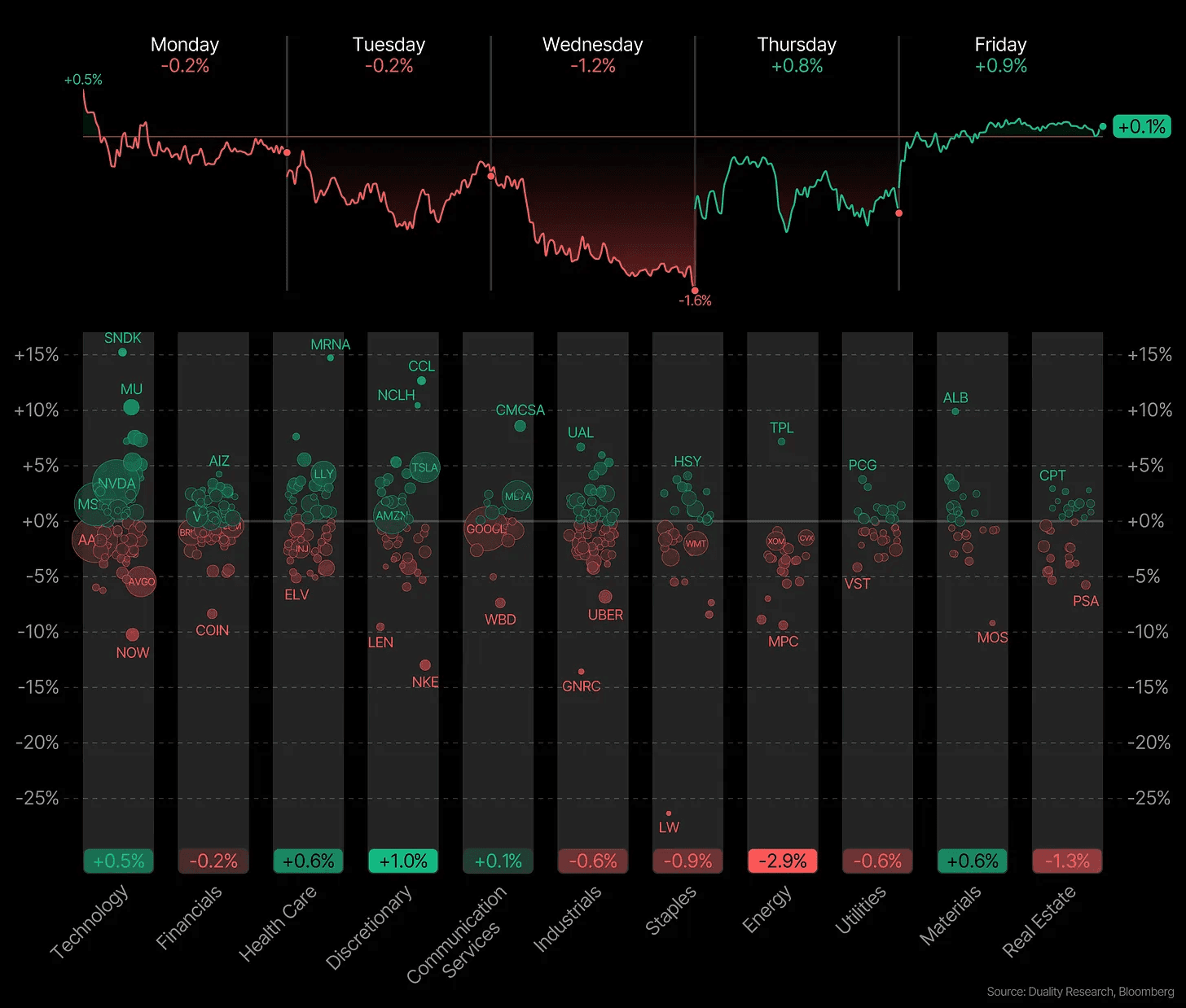

This week the broader market pulled back a bit even though we saw record earnings from TSMC. The selloff came from somewhere else. Rising yields and fresh talk about who the next Fed Chair might be.

That’s how markets work. The story changes every day.

One day it’s rates. The next it’s geopolitics. Then central banks. Then tariffs. And so forth.

Just over the weekend, Trump announced new tariffs targeting Europe, tied to the US pushing to buy Greenland. This is the environment we’re in right now. There is always a new headline. Always a new reason for fear or excitement.With earnings season starting again, so expect volatility to return.

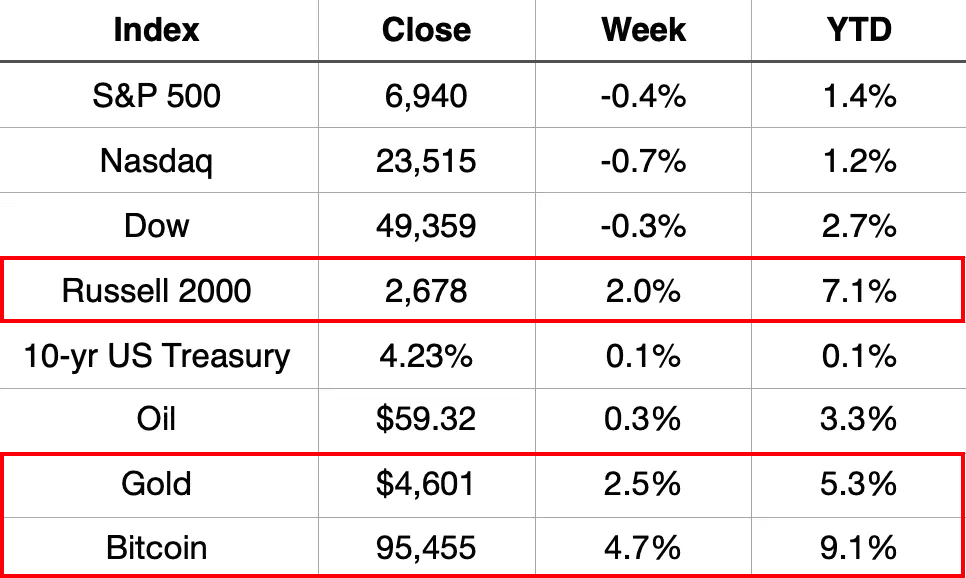

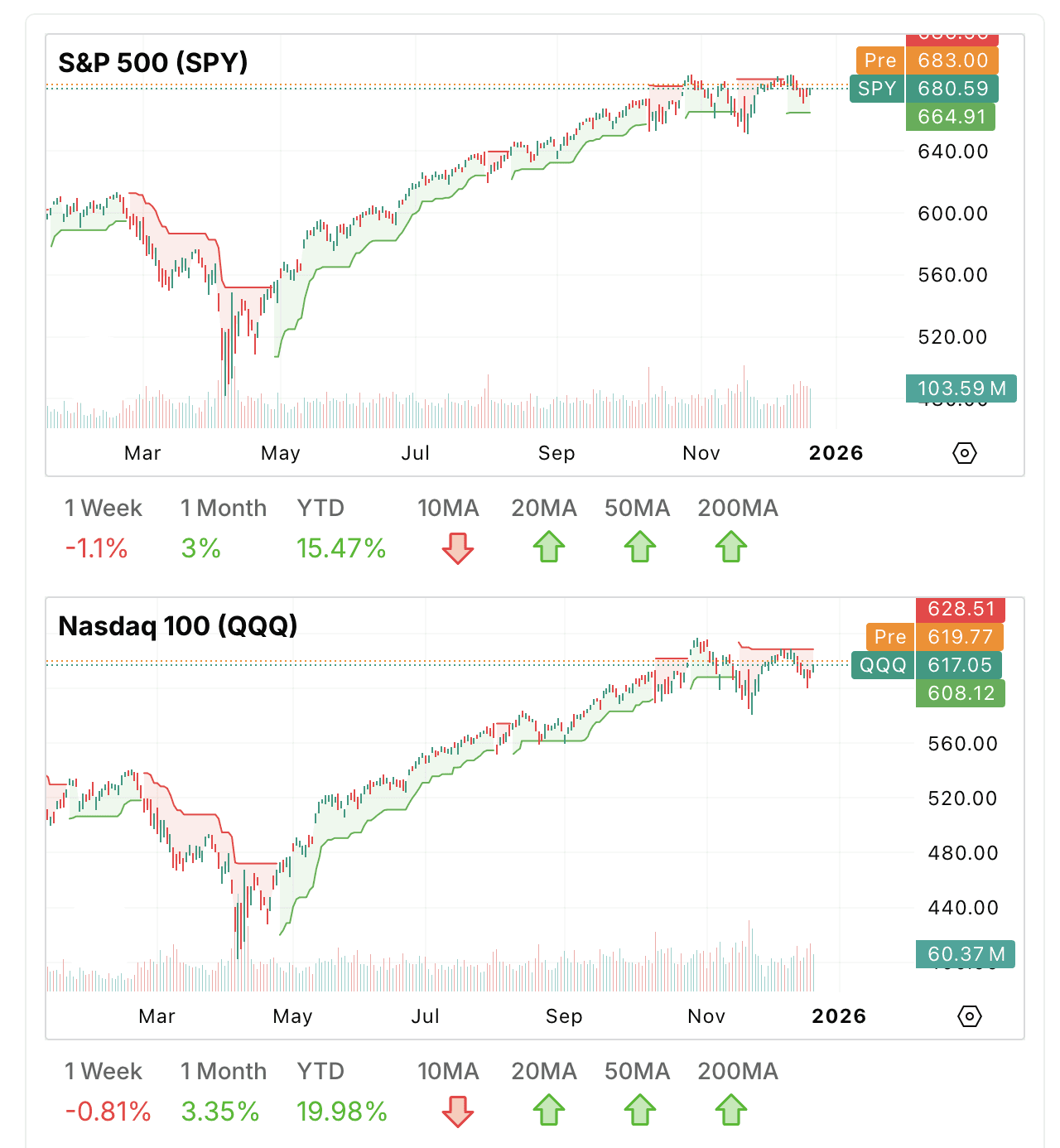

All major indices ended the week in the red. But not everything was down. Bitcoin, gold, and Small caps were up. That tells you money did not leave the market. It just rotated.

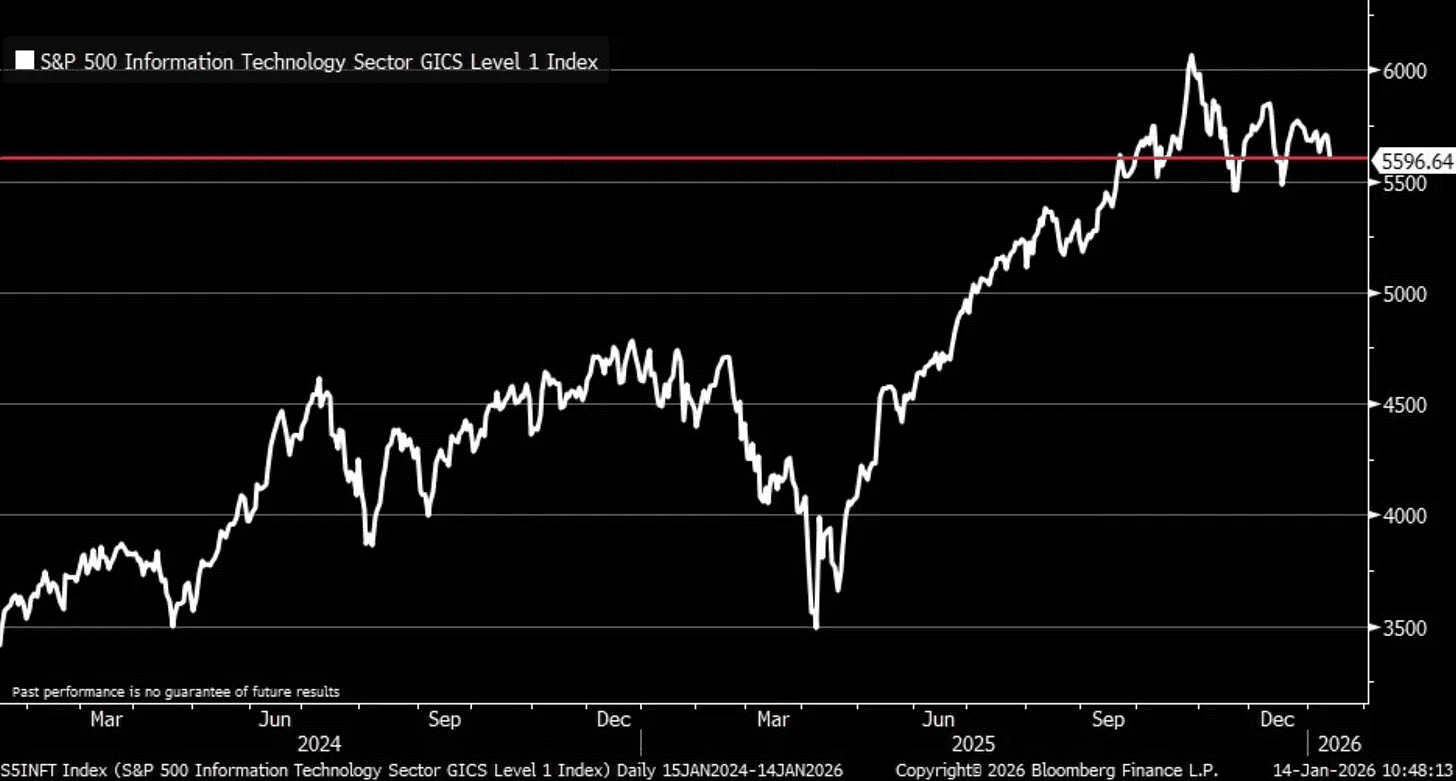

The Nasdaq and S&P 500 are essentially flat over the last four months.

Long periods of consolidation usually don’t last forever. They tend to lead to a big expansion move. The only question is the direction.

Ideally, we see QQQ break out of this range. But a breakdown is also possible. That’s the reality of markets. Nobody knows anything for sure. What we can do is study history, look at the data, and consider different scenarios to form a hypothesis.

Only time will tell. But it will likely be coming sooner rather than later.

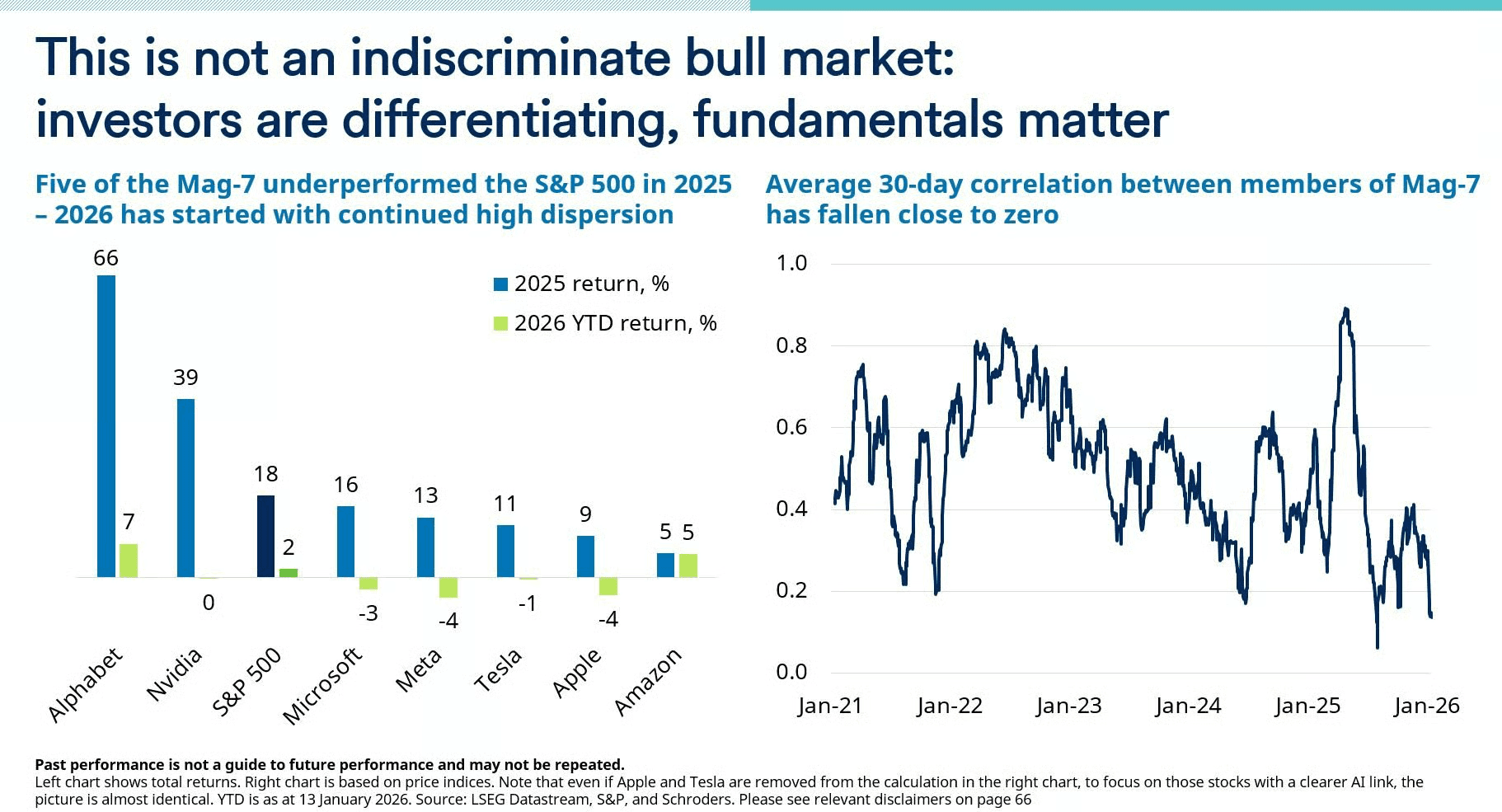

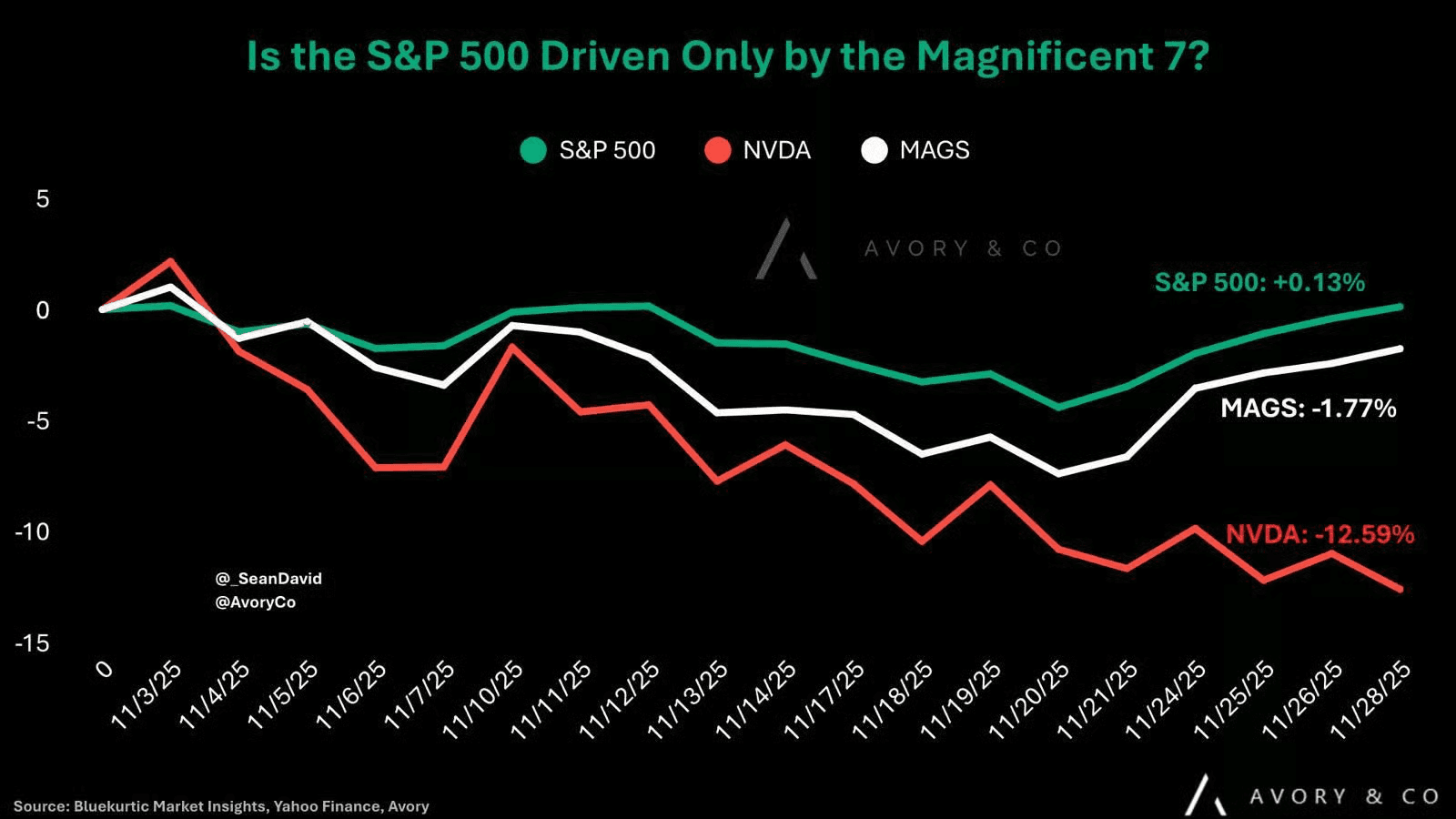

Interestingly, the big tech stocks aren’t really moving together anymore. The average correlation between the Mag 7 is close to 0. In simple terms, they’re no longer acting like one big group. Investors are trying to separate the winners from the losers. Right now, Google and Amazon are the ones holding up best.

Except for some weakness in a few areas, most other sectors are actually doing fine.

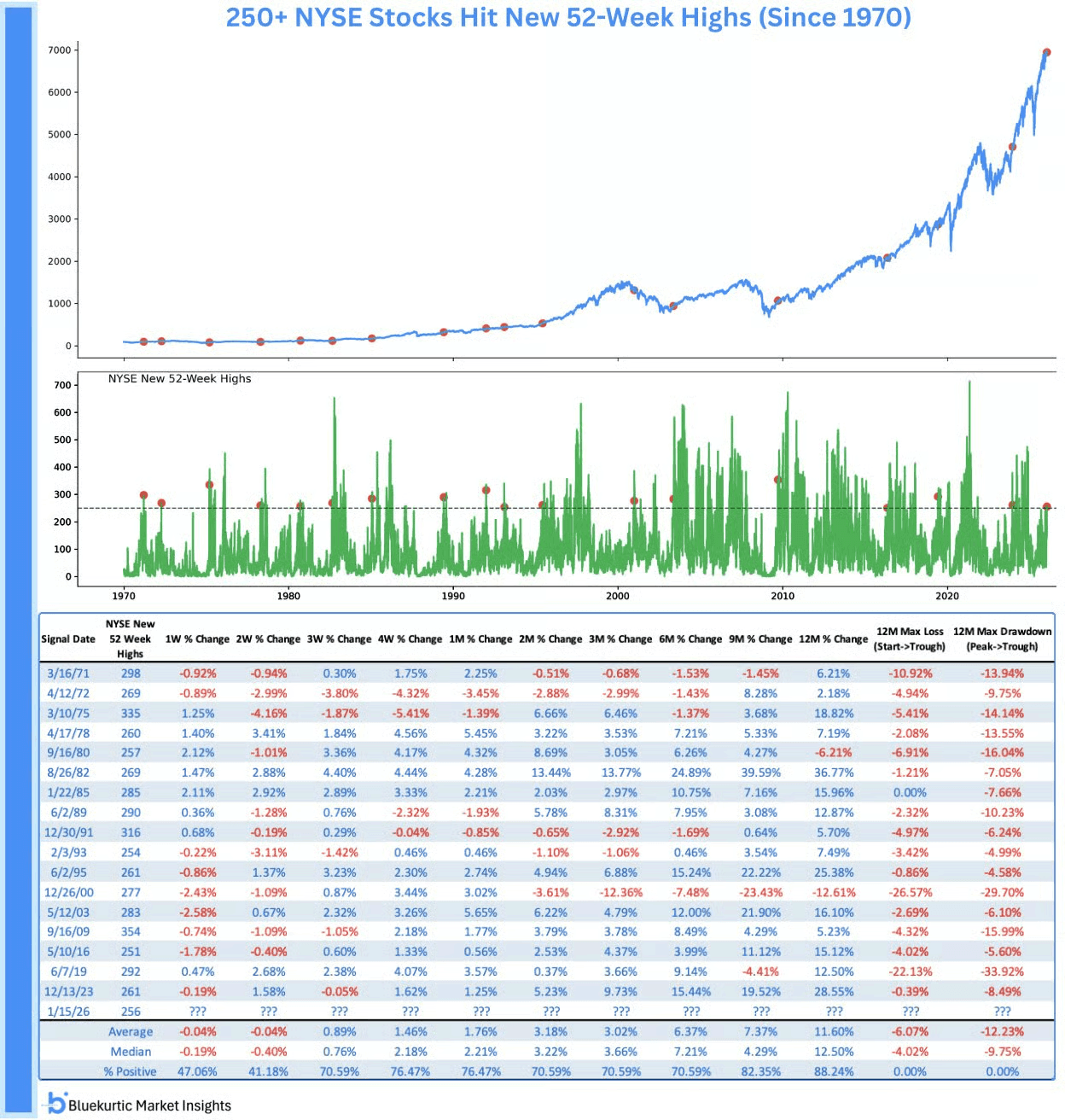

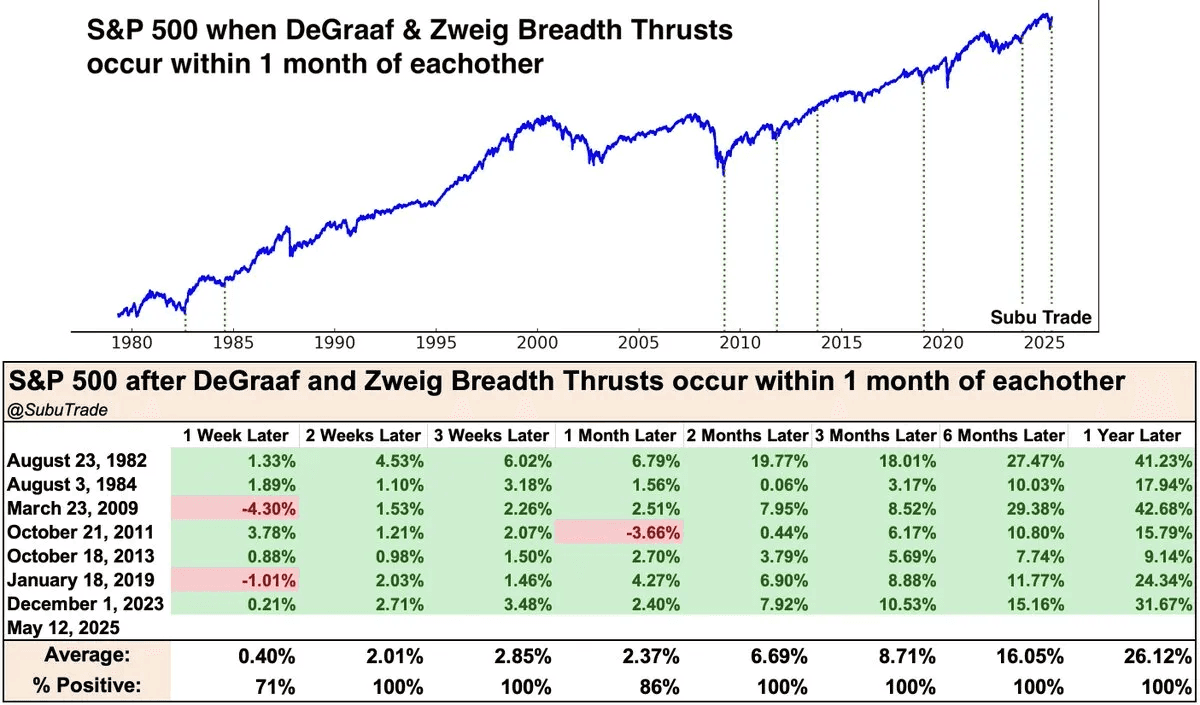

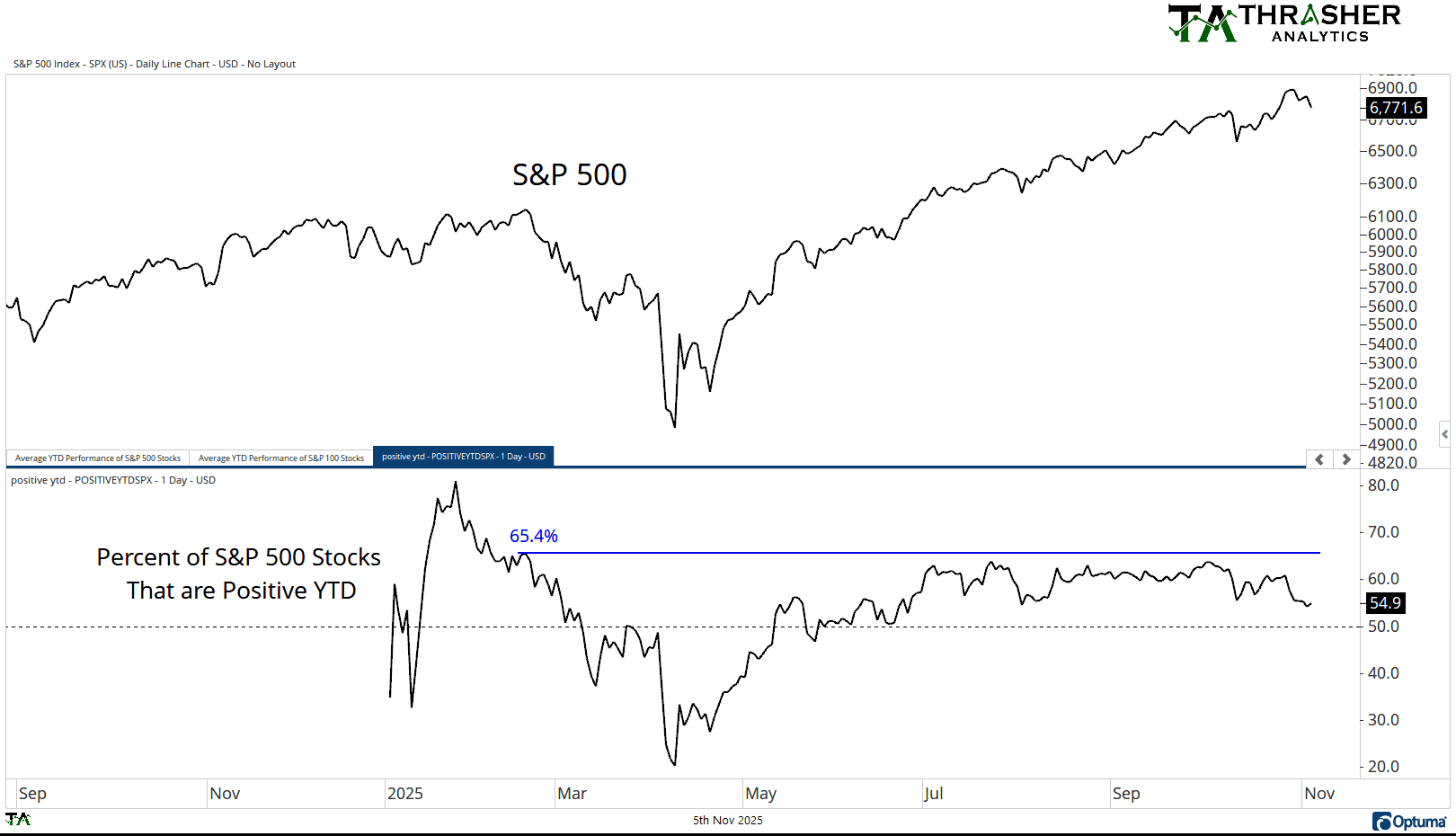

Market breadth keeps getting better, and that’s important. More stocks are participating. Last week, more than 250 NYSE stocks hit new 52 week highs. That’s rare. It has only happened 18 times since 1970.

History is pretty clear here. In the prior 17 cases, the S&P 500 was higher 12 months later 88% of the time. Of course, nothing is ever guaranteed, but improving market breadth like this usually shows the market is healthier than the headlines may make it seem.

Even crypto is starting to come back to life.

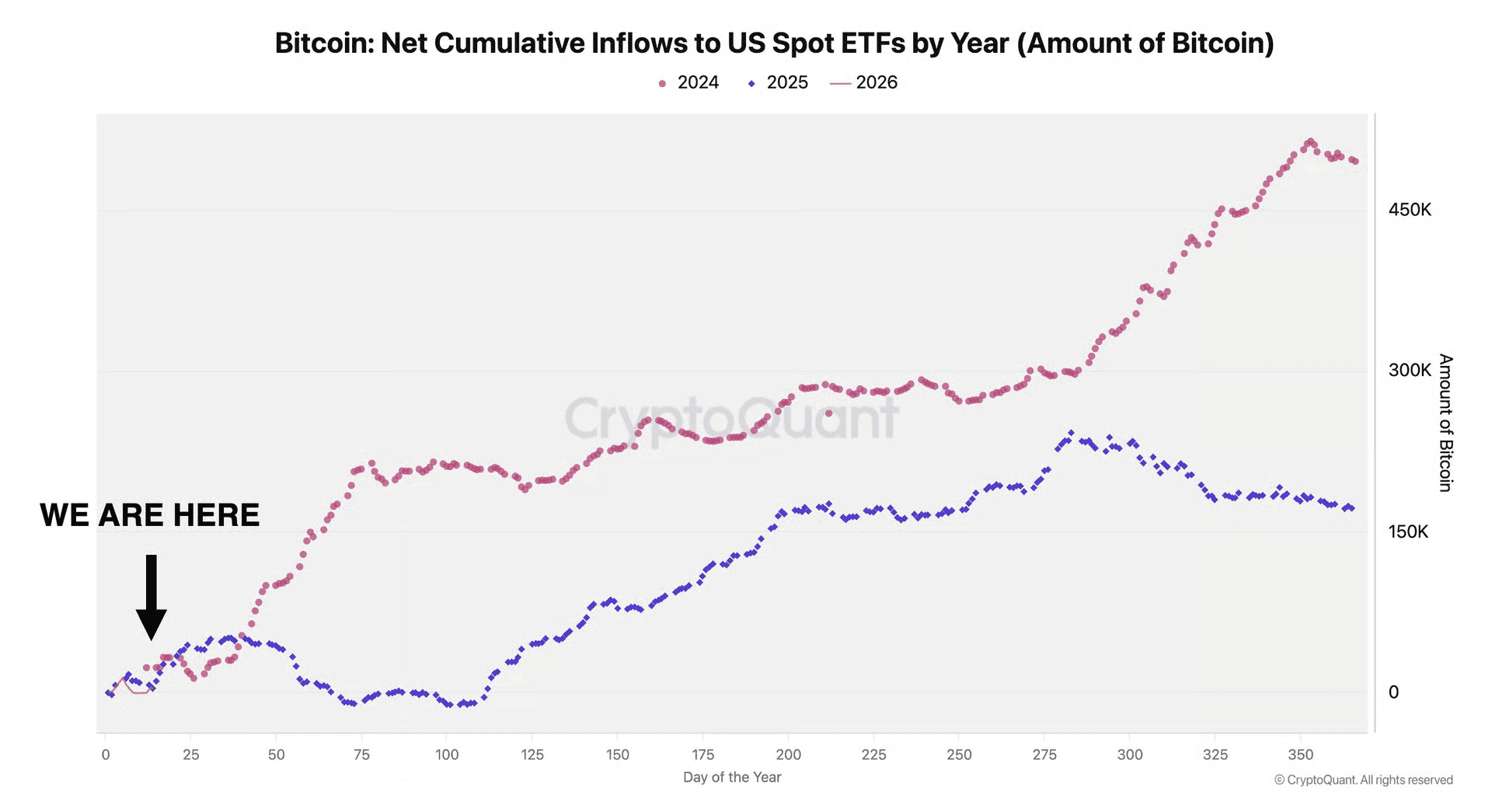

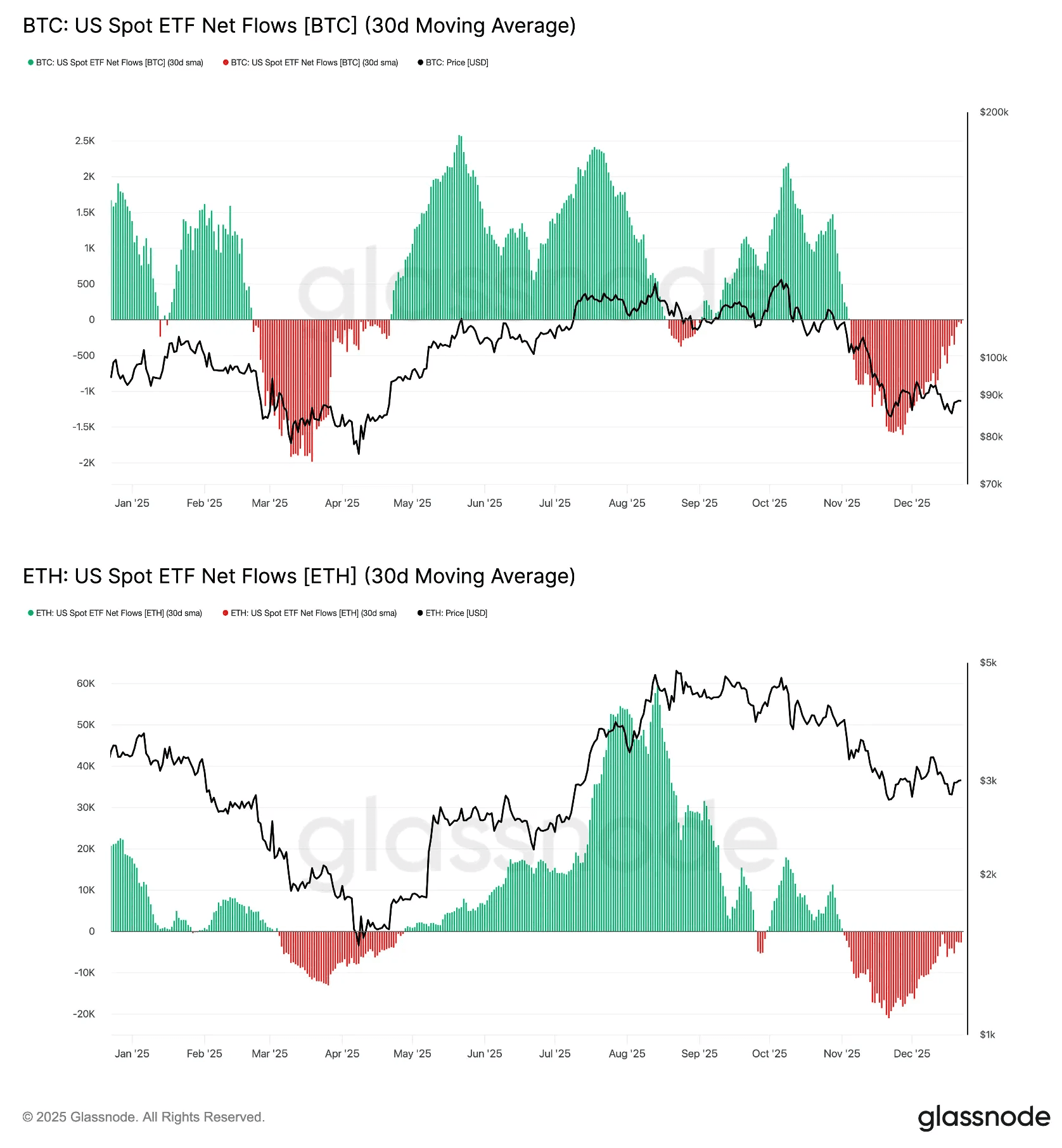

Bitcoin ETF inflows this year have reached about 3.8K BTC. That’s slightly more than the 3.5K BTC we saw in the same period last year. This is still early in the year. That’s important because January is usually quiet for crypto flows. The bigger inflows tend to show up later, often between February and April.

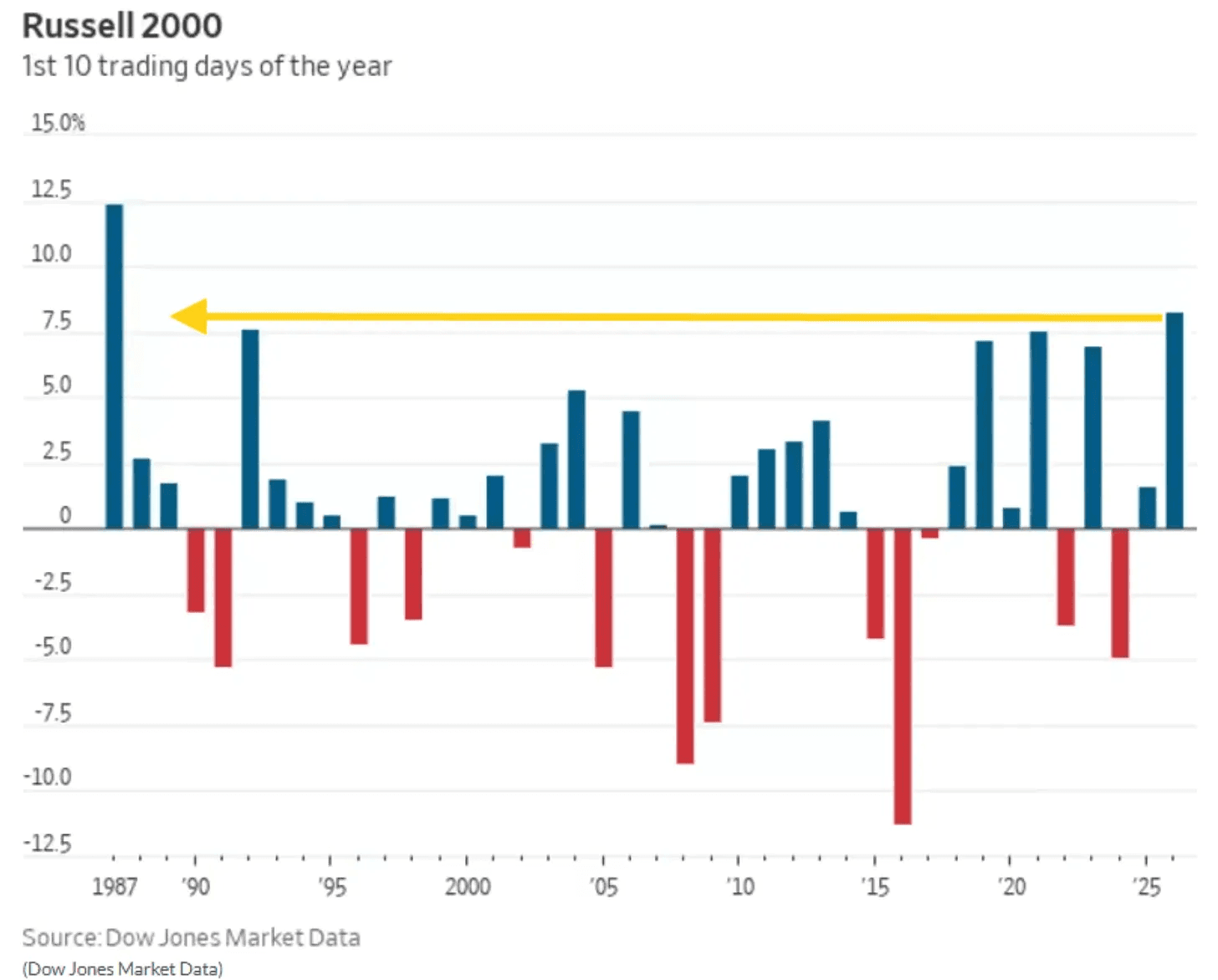

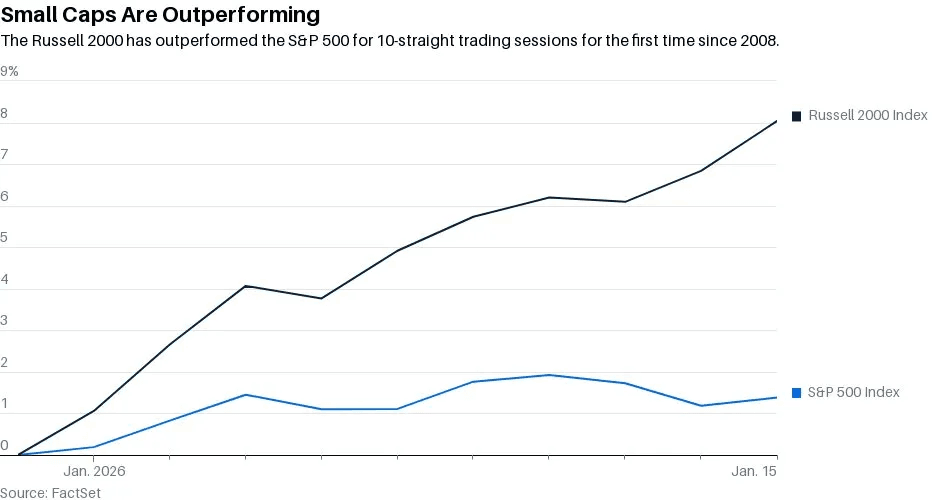

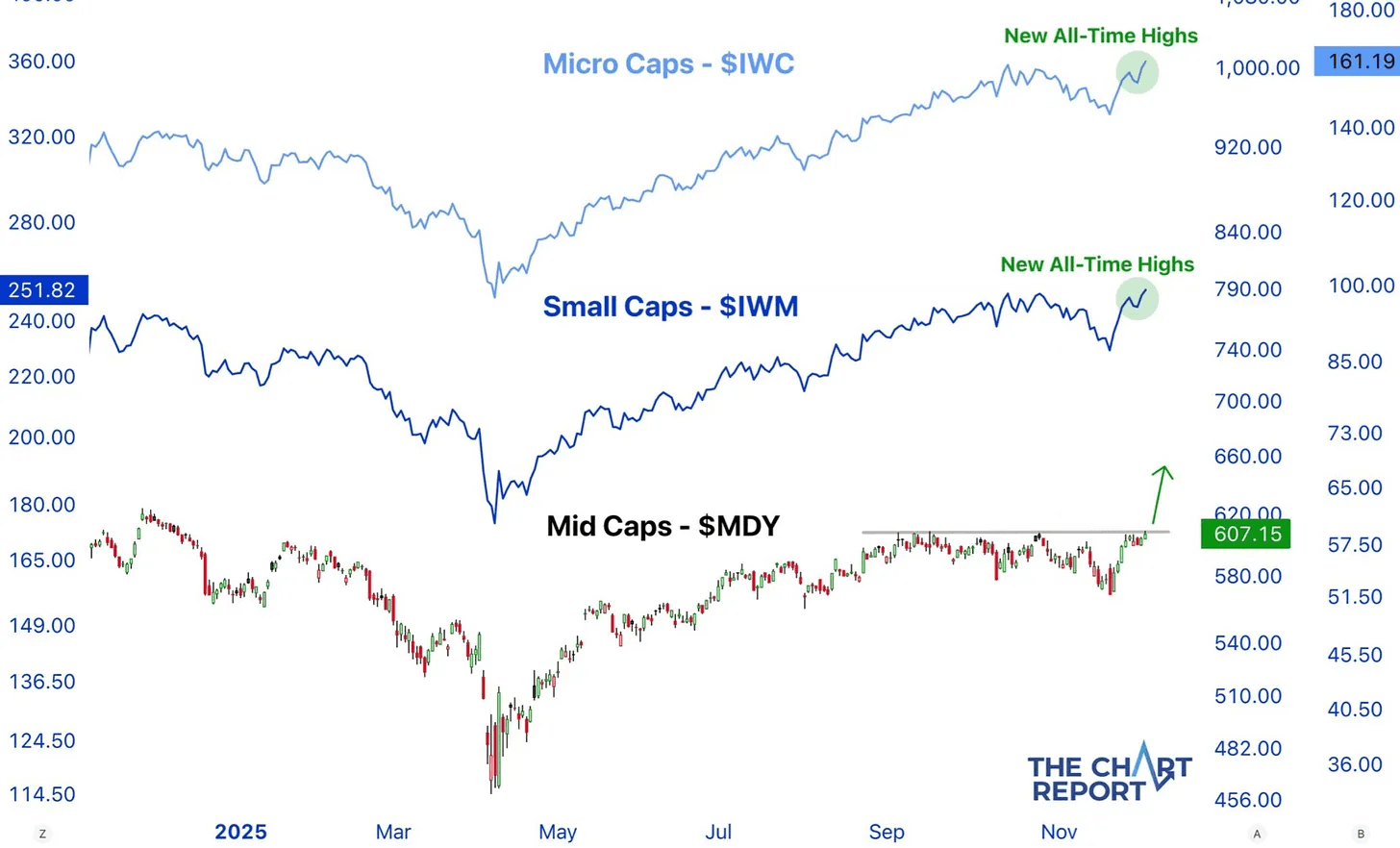

Small caps are off to a strong start.

The Russell 2000 is up more than 7% to start 2026. That’s the best first 10 days of a year since 1987. A very uncommon move. In fact, the Russell 2000 has now outperformed the S&P 500 over the last 3 months.

Small caps are clearly leading. And there’s a good chance that leadership continues through the year. It’s another sign the market is broadening out, not narrowing.

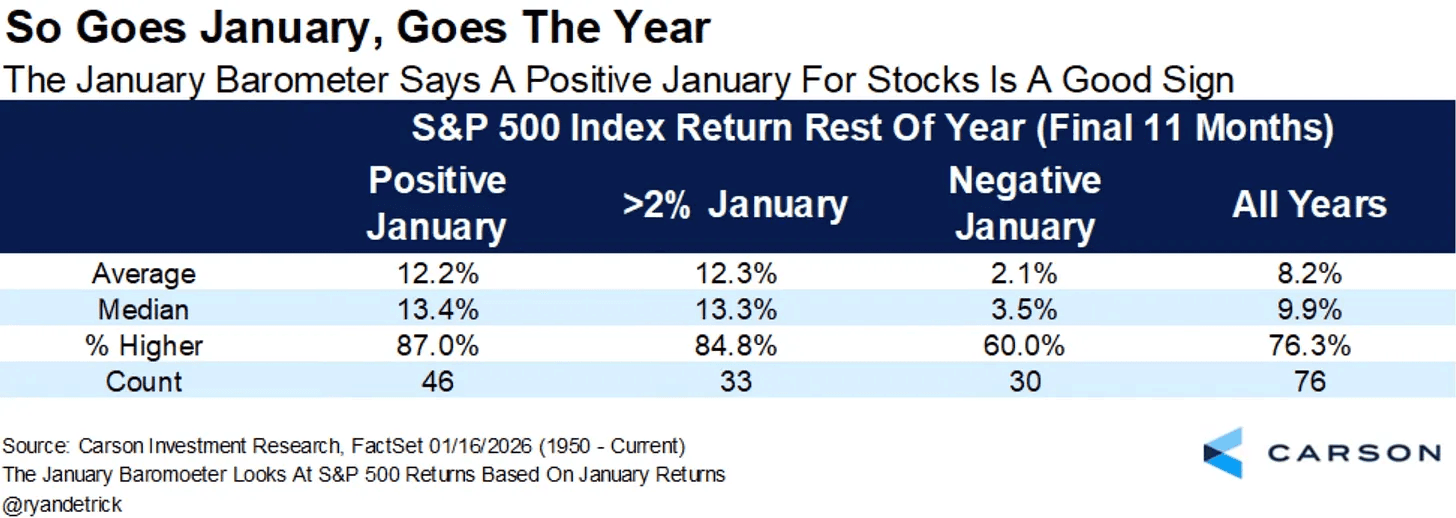

January’s performance is worth paying attention to, mostly because history has been pretty clear on this.

If January finishes higher, it’s usually a good sign for the rest of the year. When January is up, the final 11 months tend to do even better. And when January is up more than 2%, the rest of the year is higher almost 85% of the time, with returns of more than 12% on average.

Of course, nothing is guaranteed. But it’s worth keeping on the radar.

Wall Street is very bullish on 2026. And when you zoom out, it’s not hard to see why.

Stocks are at record highs.

Gold is at a record high.

Silver is at a record high.

Home prices are at record highs.

Copper is at a record high.

Platinum is at a record high.

Money market funds are at record highs.

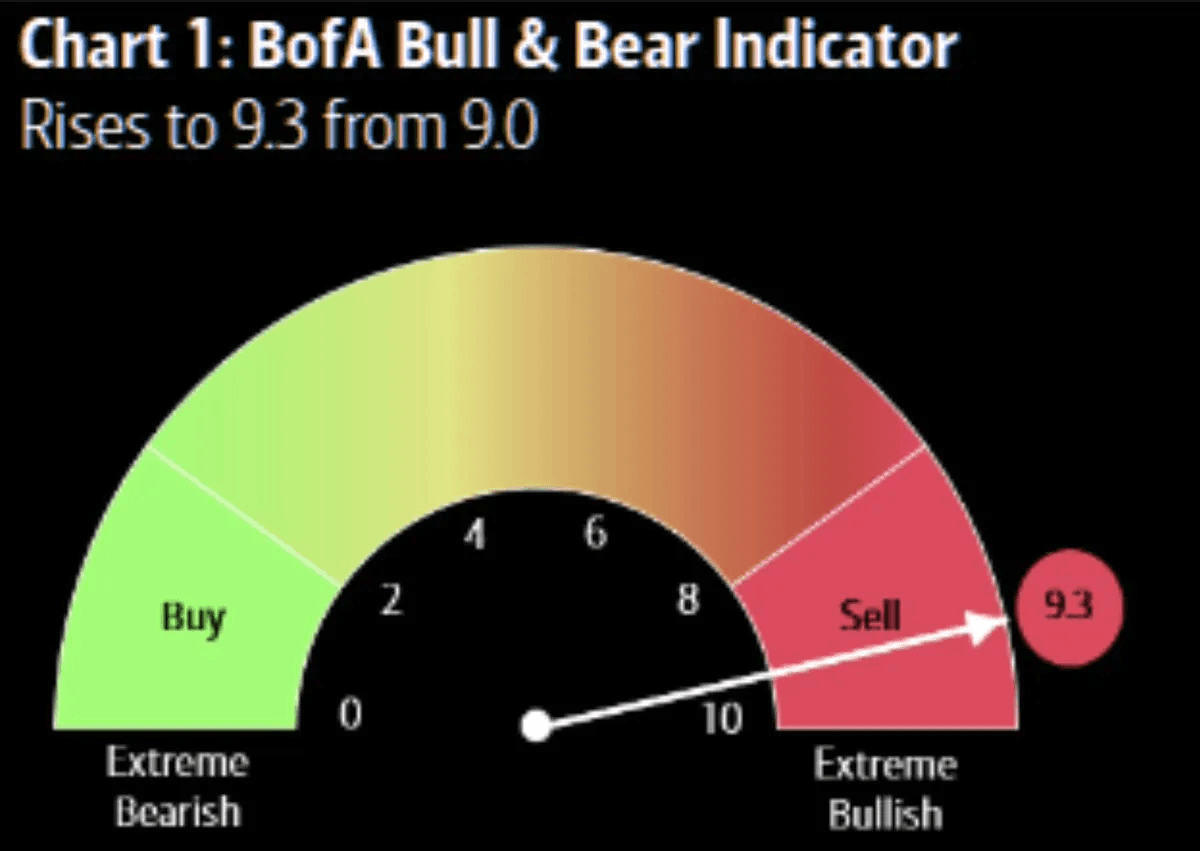

Almost everything you look at is sitting at or near an all time high. So it really shouldn’t surprise anyone that bullishness is also at a record level.

The only thing that’s a bit worrying is when almost everyone is bullish and on the same side of the boat. There aren’t many new buyers left, expectations get really high, and even a small surprise can move the market more than people expect.

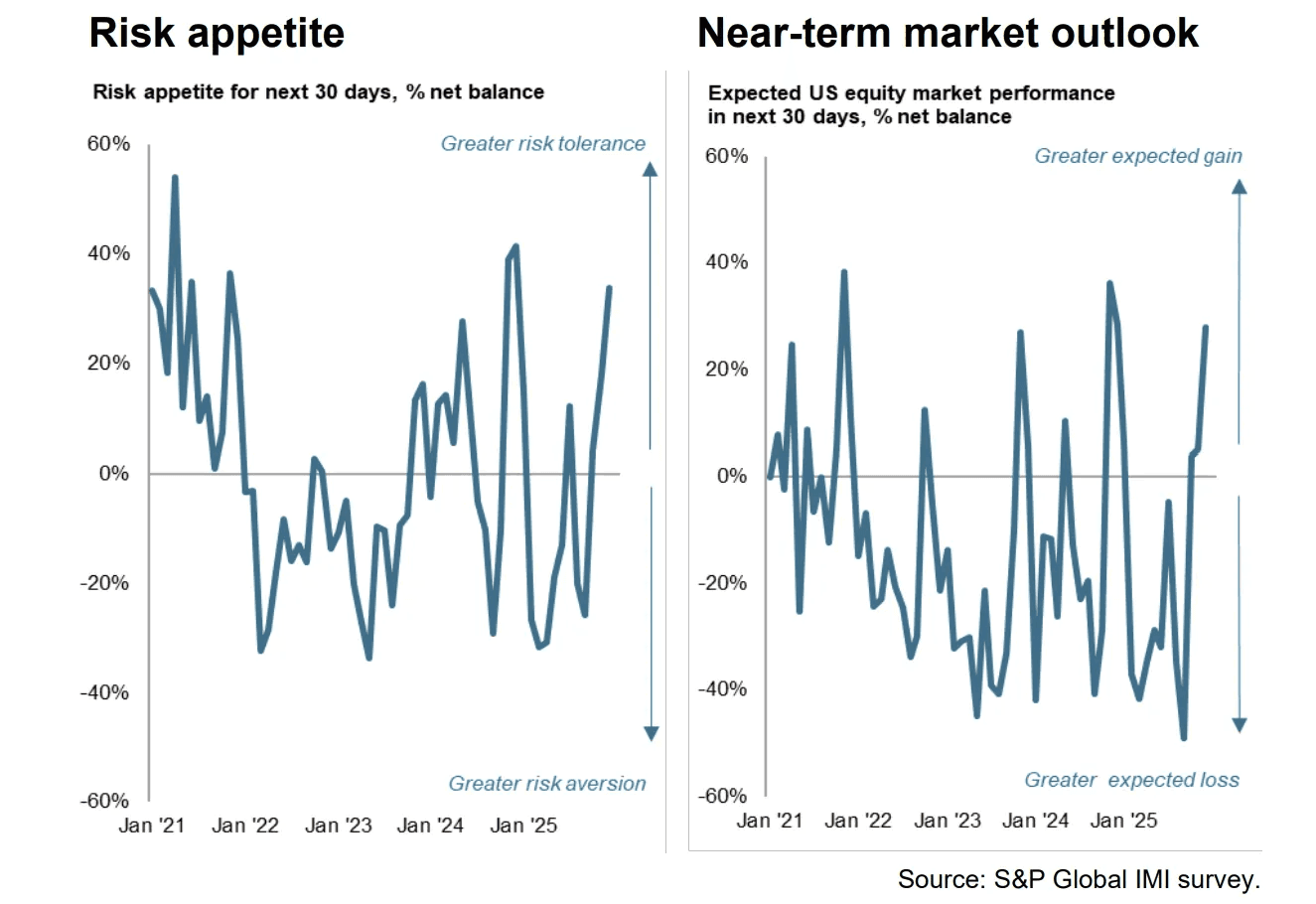

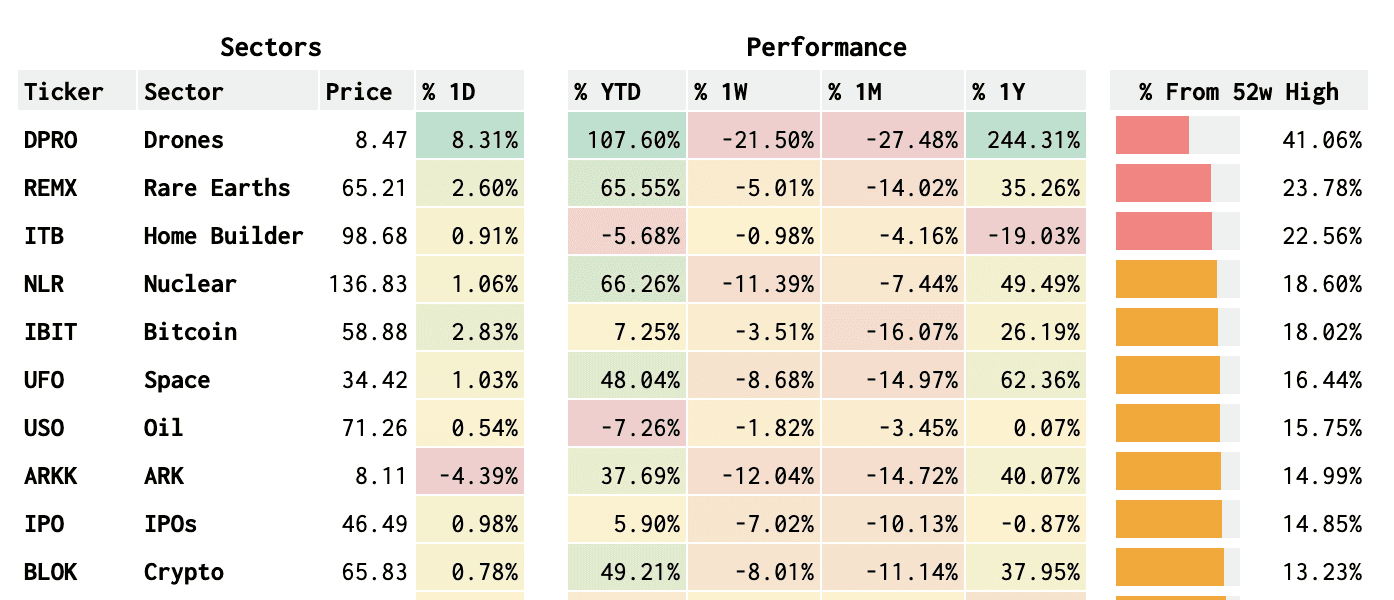

And it’s not surprising that risk appetite has increased a lot. You can see it clearly in the market. More speculative themes like rare earths, space, robotics, biotech, nuclear, crypto, drones, and quantum are all starting to take off.

By itself, that’s not a bad thing. You can actually benefit from it if you play it right. But you have to manage risk and your exposure at all times.

This is a big change from where things were just a month ago.

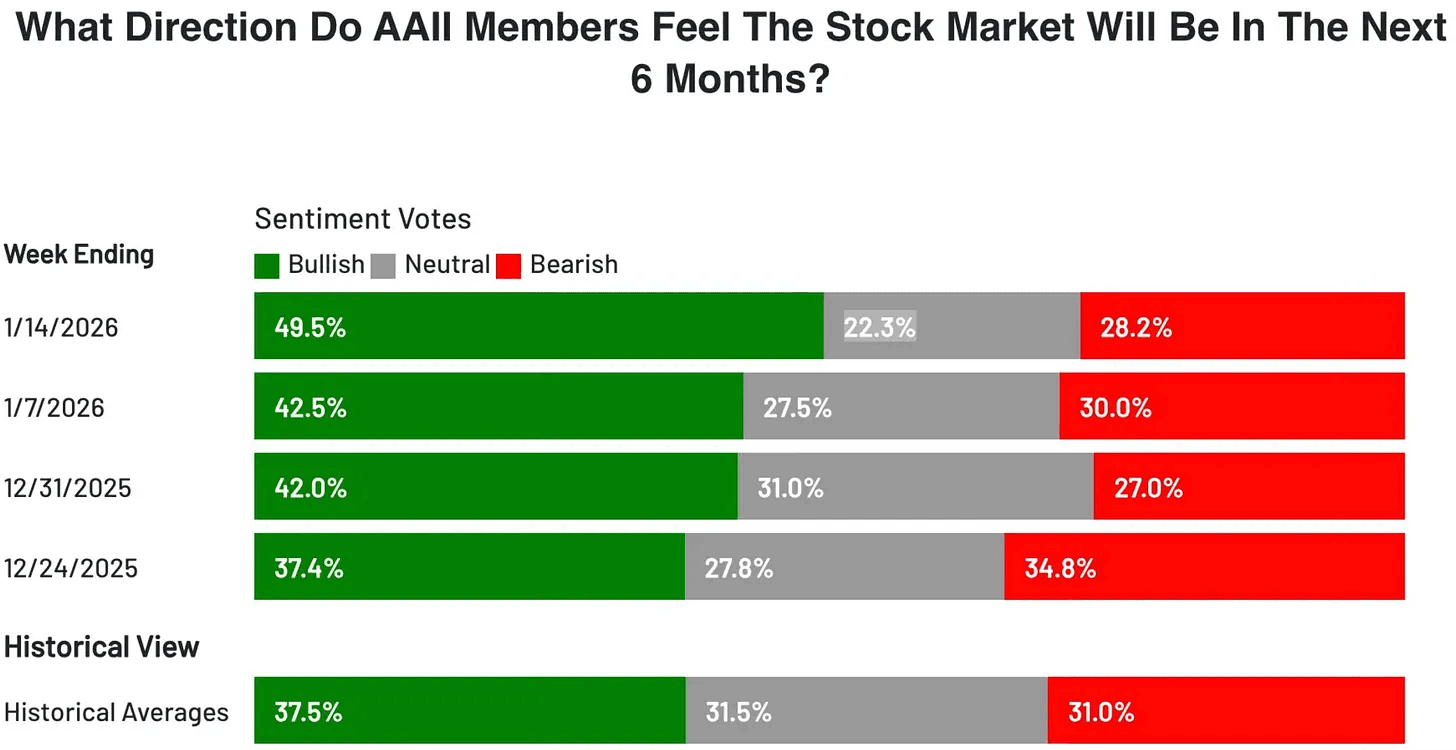

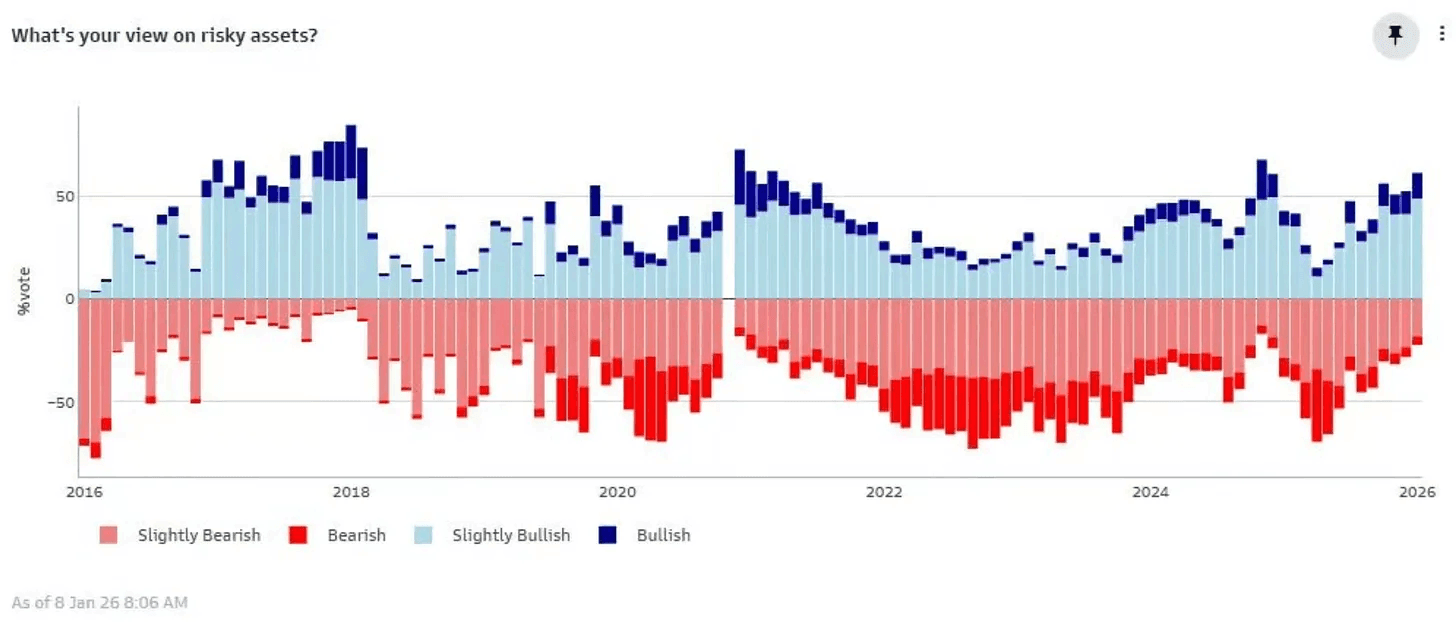

The AAII sentiment survey is now at 49.5%, the highest level we’ve seen in the past year. The Fear and Greed index has also flipped back to Greed for the first time in what feels like forever. On top of that, the BofA Bull and Bear indicator is now at 9.3.

It’s worth paying attention. That’s enough to start being a bit more cautious.

Goldman’s Marquee client poll shows bullishness at levels we’ve only seen three other times in the past decade. Late 2017, late 2020, and late 2024. In 2 of those cases, the market saw a correction within about 3 months.

For now though, the music is still playing. And there’s no clear sign that it’s about to stop.

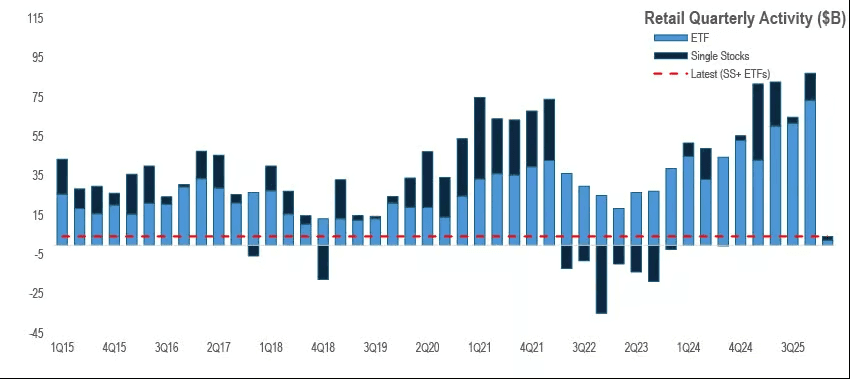

Retail traders have carried their buying streak into the new year after a record 2025. In the first 4 trading days of January, purchases hit the second highest level in almost 8 months.

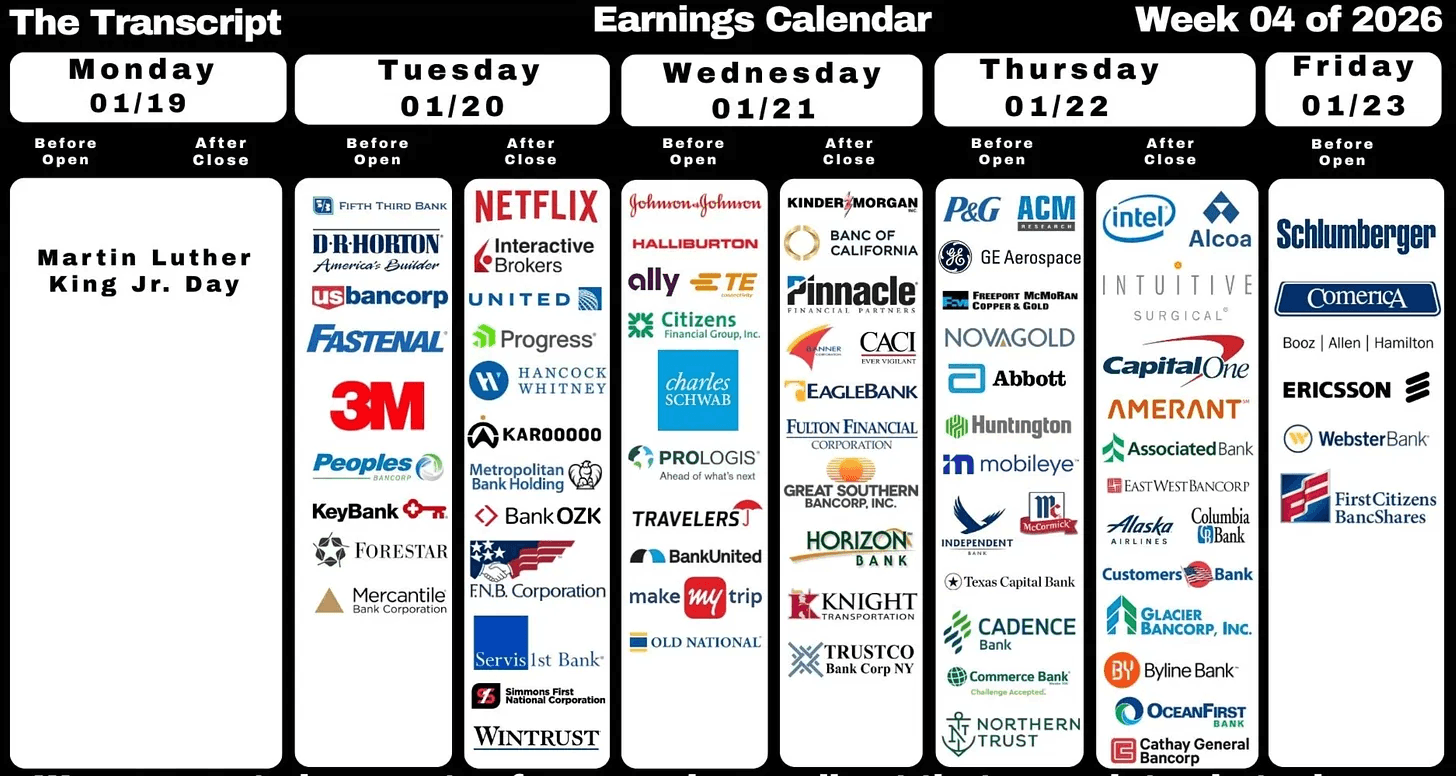

Earnings season is well underway, and this week brings a few important reports.

Netflix will give us a good read on the consumer and whether discretionary spending is still holding up. Intel is another key one. Expectations are high after its recent stock run, so the bar is set pretty high.

I’ll be paying more attention to the guidance and management commentary than just the headline numbers. Intuitive Surgical is also worth watching. Last quarter it had a huge earnings gap, and the market will be looking to see if it can deliver something similar again this time.

A lot of banks are reporting as well, along with a few smaller names like Mobileye ($MBLY).

Wars, unemployment, the Fed, Greenland. There is always noise in the market, and there always will be.

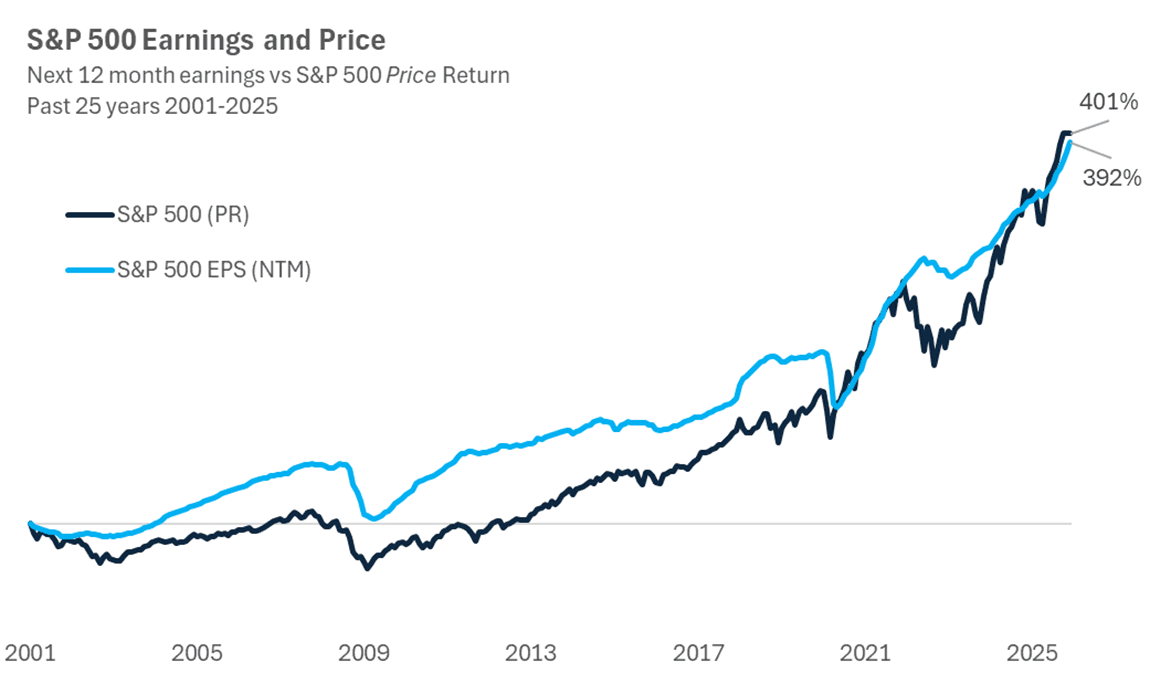

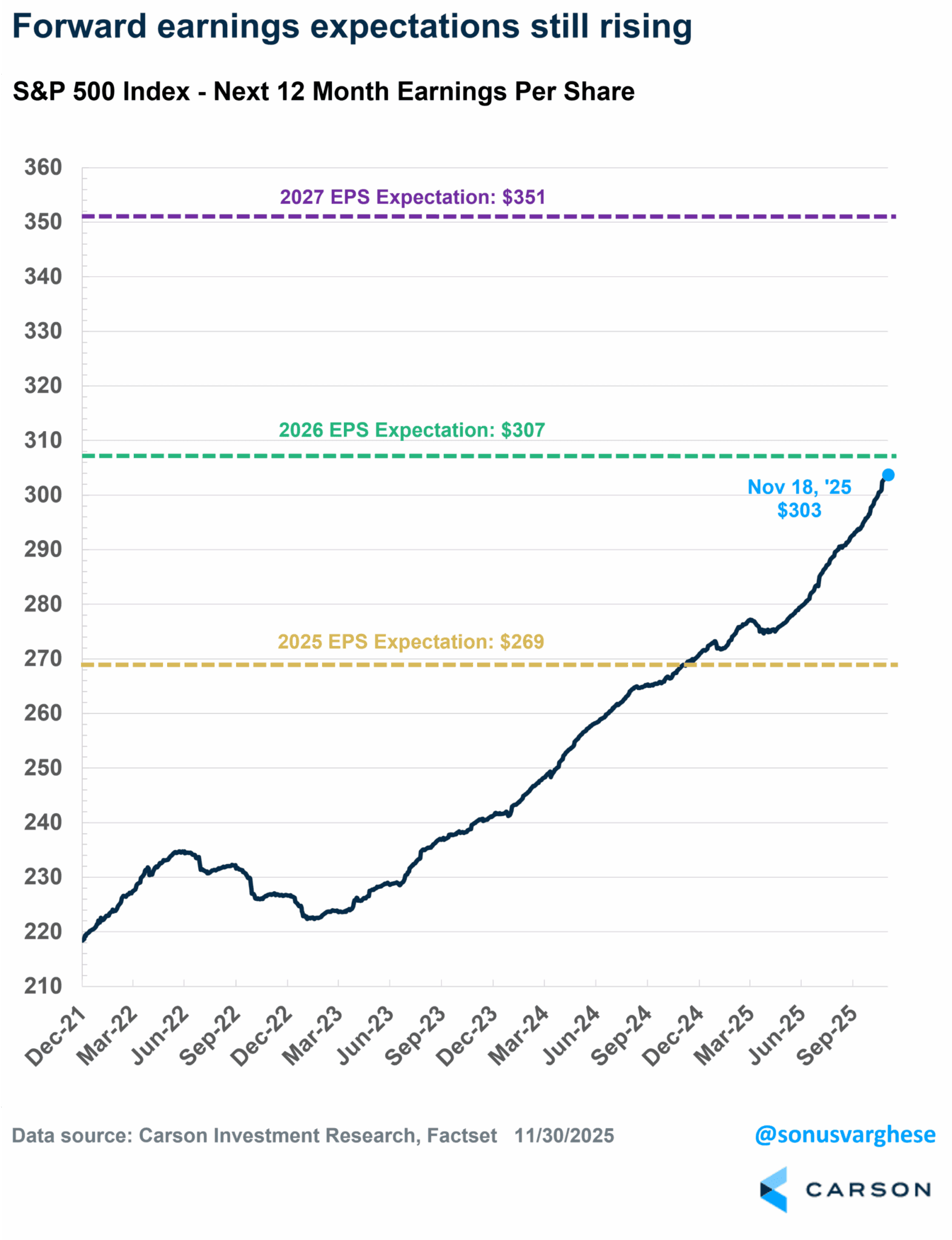

That noise isn’t all bad. But at the end of the day, what really matters for stocks is earnings. A lot of things affect earnings, but the direction of those earnings is the long term driver of stock prices.

Over time, prices follow profits.

The chart below shows this clearly over the last 25 years. Forward looking earnings move closely with stock prices. There are ups and downs, times when the market runs ahead or falls behind, but over the long run, earnings and prices tend to move together.

This bull market isn’t ending anytime soon, but it does suggest we could see some short term volatility.

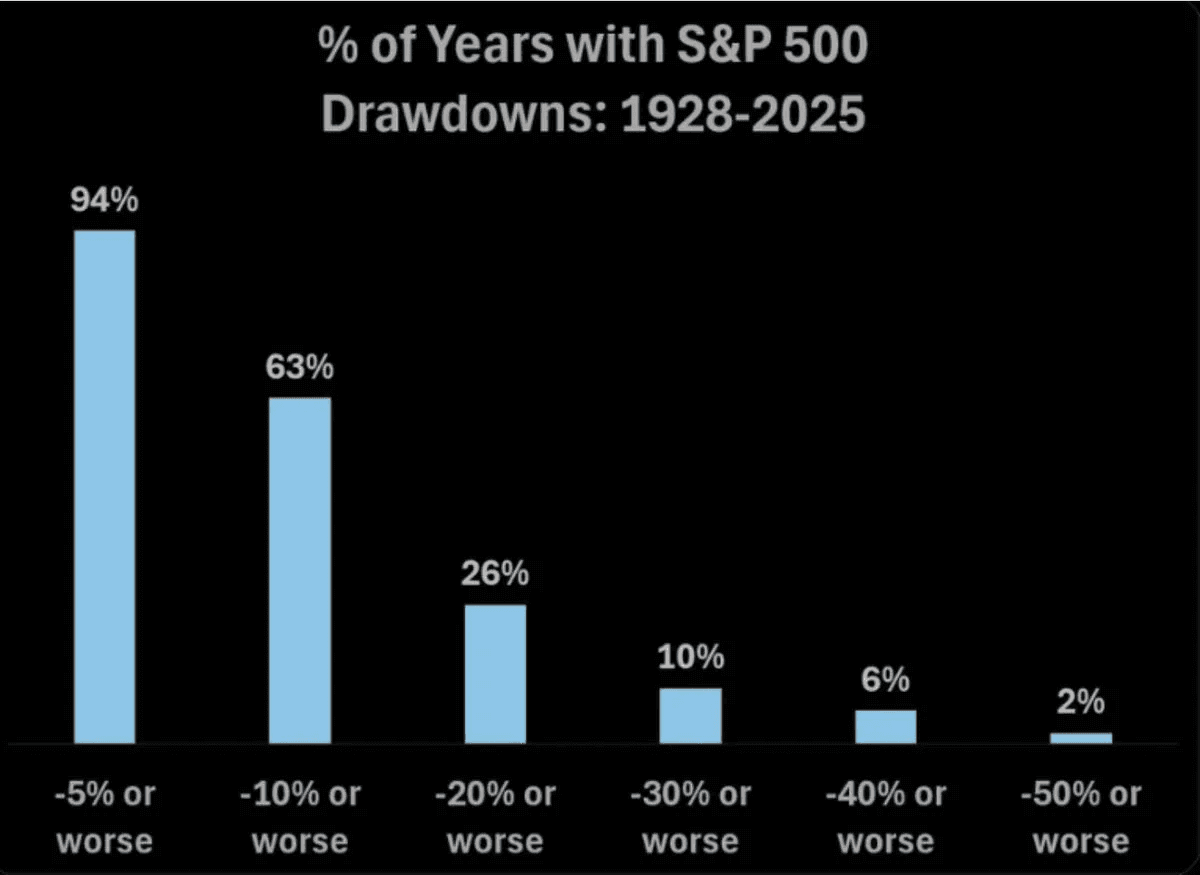

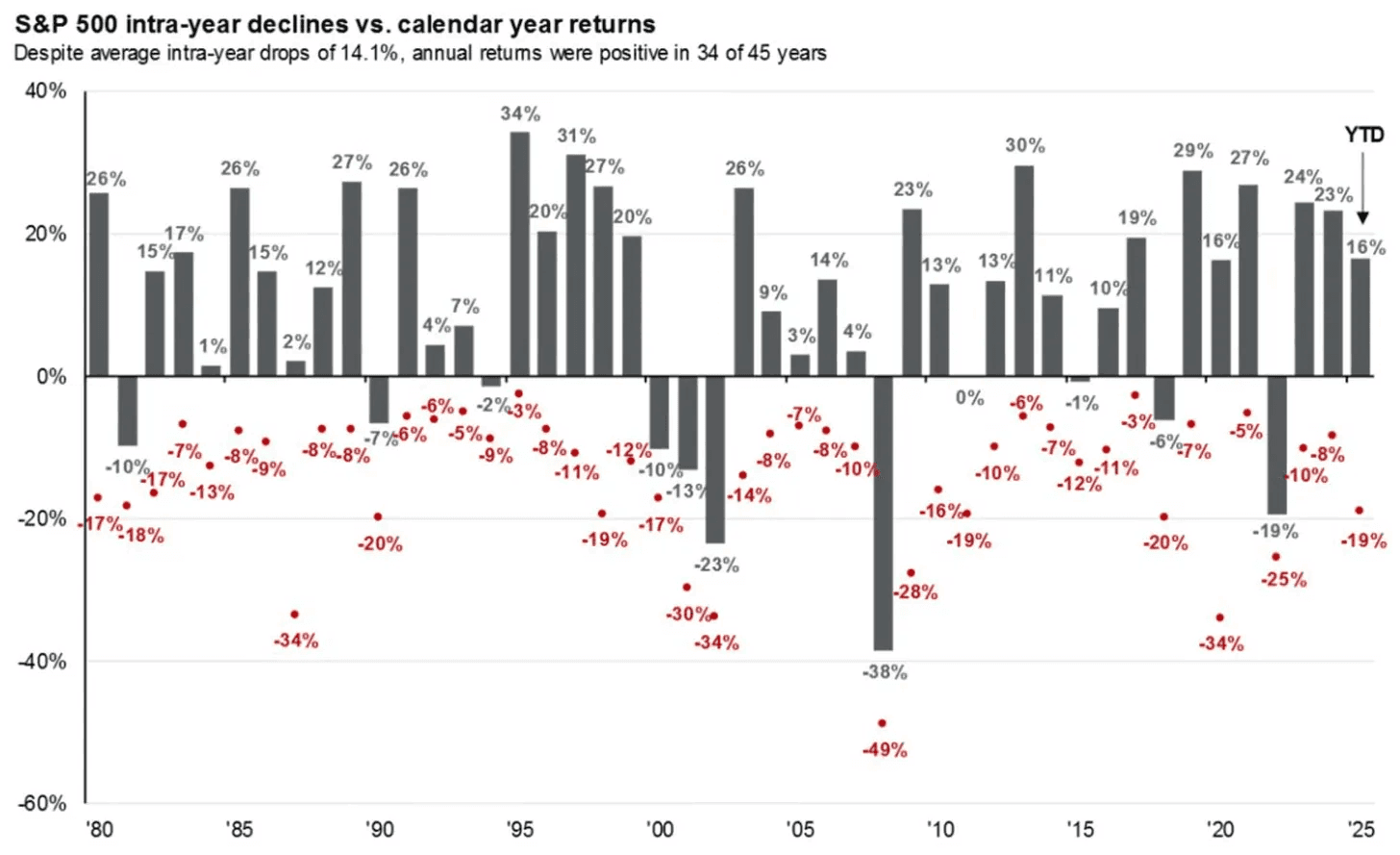

Pullbacks are normal. In fact, 94% of years see at least a 5% pullback in the S&P 500. And about 63% of the time, we get a pullback of 10% or more.

Volatility is the price of admission. If you want to take part in the greatest wealth building machine on earth, you have to accept those swings. If the market were risk free, everyone would be doing it. Unfortunately, t’s not.

There are a few things to watch. Earnings are coming up. On the macro side, we have new tariff threats, Iran, and the whole Greenland situation. To me, this is mostly noise. It can create some short term volatility, but nothing that changes the bigger picture. If we were to get another pullback like we saw in April because of headlines like this, that would be a gift. I think the market has learned its lesson, and a selloff like that feels unlikely. Some volatility, though, makes sense.

There are clear pockets of excitement and froth in areas like space and drones. That said, the bigger macro trend still points higher, even if we run into some bumps in the short term.

Overall, this price action looks healthy. I don’t see any major red flags yet. What we’re seeing is rotation, and rotation is the fuel of a long lasting bull market. Money is moving into new stocks and new sectors.

Lin

Jan 8, 2026

AAPL

Watch

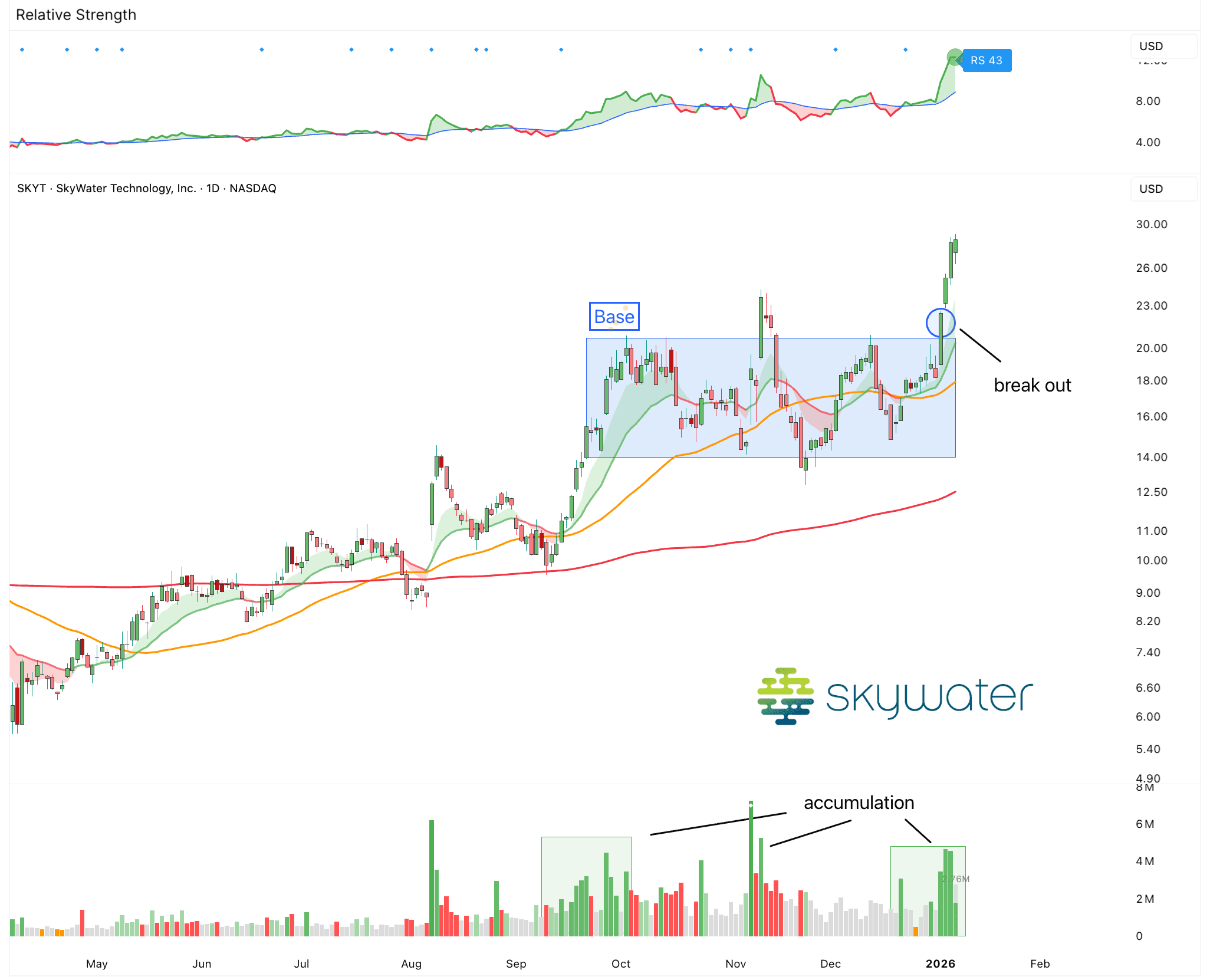

Stock to Watch: $SKYT

SkyWater is a pure play chip foundry.

That means it makes chips for other companies, similar to TSMC. Customers design the chips. SkyWater builds them in its own factories, called fabs. It does not sell its own chips or consumer products. Instead It works with fabless chip companies, large chip makers, and equipment companies that do not want to run their own fabs. And SkyWater focuses only on manufacturing and the engineering behind it.

SkyWater works very early in the chip process. Customers often come with just an idea or early design. SkyWater helps turn that idea into a real chip. This includes choosing materials, figuring out how the chip should be built on silicon, testing prototypes, and then producing the chips at scale. It supports the full path from design to volume production in the same fab.

This model is called Technology as a Service.

The big difference versus companies like TSMC is the type of chips SkyWater makes. Its chips are usually not the most advanced or smallest chips. Instead they are highly specialized. They are built for reliability, safety, and security. Many are radiation hardened for space and defense, mixed signal chips, MEMS, power devices, or fully custom designs.

These chips are used in aerospace and defense systems, cars, industrial equipment, medical and biotech devices, and some advanced computing and quantum related projects. These are the sectors where customers care more about trust, long lifetimes, and U.S. production than about the lowest cost or fastest node.

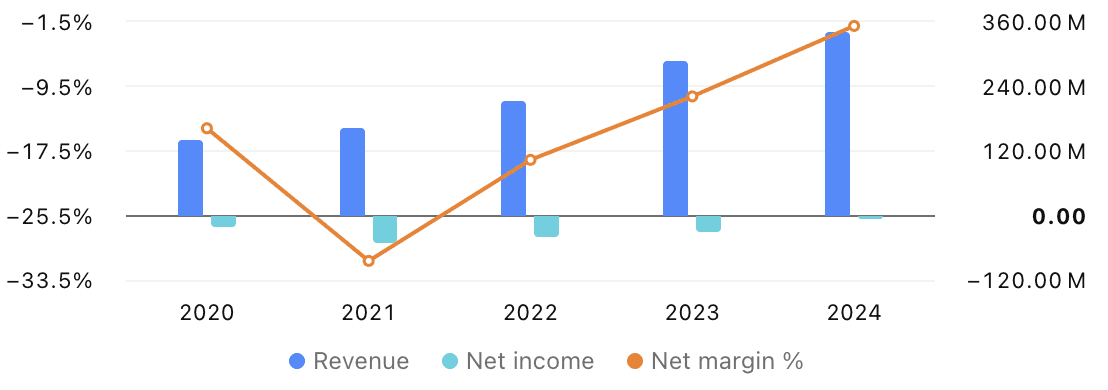

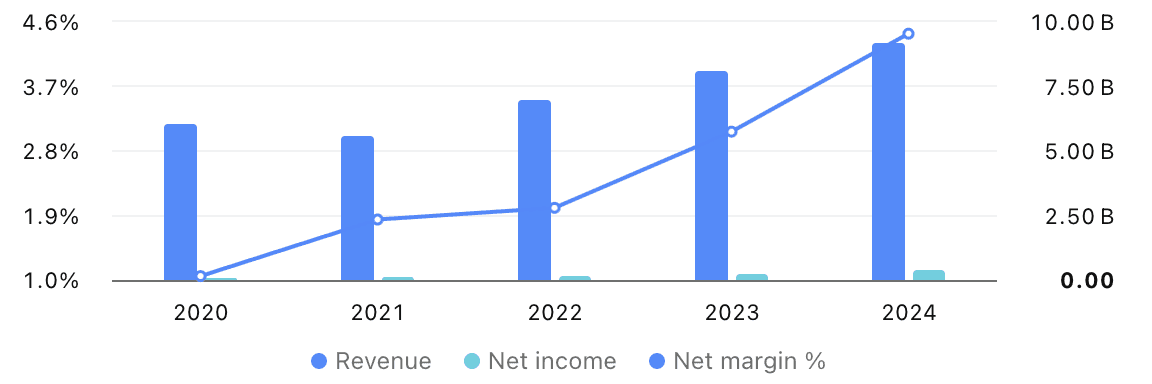

It’s been growing steadily until this recent quarter. In FY2024, the company did about $340M in revenue and was only barely profitable. Then last quarter alone, revenue jumped to around $150M, which is close to half of last year. That’s because their newly acquired fab in Texas added a ton of production capacity and revenue right away. Overall, business is accelerating.

At the same time, there has been noticeable institutional buying over the past few months. Large investors and institutions are building positions. And it just broke out of a 3 months long consolidation. This is one to watch very closely.

Lin

Jan 7, 2026

Market Update: The Next Phase of AI

Early January is one of my favorite times of the year.

Not just because it’s a fresh start, but because the biggest Consumer Electronics Show (CES) happens right now.

It’s the best glimpse into the future.

All the newest ideas and technologies show up here. AI. Robotics. Smart glasses. And a lot more. Watching it all makes my engineering heart beat faster and gets me incredibly excited about the future.

And one of the biggest names at CES is, of course, Nvidia.I highly recommend watching Jensen’s presentation. It’s really good. Many of the topics we’ve already discussed right here. You can watch it here.

But if you do not have the time, here’s the short version.

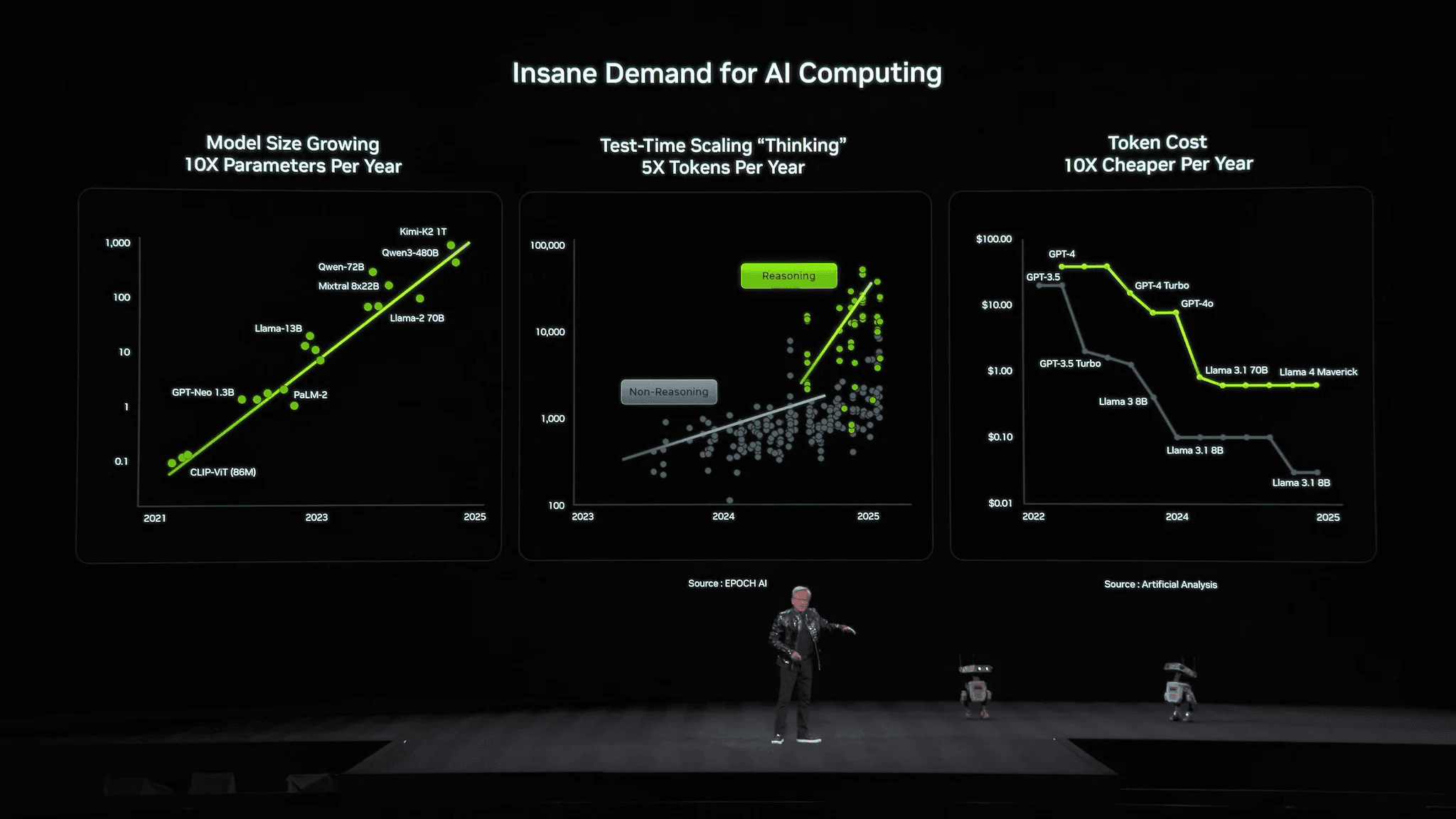

AI is moving at breakneck speed. It’s ten times bigger and advancing 10x faster than anything we’ve ever seen.

This is not a fad. This is a historic moment. It’s a turning point.

Most people overestimate what AI can do today. But they completely underestimate what it will be able to do in a year or two.

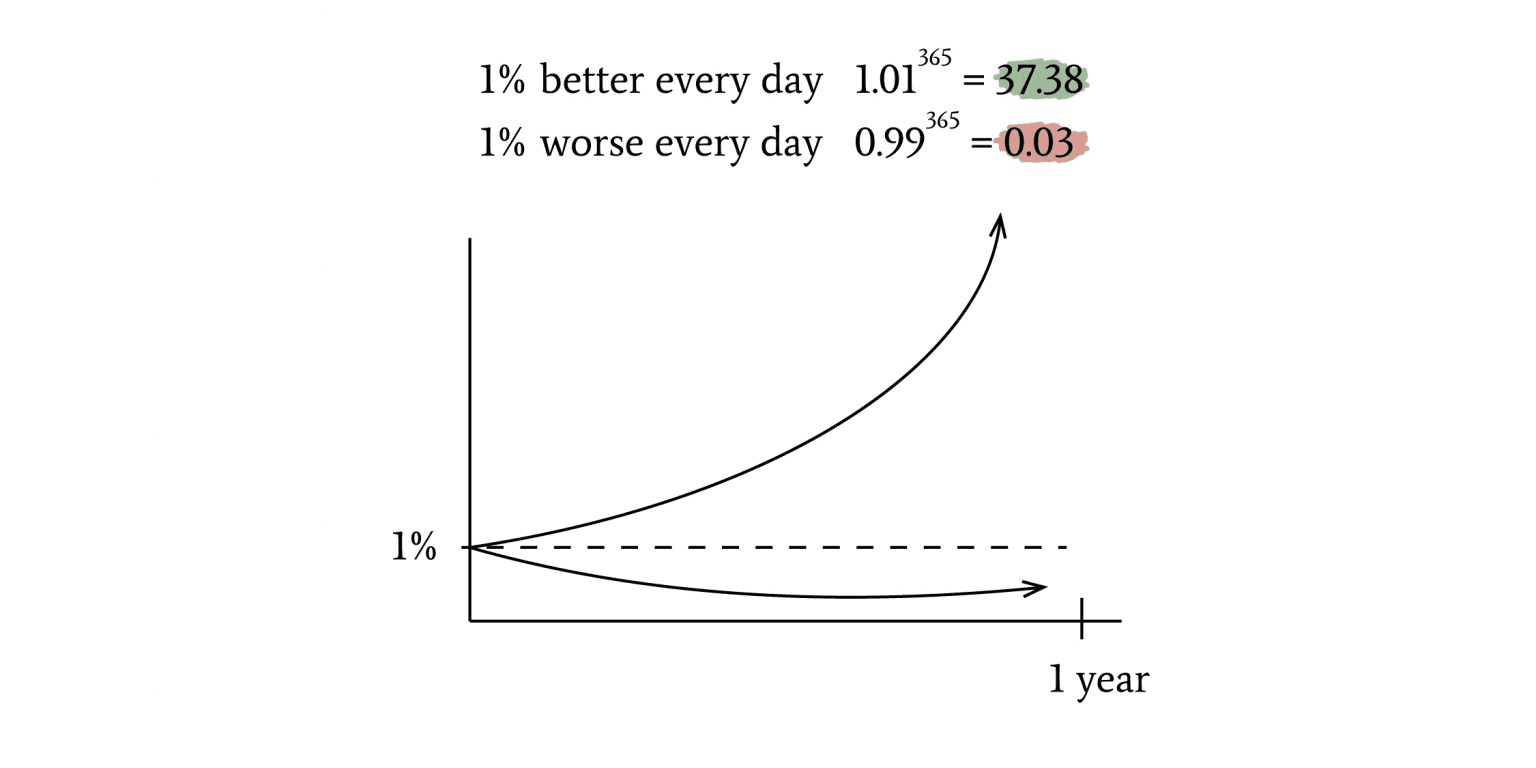

When you move at this incredible pace, every small improvement in technology compounds.

Just as a thought experiment, if you get better by 1% every day, you would be about 37x better by the end of the year.

Now imagine if you are not improving by just 1% but by much more.

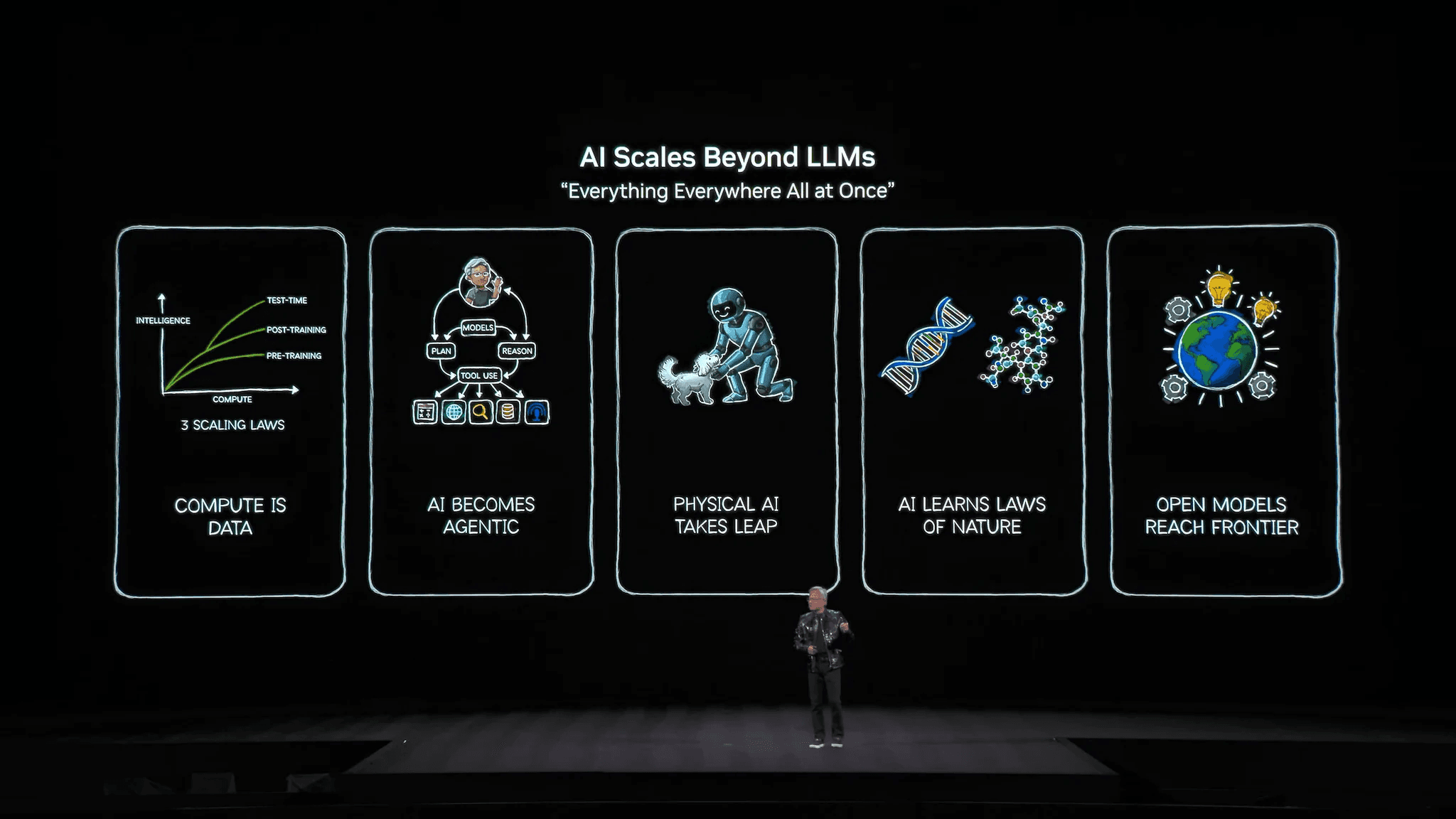

So far, AI has mostly been limited to text. For most people, AI means chatbots like ChatGPT. You type something, it answers. But soon, we will move beyond natural language processing and LLMs. AI will become agentic and multimodal.

What comes next is much bigger.

AI will move beyond just understanding words. It will see images, hear sounds, watch videos, and understand the real world. This is what multimodal means. One system that can read, listen, watch, and respond all at once.

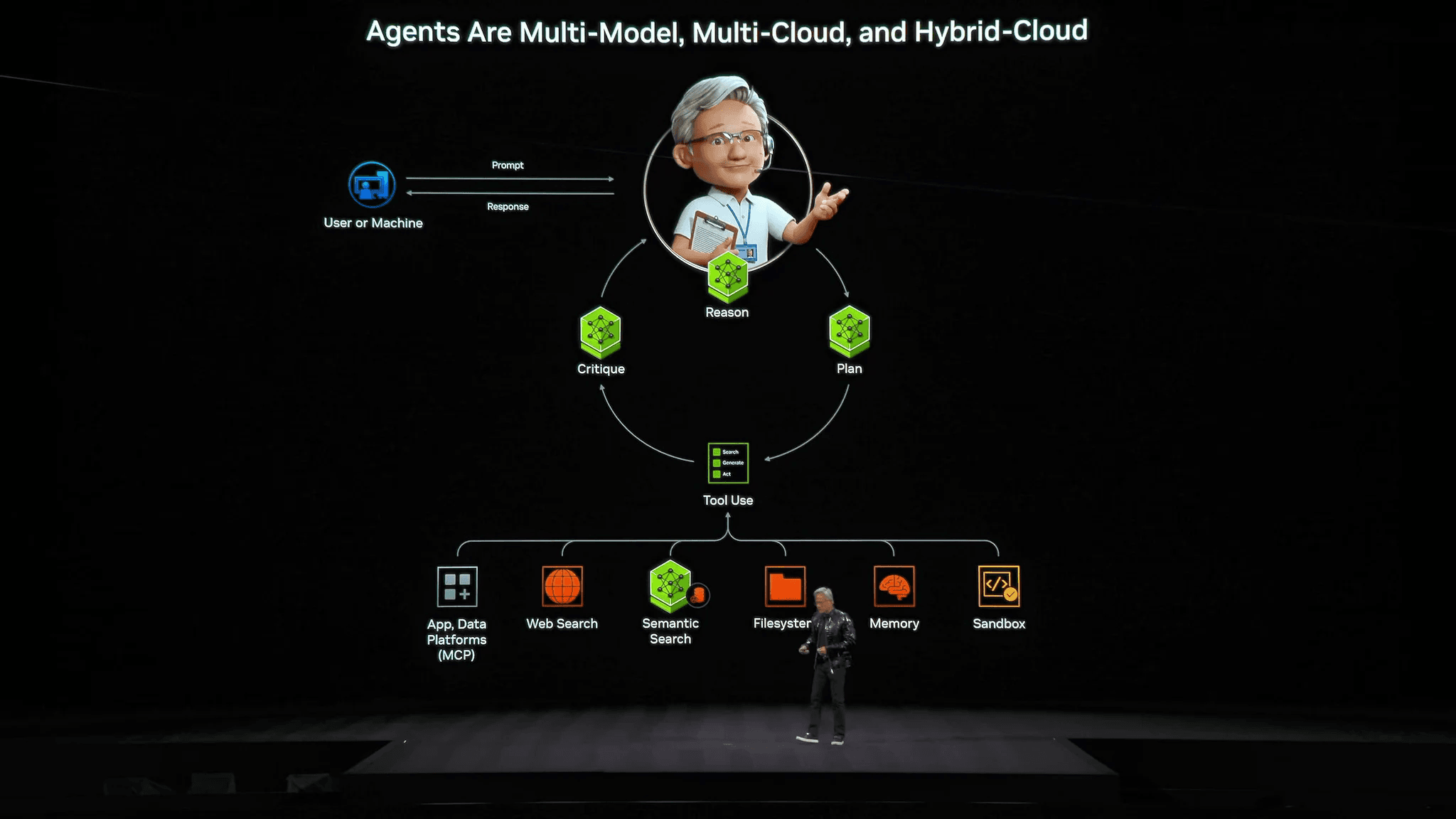

At the same time, AI will become agentic.

That means it will not just answer questions. It will take actions. It will plan steps, make decisions, use tools, and work toward goals on its own. Instead of asking AI to write an email, you will ask it to handle a task. It will decide what to do, when to do it, and how to do it.

AI will be able to call other AI agents to help. It will work with images and videos. And most importantly, it will handle real world tasks.

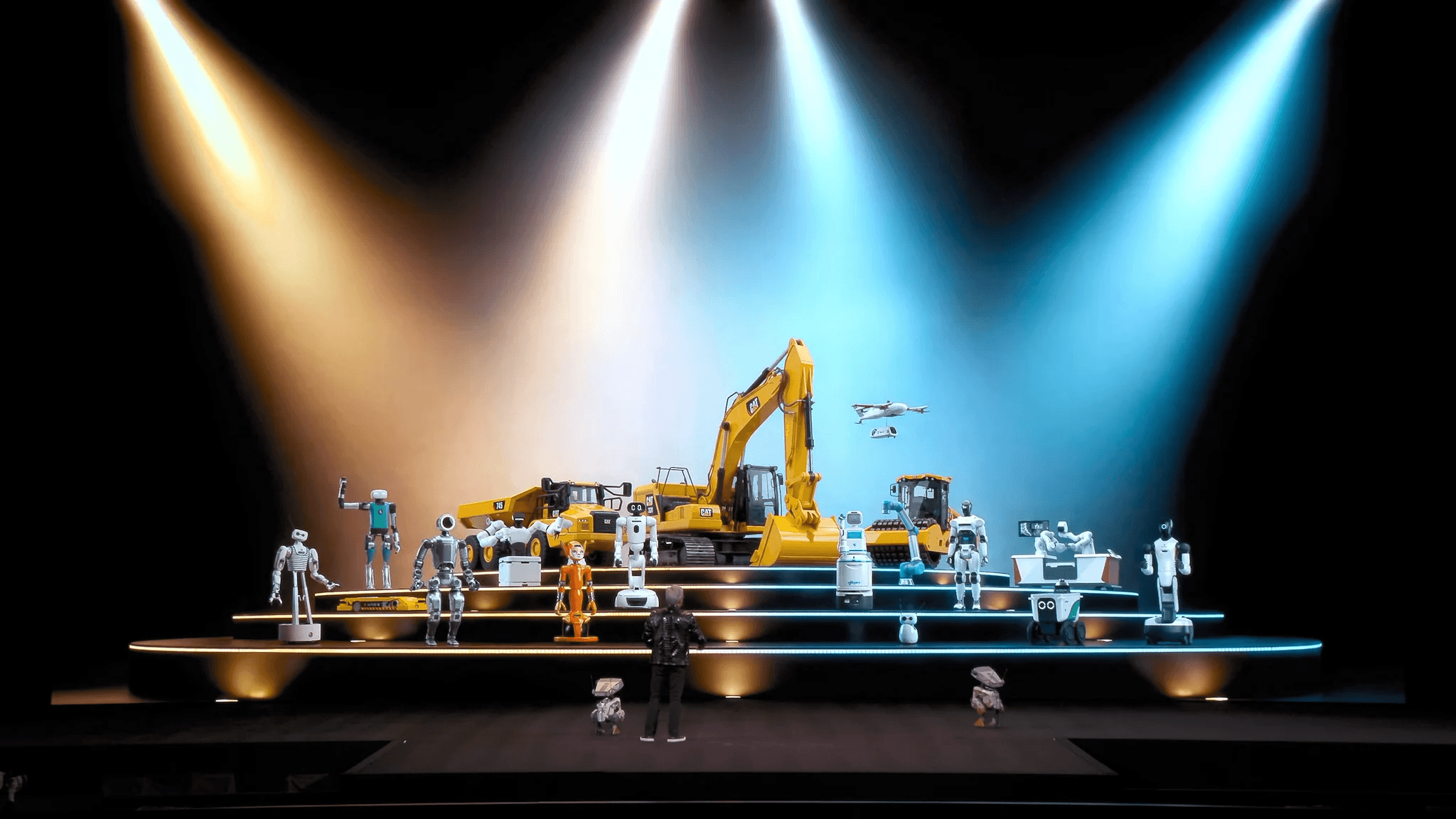

2026 is likely the year we see a real breakthrough moment. Think ChatGPT, but for physical AI. Robotaxis will likely roll out at scale, with humanoid robots following a year or two later.

Nvidia just released a full new robotics stack. That includes robot foundation models, simulation tools, and specialized hardware. It wants to be a full stack robotics provider or the default platform for robotics, just like Windows became the default for PCs or Android for smartphones.

These are multi-trillion markets emerging from 0.

All of these require exponentially more compute: Text → Reasoning → Agents → Images → Videos → Physics → Real-word Applications

There is basically no limit for how much processing power we can use. Every jump in compute unlocks new things we simply could not do before.

AI is one of the rare platform technologies. It does not just create new products. It makes almost every other technology better at the same time.

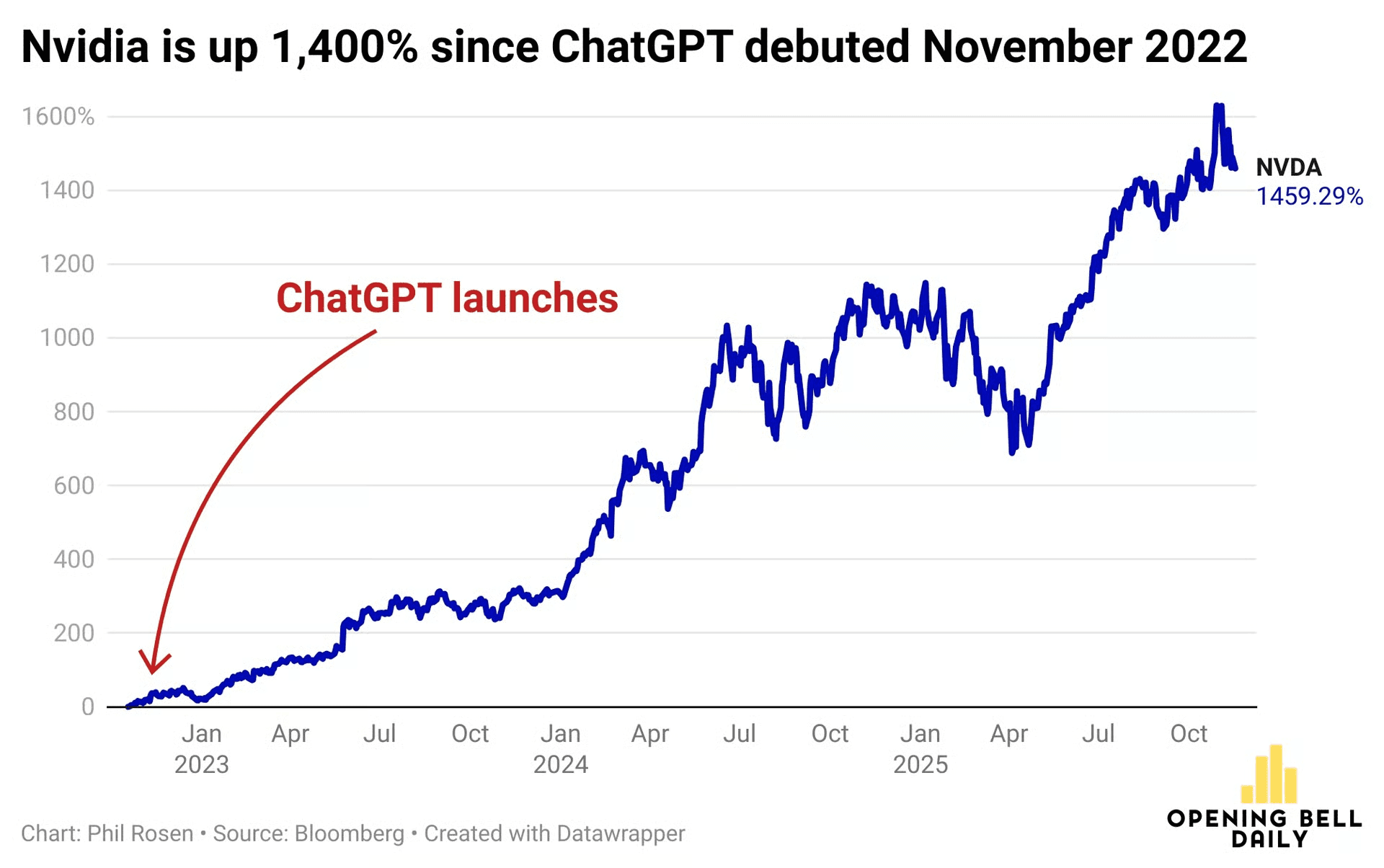

And Nvidia is sitting on the forefront of this tech revolution.

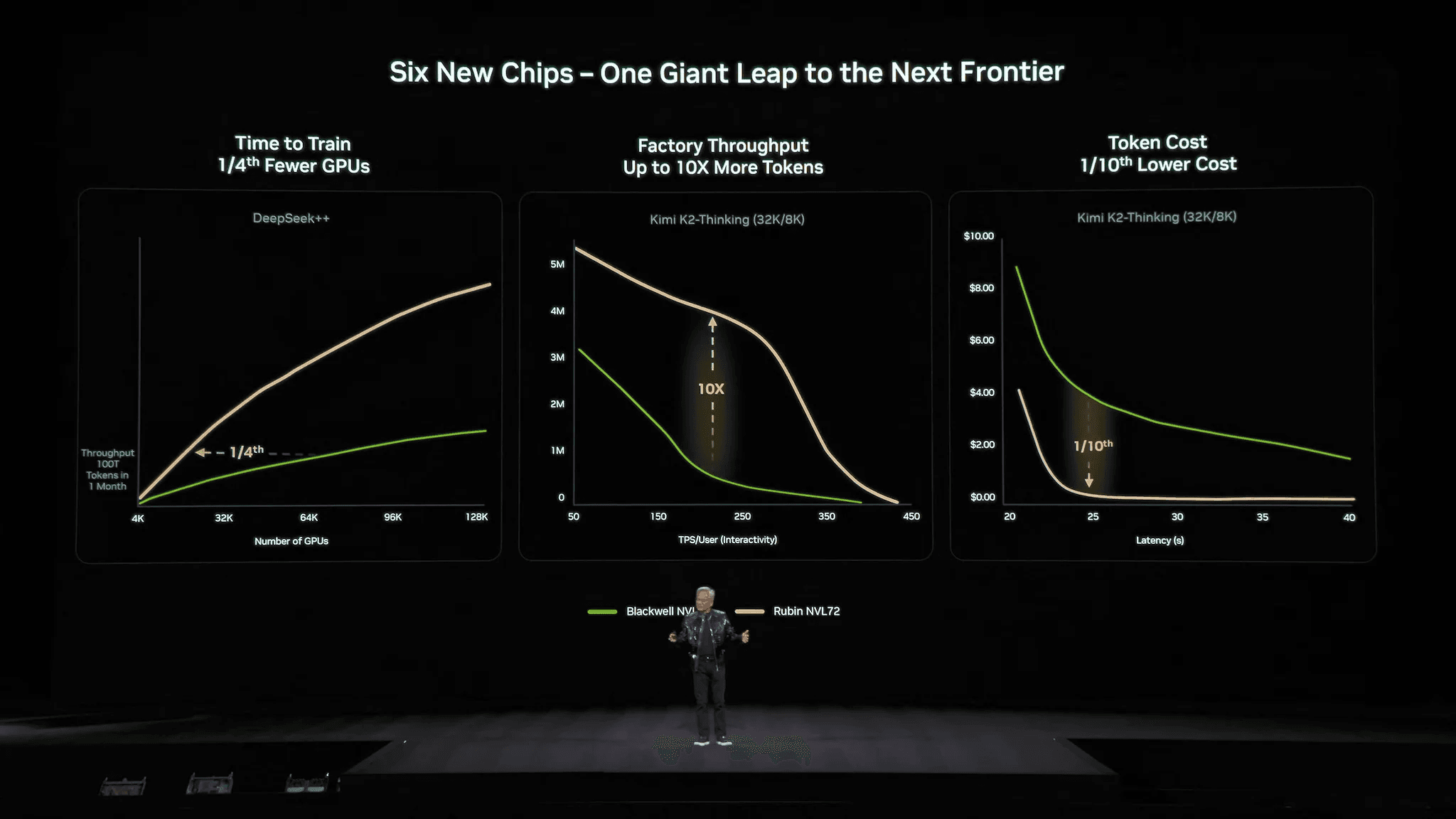

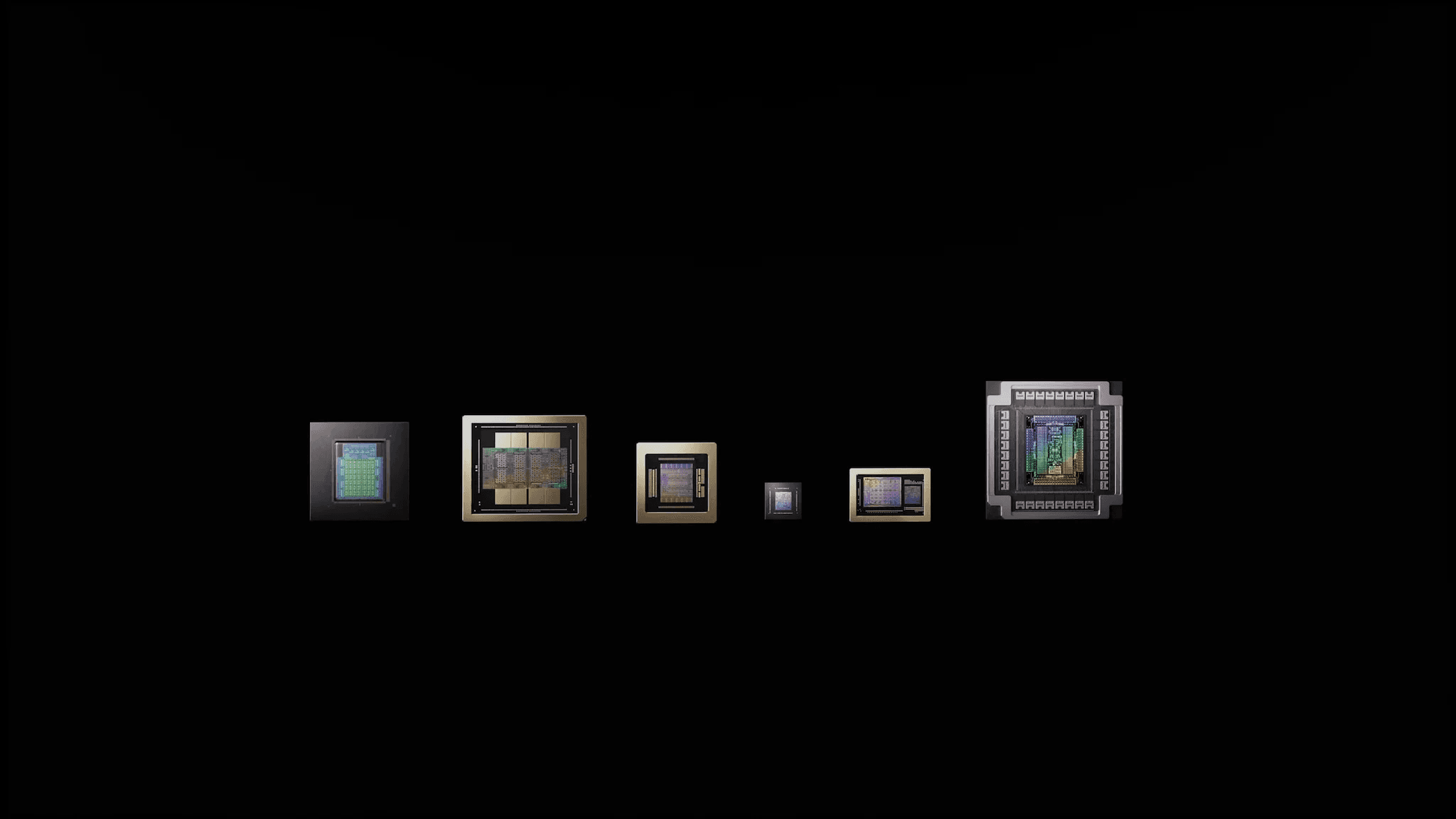

They just announced their next generation chips, called Vera Rubin. And it is not just one chip. It is actually 6 new chips, all redesigned from the ground up.

There is no doubt in my mind that Nvidia will stay at the frontier of innovation and continue to lead the AI era.

Lin

Jan 5, 2026

A Few Portfolio Changes

Here are a few new positions I’ve initiated:

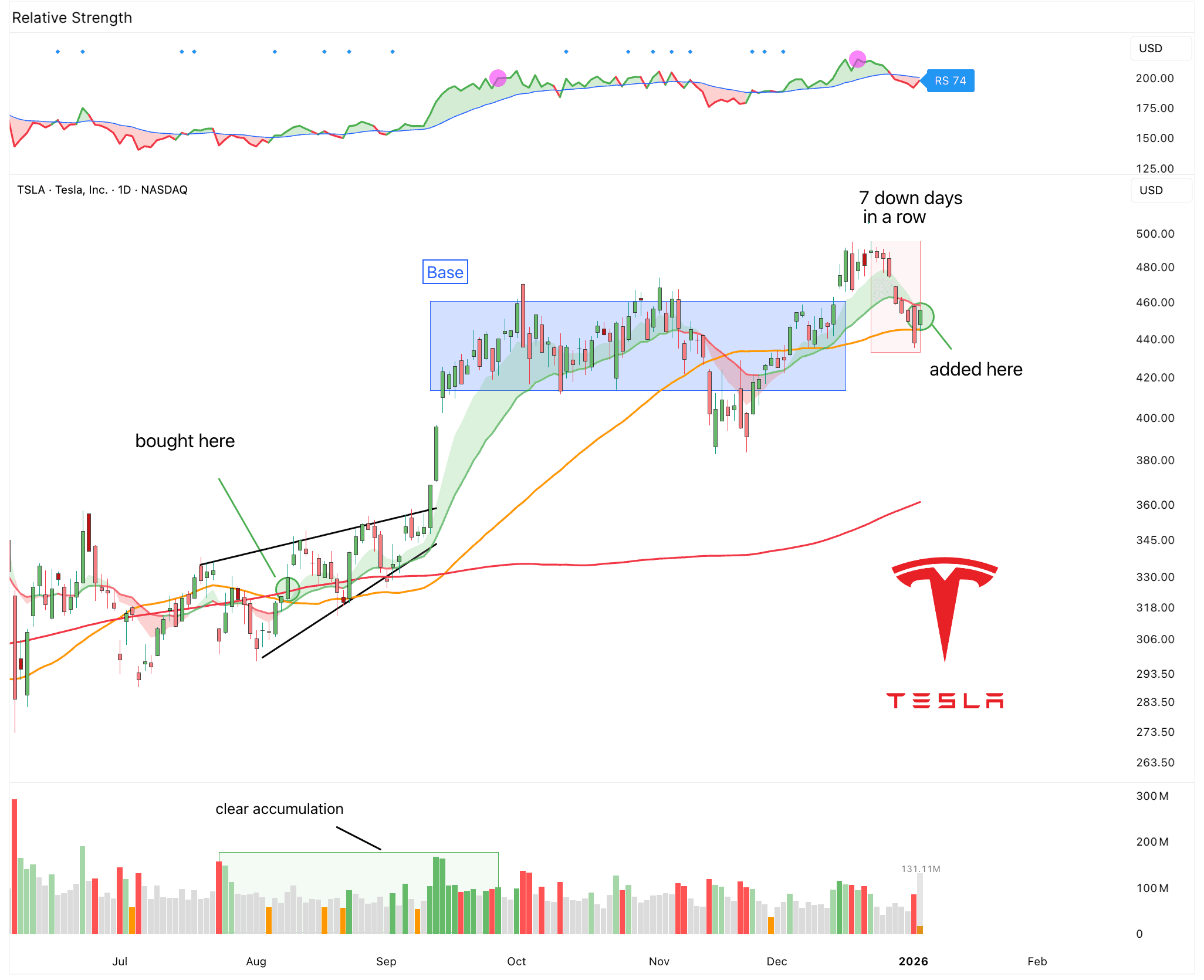

1. Add: Tesla ($TSLA)

I’ve talked about Tesla at length already.

2026 will be a critical year for Tesla. It has many potential tailwinds ahead. There are a few key highlights to watch this year: Cybercab production begins, without a steering wheel or pedals. Unsupervised FSD is solved. Optimus V3 is unveiled. Robotaxi expands more widely and sees broader adoption. Tesla Semi production starts. And the Tesla Roadster is unveiled.

Of course, Tesla still needs to deliver on its promises. But this could be a pivotal moment. With a potential SpaceX IPO coming, Elon has mentioned that Tesla investors could receive preferential treatment. We will see how that plays out.

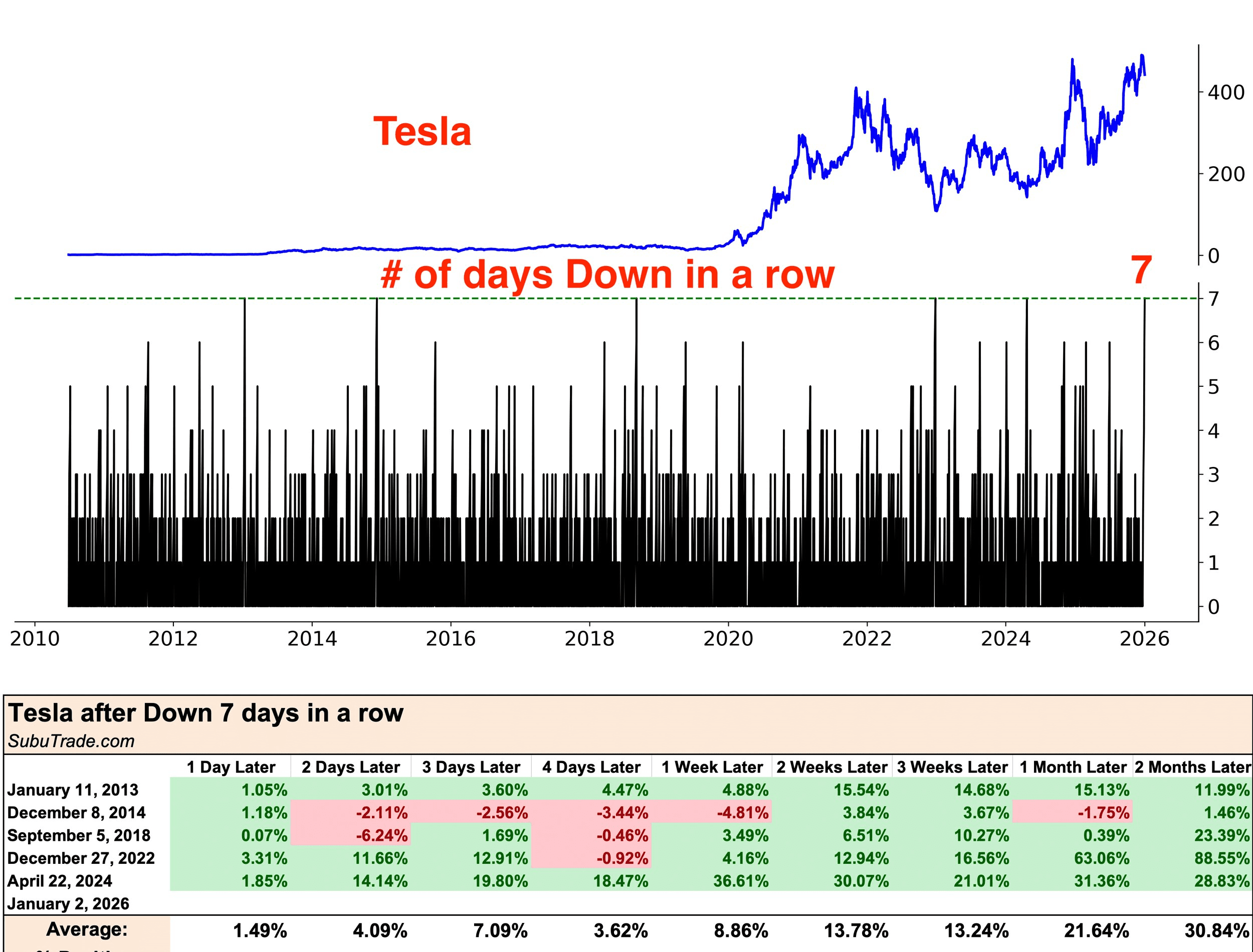

The stock is just below all time highs and has had 7 down days in a row. That is tied for the longest streak ever. Tesla has never fallen 8 days in a row. I have been waiting since August to add to my position, and this looks like a good opportunity.

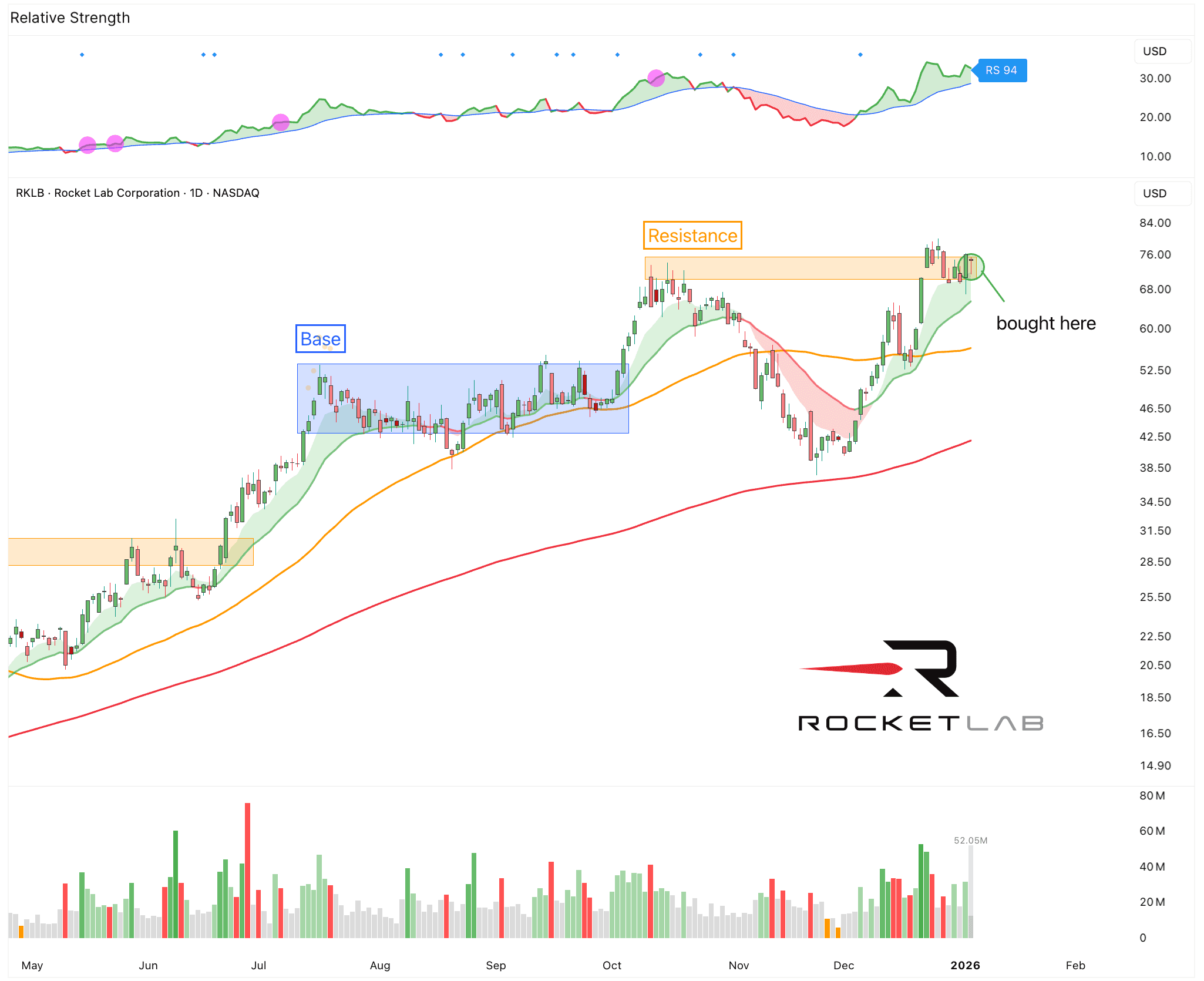

2. Buy: Rocket Lab ($RKLB)

As highlighted in my sector outlook, I wanted to get exposure to the Space sector. Hence, I used the pullback in RKLB today to initiate a position.

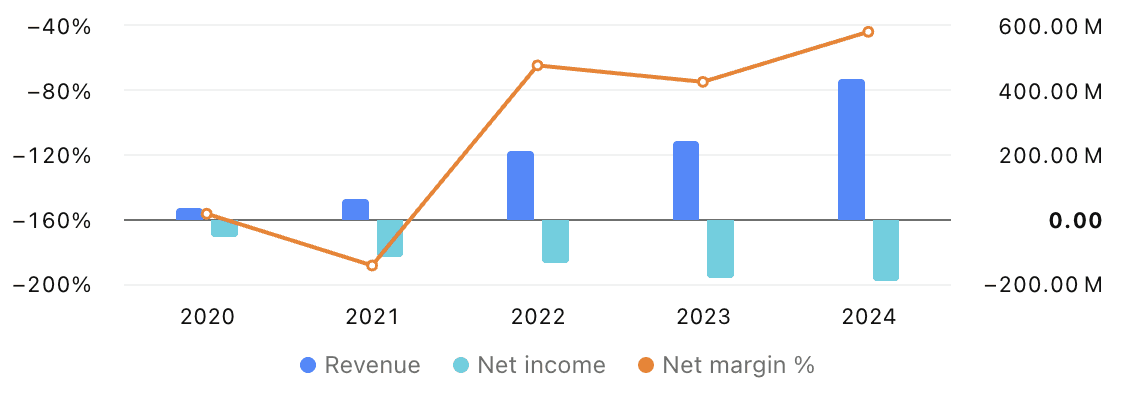

I’ve talked about Rocket Lab for a while now. It stands out as one of the few space companies already generating significant amount of revenue from both launches and satellite components. While it isn’t profitable yet, the company is investing heavily in new technology and long-term growth.

It’s one of the few public companies with a real shot at competing in the multibillion-dollar space industry.

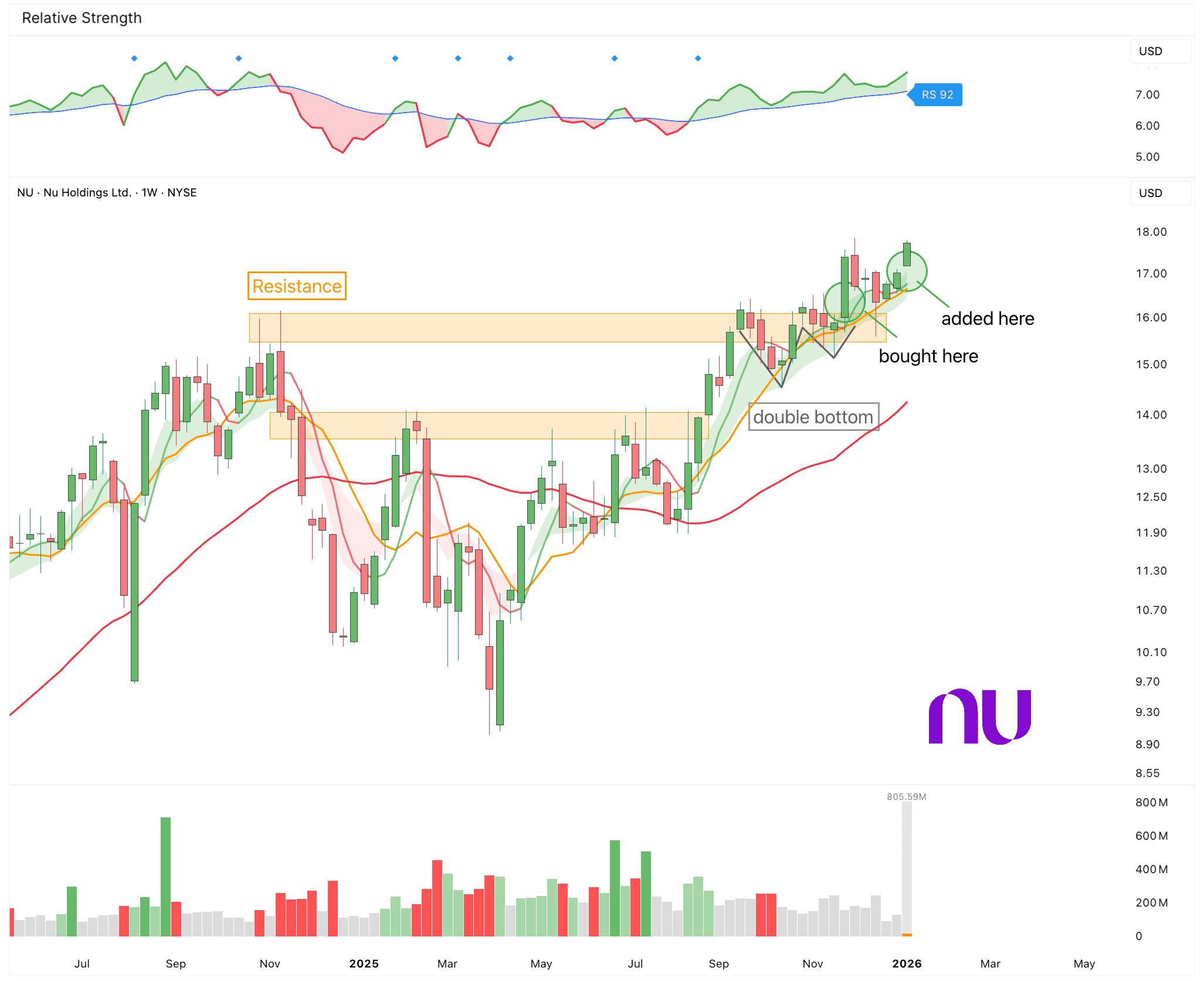

3. Add: Nu Holdings ($NU)

I’ve also added to my NU position.

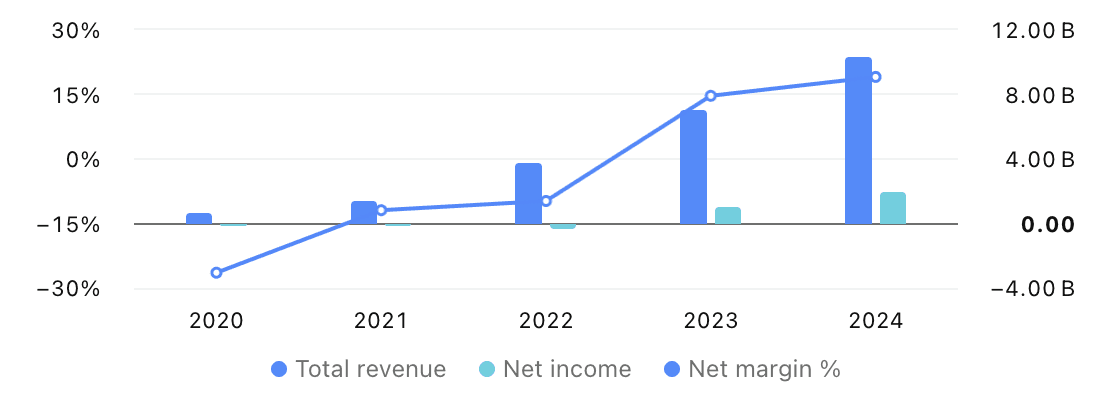

Nu is building a large digital bank with a lean cost structure and a broad product portfolio on top of it. And the bigger it grows, the more data it collects, better its systems become. And even with all that growth it is still at a reasonable 30 PE.

After the initial break out a few weeks ago, it did a perfect retest and is now approaching new all-time highs.

Lin

Jan 4, 2026

Weekly Market Update: Venezuela Attack

Most of you have probably seen the news.

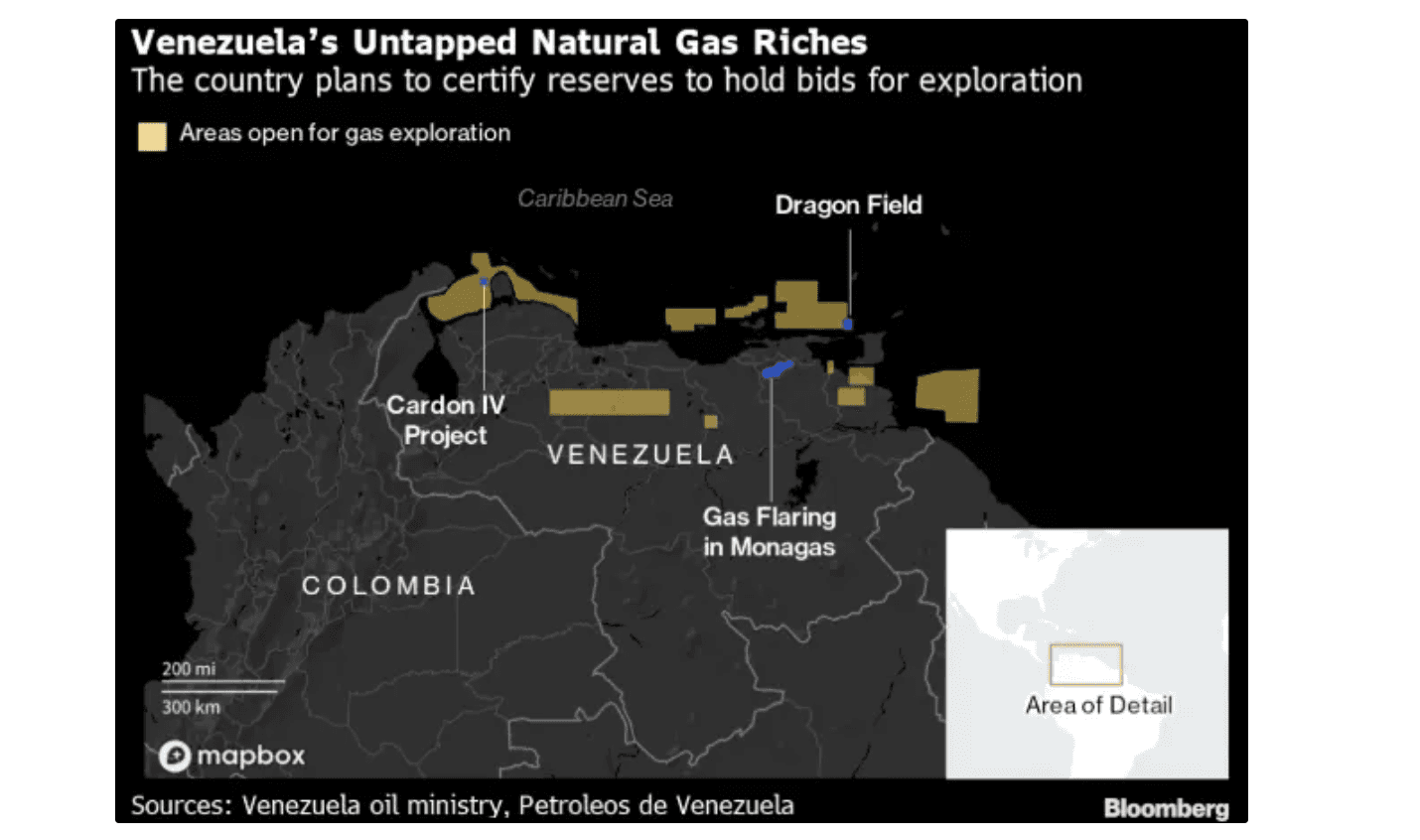

The US just attacked Venezuela. We can only speculate what Trump’s exact motivation is. But it’s likely not just benevolence. And it likely has a lot to do with Venezuela’s resources. In fact, it’s one of the richest countries in the world when it comes to natural resources.

Venezuela has significant, yet largely undeveloped, deposits of rare earth elements.

Estimates show Venezuela has the 12th-largest iron ore reserves in the world.

And most importantly, Venezuela holds hundreds of billions of barrels of oil reserves, one of the biggest in the world. However, much of this is heavy crude oil, which is far more expensive to extract because it’s harder to process and requires more advanced machinery.

Not only does Venezuela hold oil, but it also holds a lot of gold. While gold is currently trading at all-time highs, many economies like BRICS have been stocking up on reserves.

We’ll likely find out more soon.

2026 is already off to a wild start. Whatever happens next, it’s clear that we’ll be in some rough waters this year. It’s also safe to assume that there will be plenty more surprises to come. So buckle up.

Volatility will definitely be a constant companion this year.

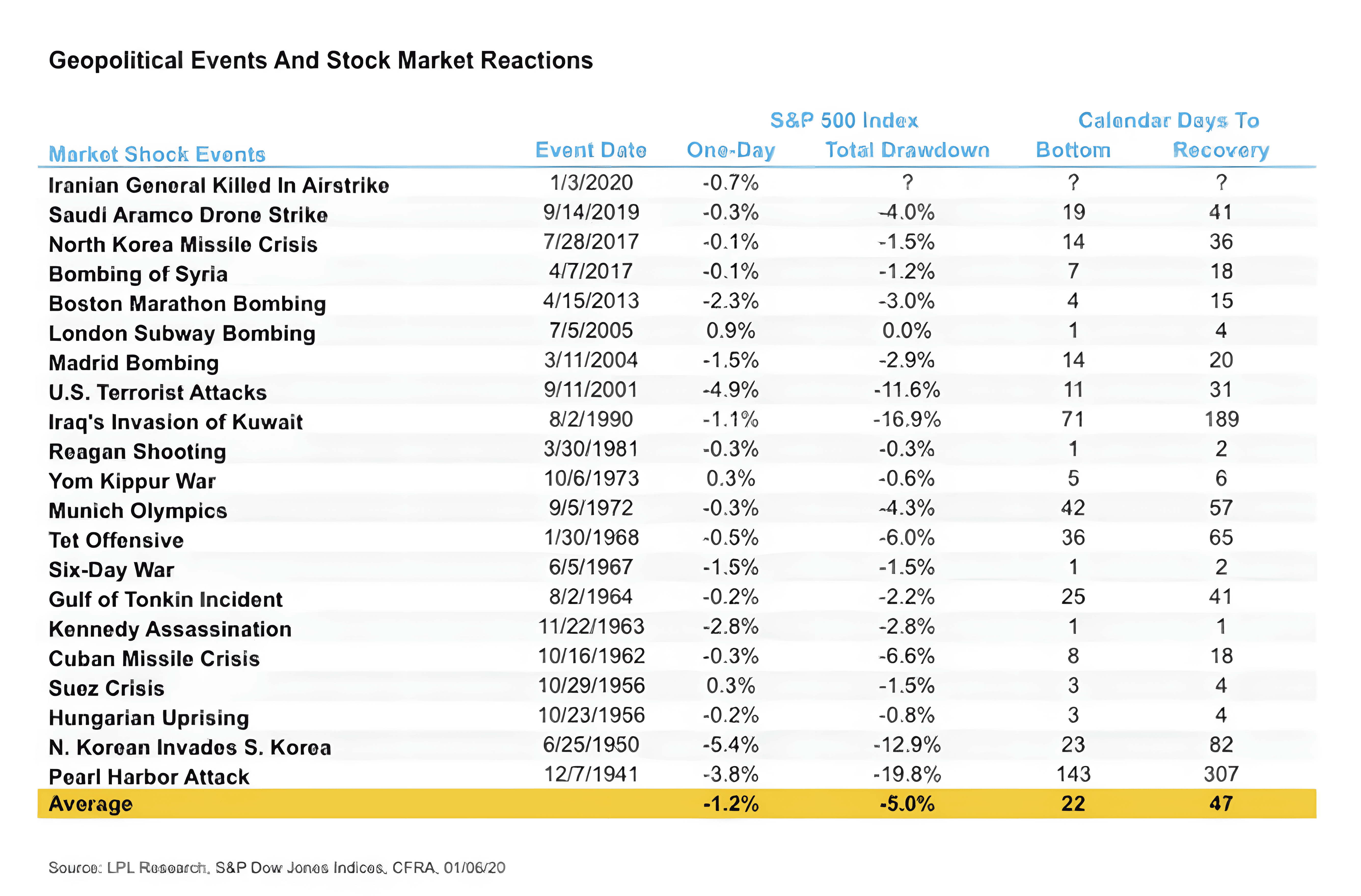

Interestingly, geopolitical events tend to be short-lived. Initially, markets sell off because of increased uncertainty, but historically, they recover quickly.

One thing to note, especially at the start of a new year, is that even during good years, corrections are pretty normal. The path isn’t just straight up. There are always drawdowns. Last year, the largest drawdown was 19%. And as you can see below 8–10% corrections are very common even in good years.

One thing I’m wary about is that everyone on Wall Street expects the market to just keep heading higher and continue rallying in 2026. They all seem to be in sync. Everyone is on the same side of the boat. But the market rarely does what…

Lin

Jan 2, 2026

The Key Sectors For 2026

I hope you all had a fantastic start to the new year.

Although 2025 was one of the busiest years of my life, it was also one of the most rewarding. It always shocks me how far you can get in 12 months if you really set your mind to it and go after your goals. It won’t be easy, though. You have to show up every day, even when you don’t feel like it. But it will be worth it.

It takes one year to change your life. Why not this one?

A year from now, you’ll wish you had started today.

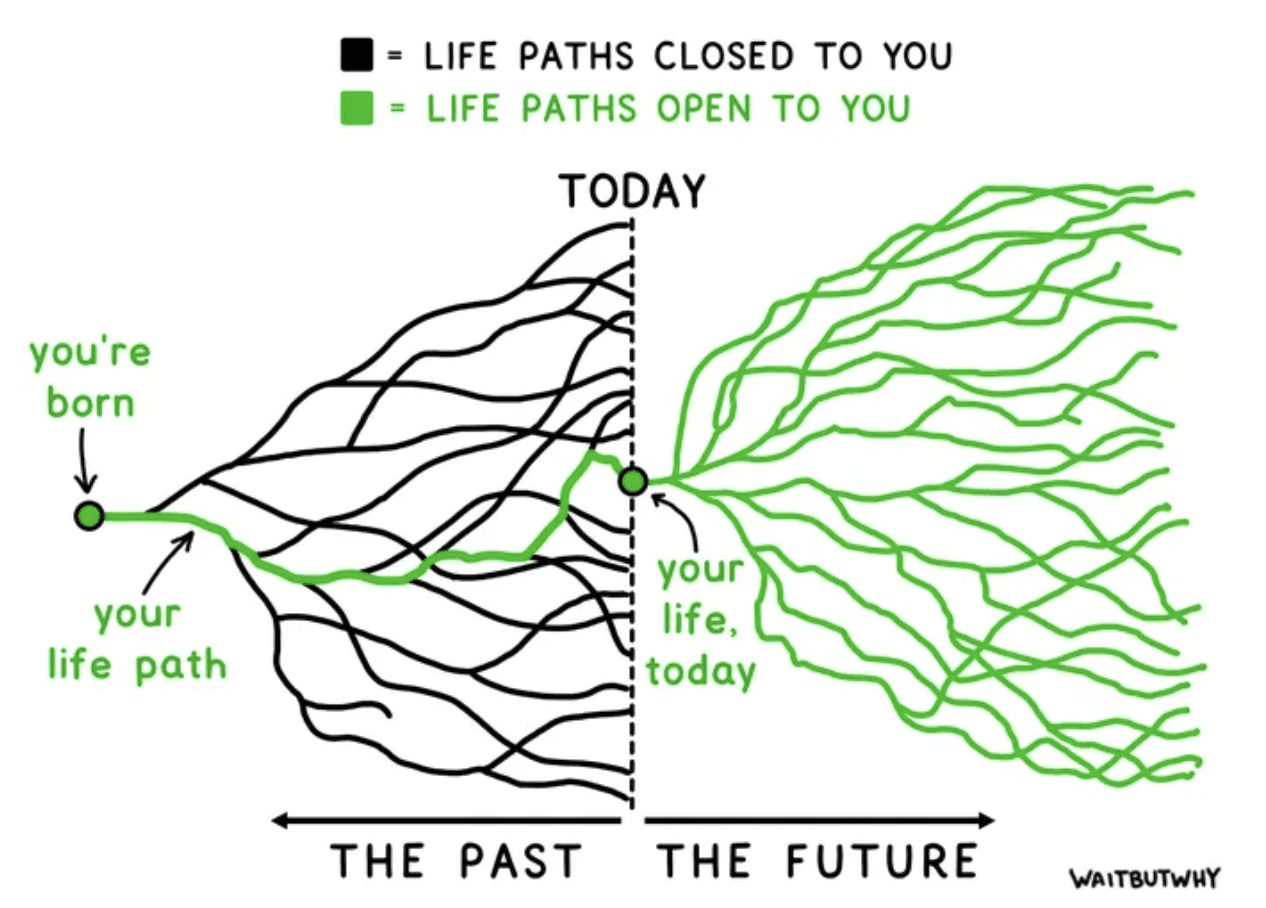

One of my favorite things to do at the beginning of a new year is to hit pause, look back, and reflect. An exercise I like to do every year is an annual review.

It’s simple. Grab a notepad and create 2 columns: positive and negative. Now go through the past year and write down all the highlights and lowlights. Put them in their respective columns. Once you’ve gone through the year, look at your list and ask, “What 20% of each column produced the most reliable or powerful peaks?” Based on the answers, take your positive leaders and do more of them in the new year.

This works for almost anything. Review your investment portfolio. Write down what went well. What didn’t. What you would have done differently. What you want to keep doing. Who and what helped you the most. Do this for any part of your life you want to improve: relationships, career, business, sports, anything.

This is one of the most effective and fastest ways to improve, because you can only improve what you track. If you don’t track it, you’ll never get better.

Block 1 or 2 hours. I’ve been doing this for years, and it has helped me tremendously.

A new year means a new opportunity.

The good thing about a new year is that you can treat it as a blank slate. All the wins, losses, mistakes, and lessons from last year can be left behind. You don’t have to carry them over.

For some, it’s just another day. But psychologically, it can be much more.

It can serve as a good reset.

Now on to the market.

….

Lin

Dec 28, 2025

Weekly Market Update: The Final Countdown

This has been one of the greatest market comebacks in history.

What a year.

I don’t think anyone had the slightest idea how eventful 2025 was going to be.

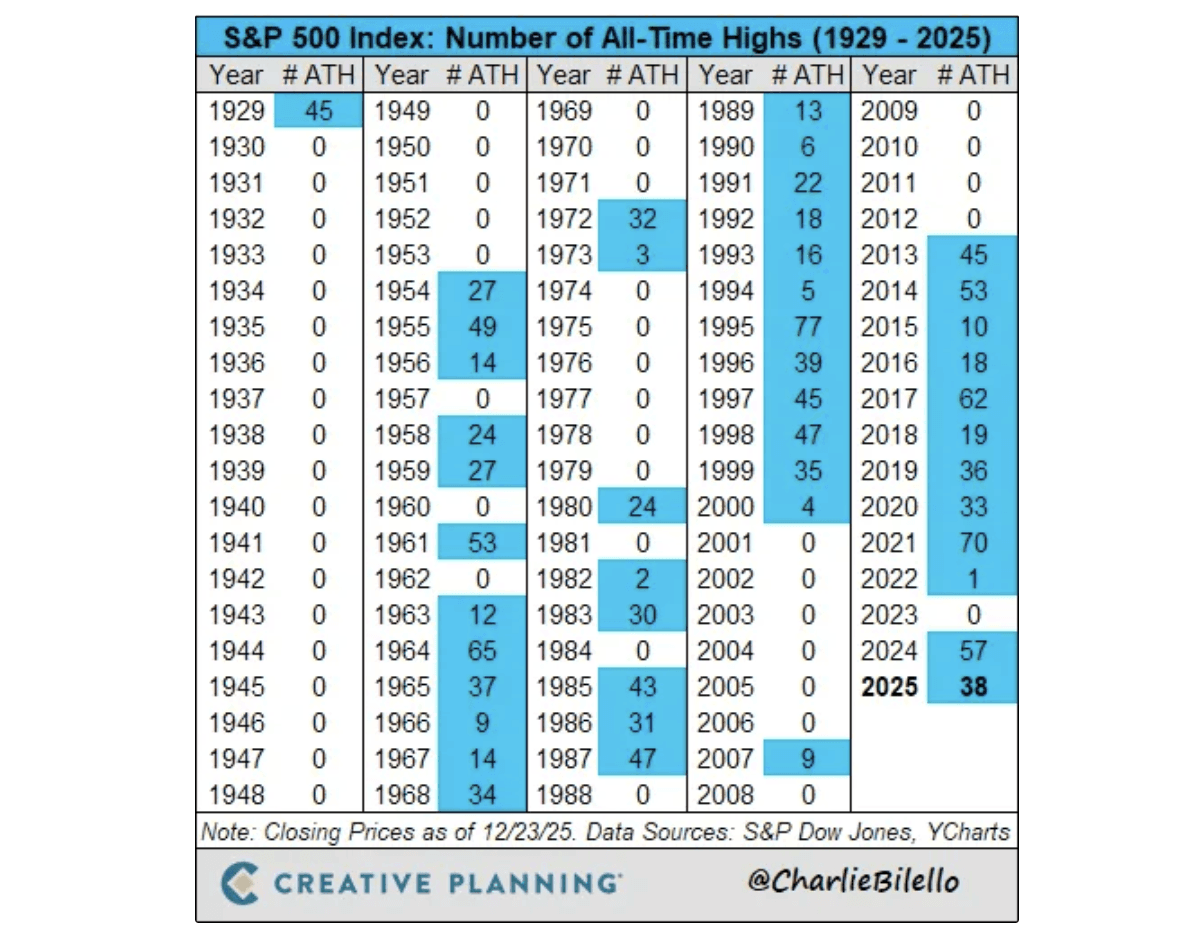

Back in April, the S&P 500 was down over 15% on the year, its 4th worst start ever. After a 38% rally, it’s now up 17% on the year, hitting 38 all time highs along the way, just in time for Christmas. 7000 is now a fingertip away.

This has been one of the greatest market comebacks in history.

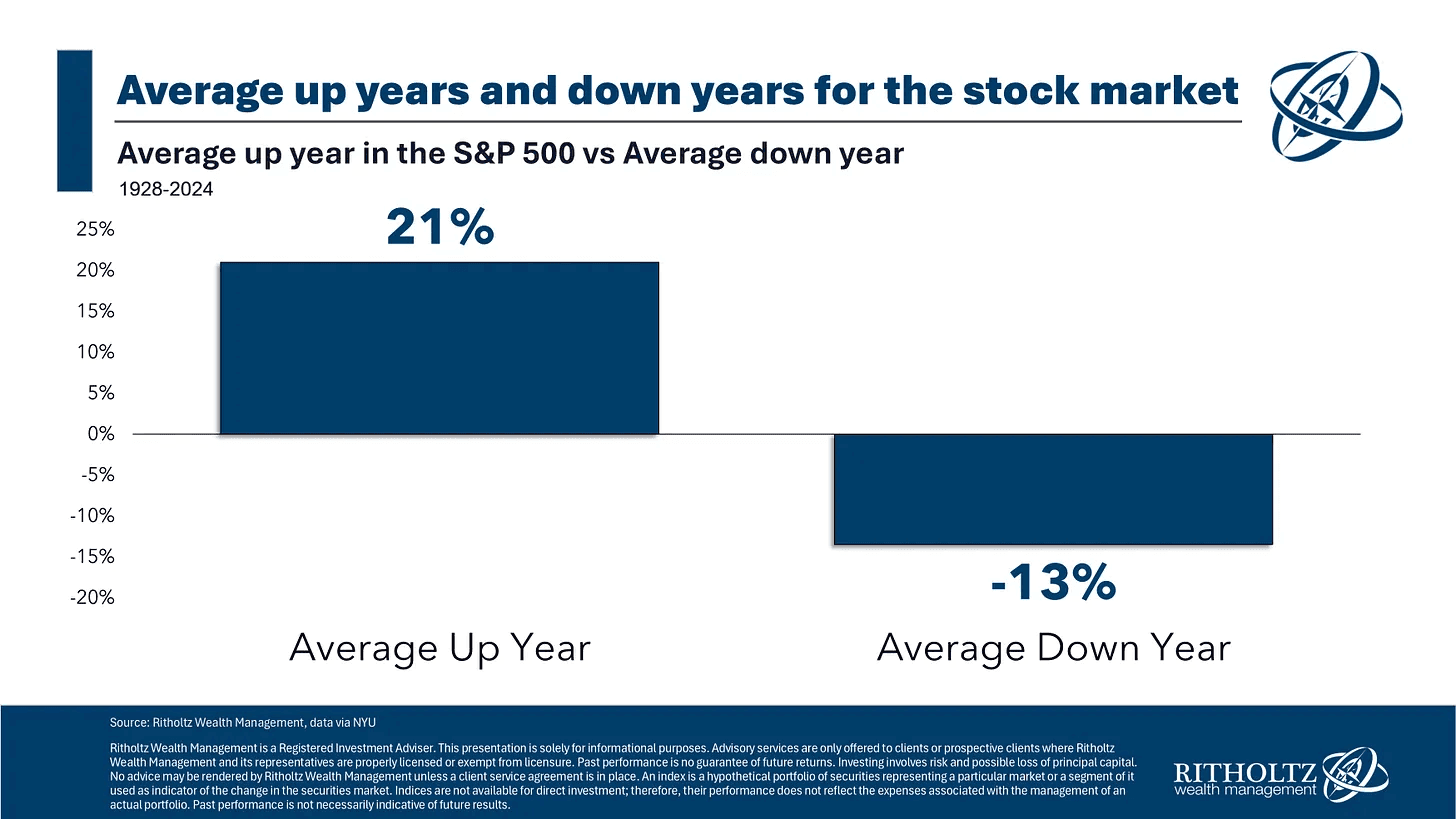

Although 17% is a really good performance for the index, it is actually below its average up year. Of course, over the long run, the average price change across all years is about +8%, but as usual, averages tend to be deceiving. The average during up years for the S&P is actually +21% versus -13% during down years.

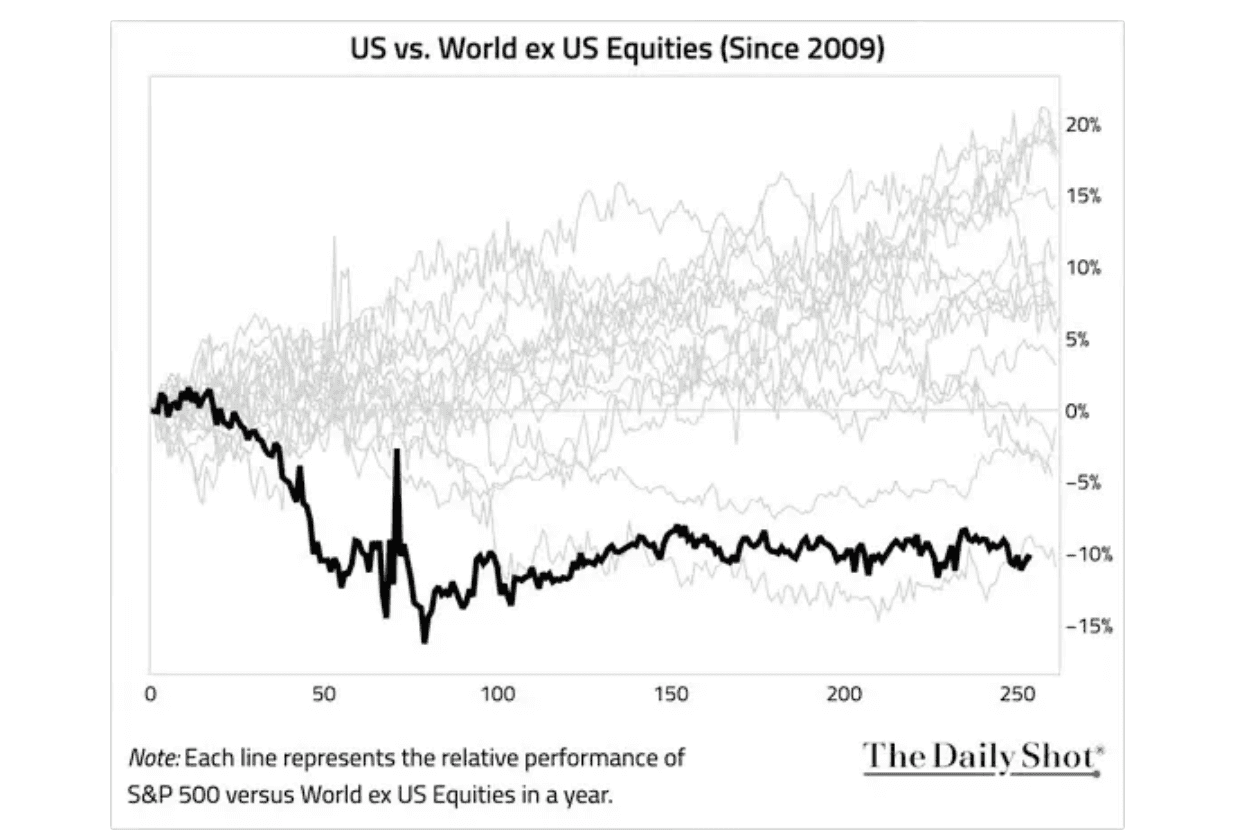

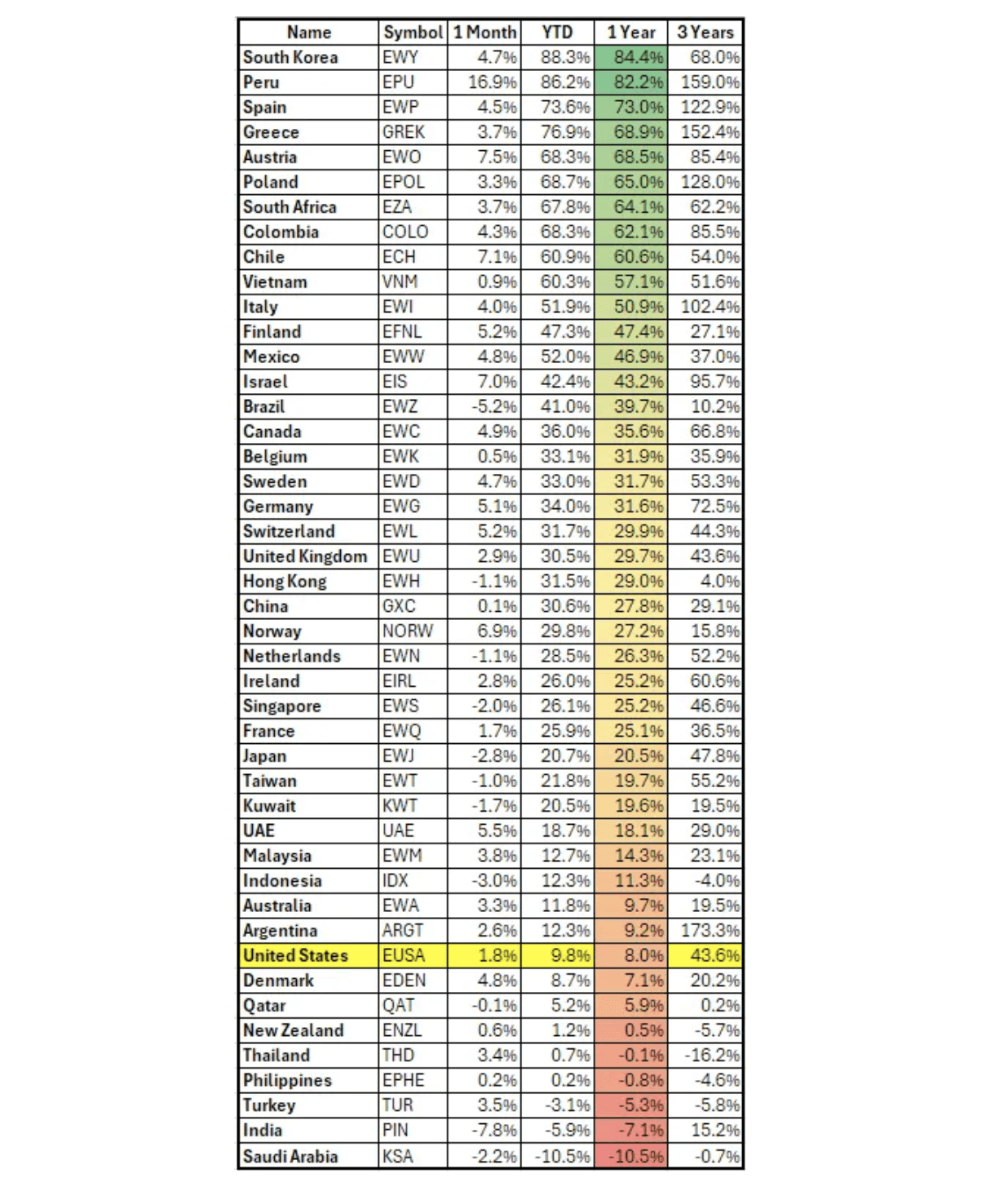

Even with all the hype around US stocks, this was one of the worst years for US markets relative to global markets since 2009.

On an equal weighted basis, the US ended up in the bottom group. That means many other countries did much better while everyone was focused on the same big US names. The big question now is whether we’re seeing a reversion of this trend in 2026.

* Note this is the US equal weighted index.

The biggest theme of the year was debasement.

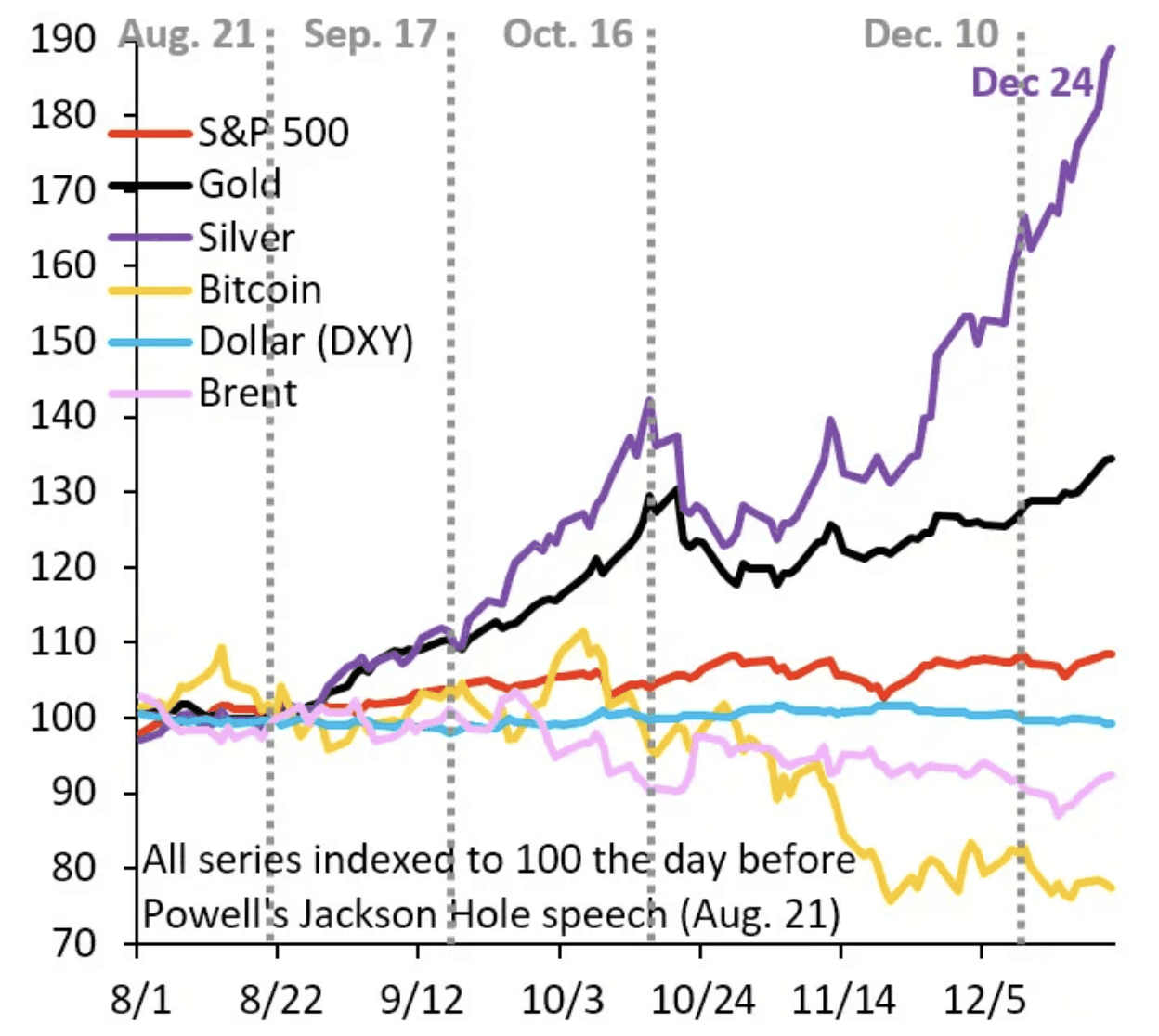

People started worrying about money losing value. Governments are spending a lot. Debt keeps rising. Global tensions are high. So investors ran toward assets. Gold and silver exploded. Since late August, silver is up around 90%. Gold is up about 35%. That is truly historic.

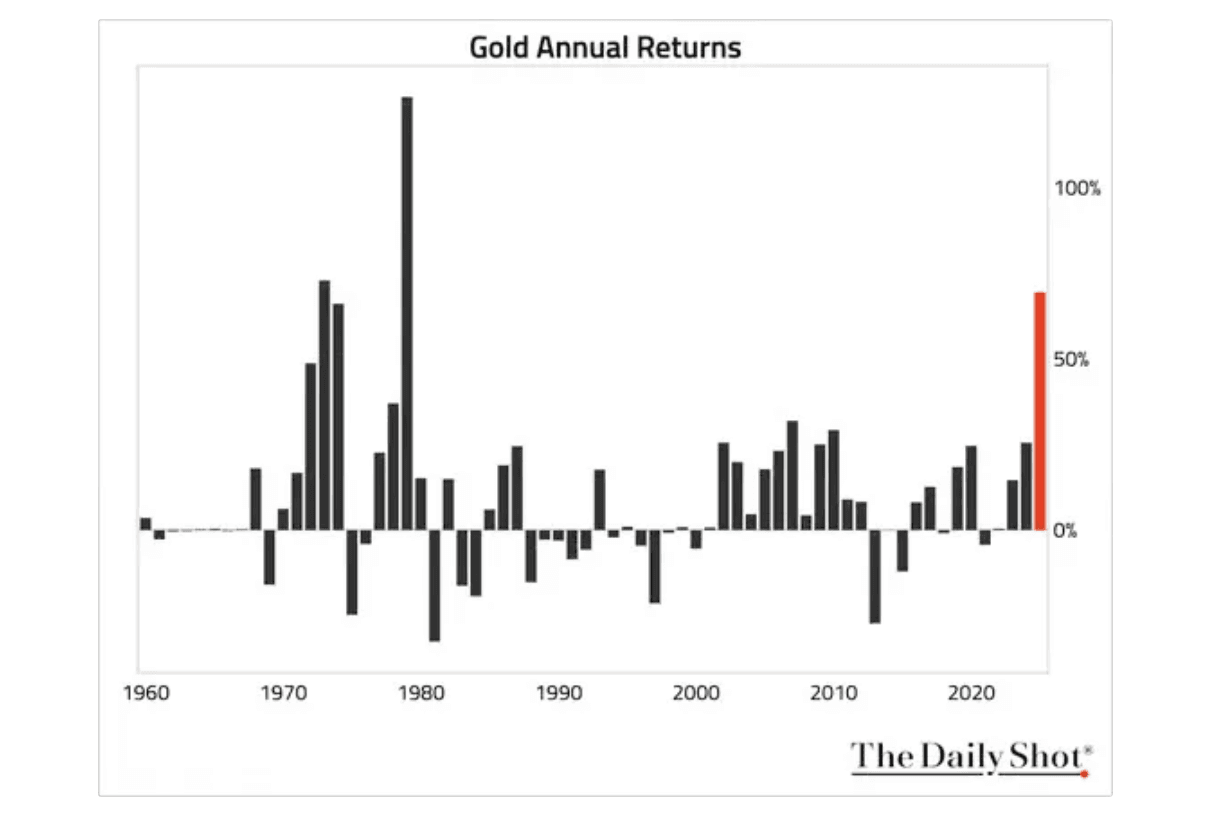

That is why gold is having its best year since 1979.

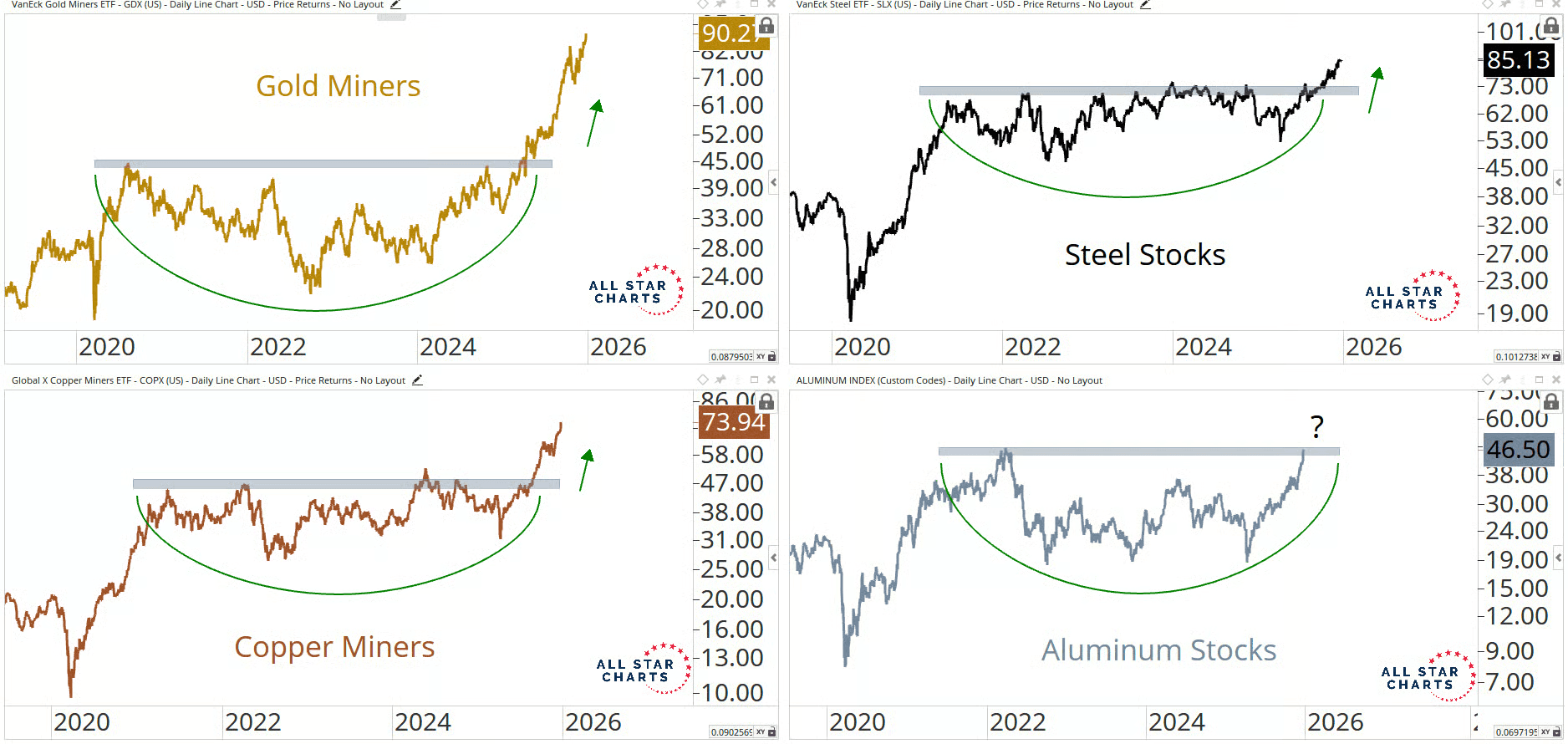

Gold went first. Then silver. Then palladium. Now copper and steel stocks are moving. Aluminum might be next. 2026 could be a supercycle in commodities.

Only crypto has been standing out this year, though not in a positive way.

In fact, it is the only major asset class that is actually down so far.

Since November, net flows into both Bitcoin and Ethereum ETFs have turned negative and remained so. But they are starting to turn positive, which tends to happen very close to the actual bottoms.

The biggest companies kept getting bigger.

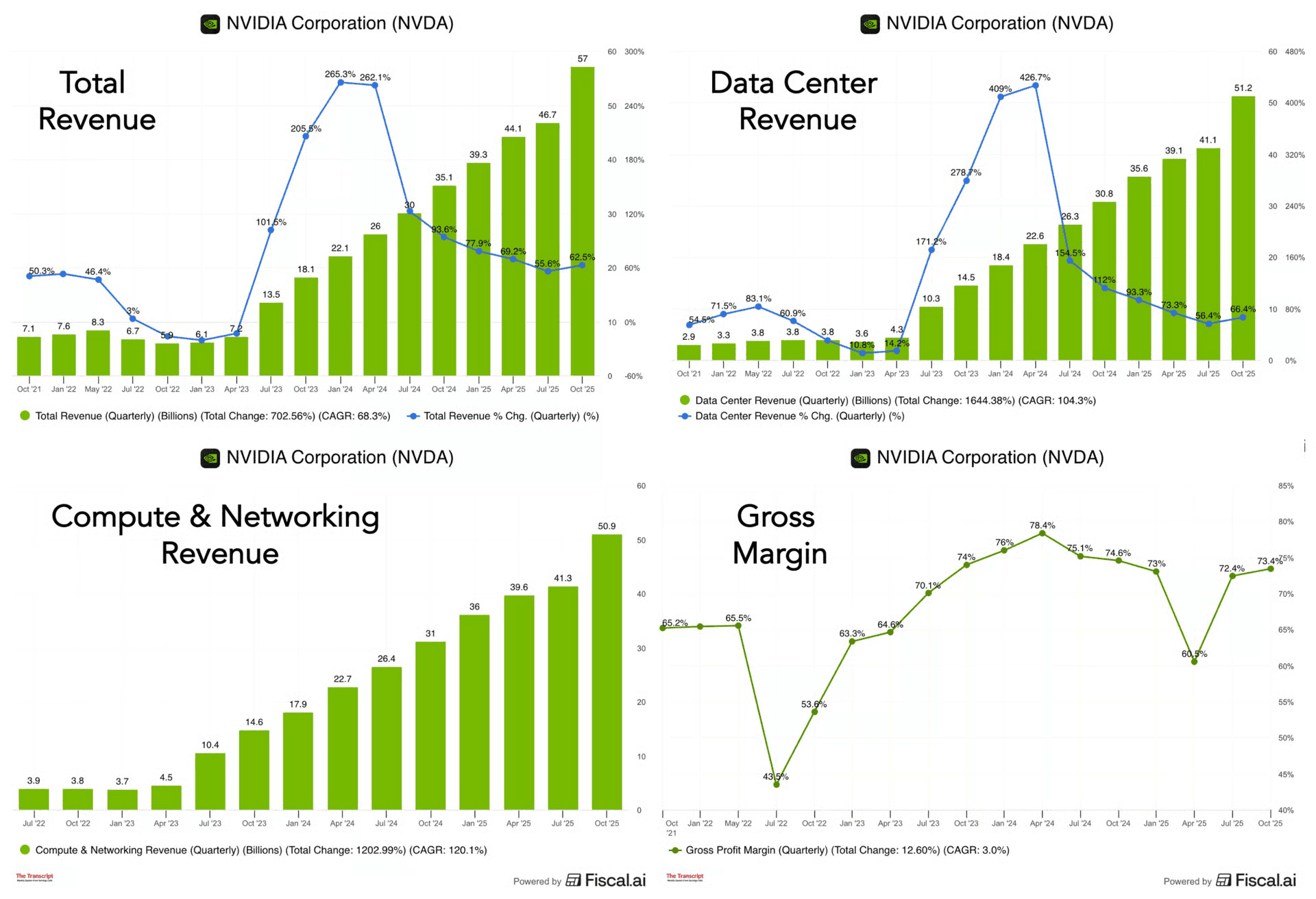

Nvidia is now the largest and most important company in the world. It became the poster child of the entire AI boom. The big lesson here is that leaders can stay…

Lin

Dec 27, 2025

Sector to Watch: Solar Energy

I just published a new thematic portfolio: Solar Energy.

One of the reasons I enjoy doing these sector breakdown is because you’ll always discover new interesting companies.

All of this comes at a time when valuations across the solar industry have pulled back after 4 very challenging years. After a long reset, the sector’s fundamentals are starting to stabilize. Solar is now experiencing a renaissance. Global electricity demand is accelerating again, and a big part of that growth is coming from data centers needed to power AI.

So, here are 3 stocks that stood out.

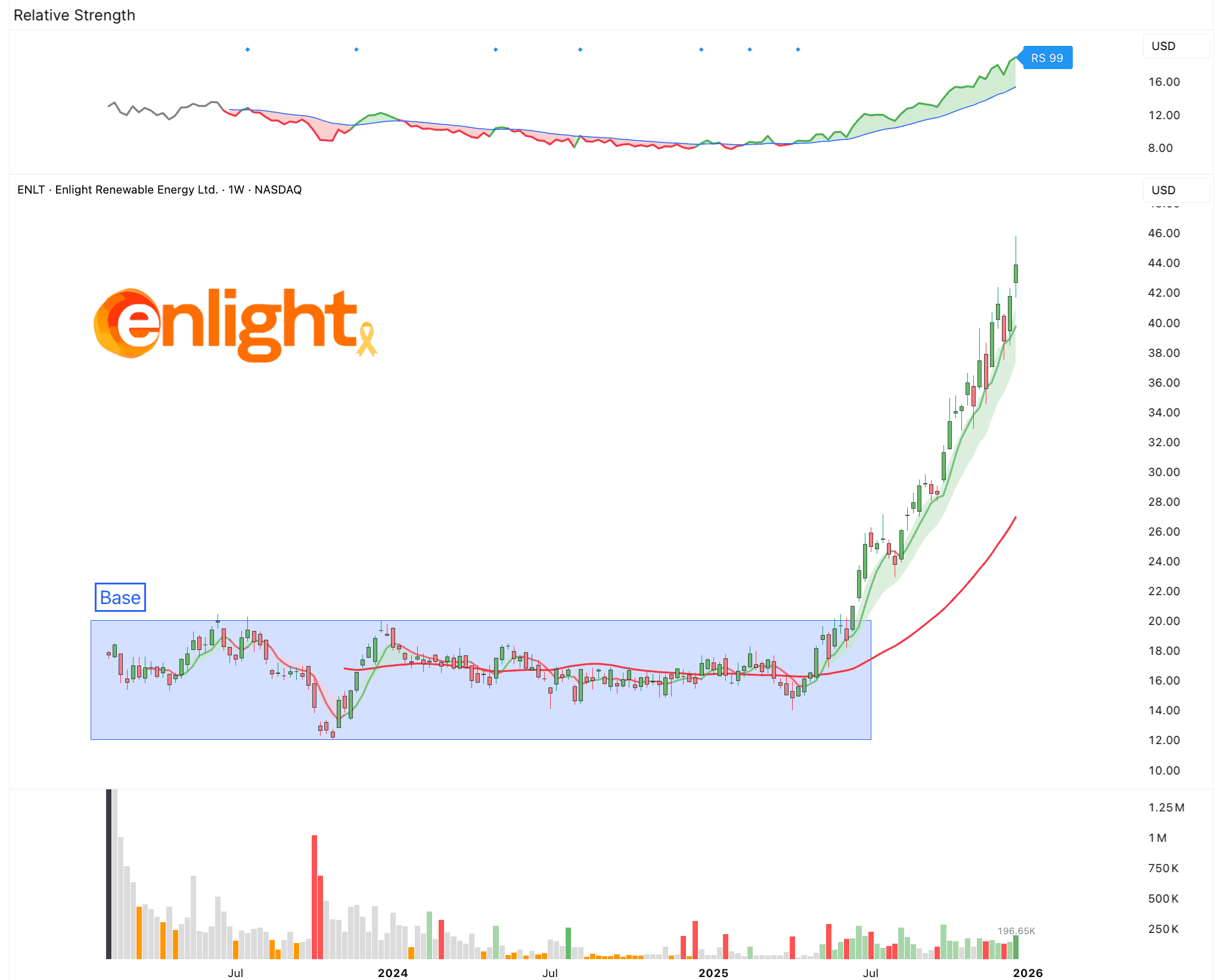

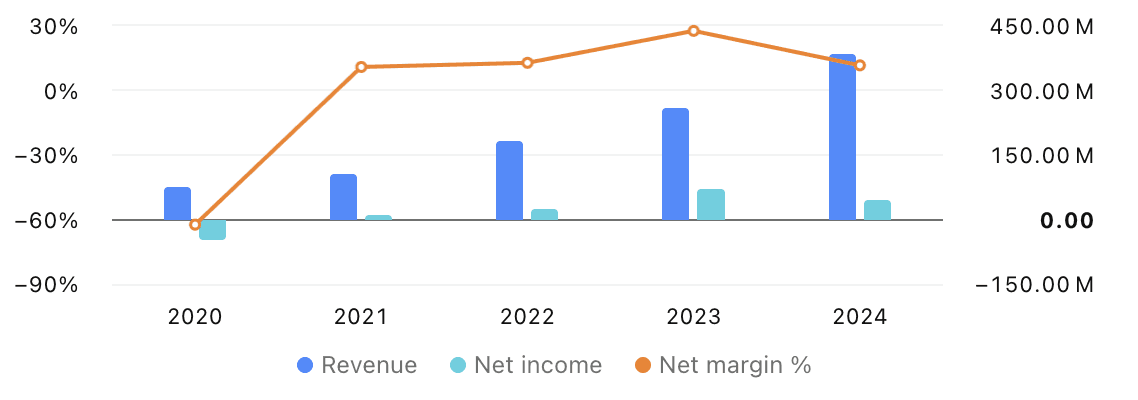

1. Enlight Renewable Energy ($ENLT)

Enlight builds and operates large clean power projects. Its main focus is utility scale solar and wind farms that feed electricity directly into the grid. These are not rooftop panels, but very large projects designed to supply cities, industries, and data centers.

Enlight works across the full life cycle of a project. It finds suitable land, secures permits, arranges financing, builds the power plants, and then operates them for many years. By owning and running the assets long term, the company earns steady revenue from selling electricity under long term contracts. The company operates internationally. While it started in Israel, it now has projects in Europe and the United States.

Solar and wind are the core of the business, but storage is becoming more important. Enlight also develops large battery systems that store energy from solar and wind and release it later when demand is higher. This makes Enlight a full stack renewable energy company.

It has not only been growing incredibly fast, but it has also been profitable for years.

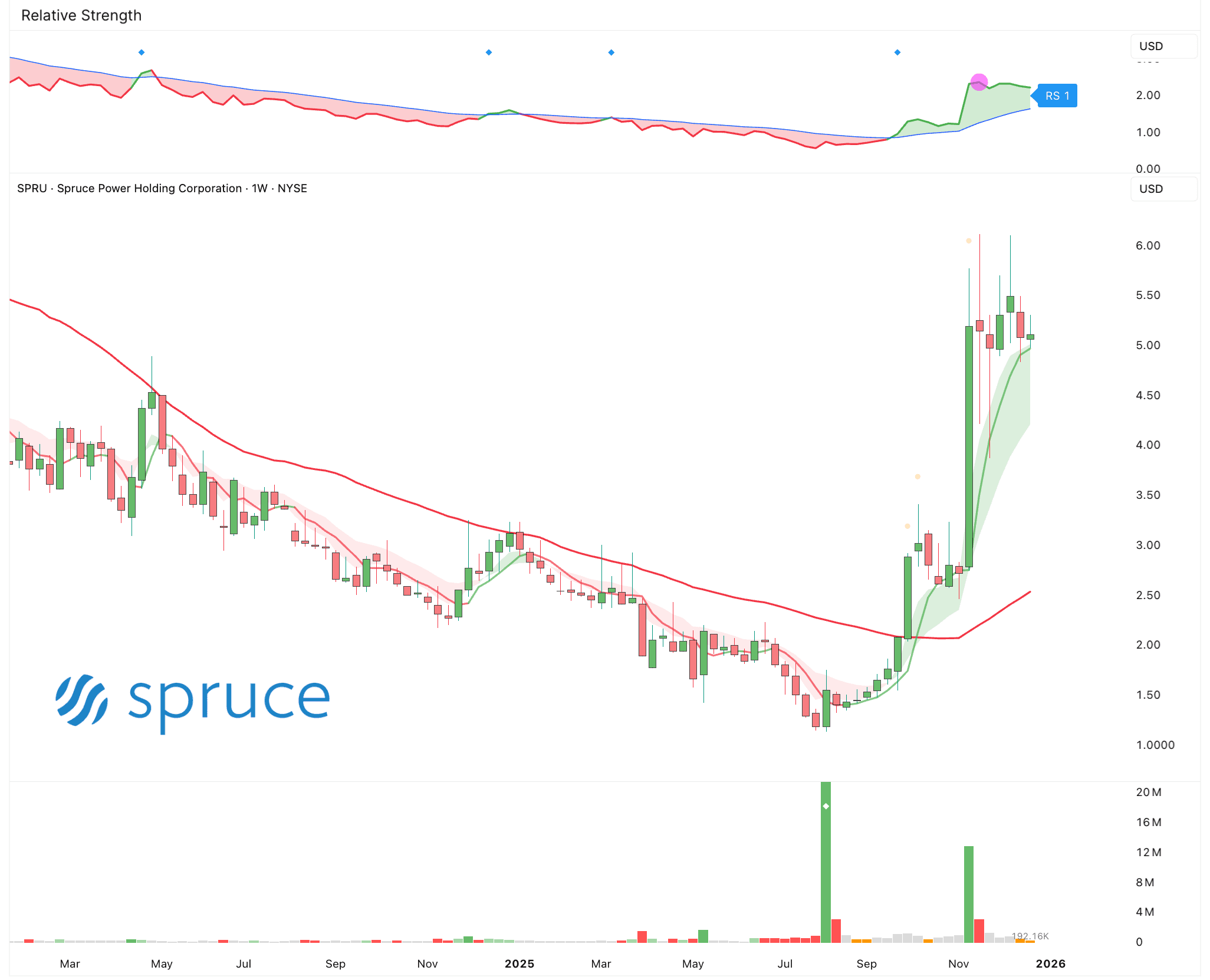

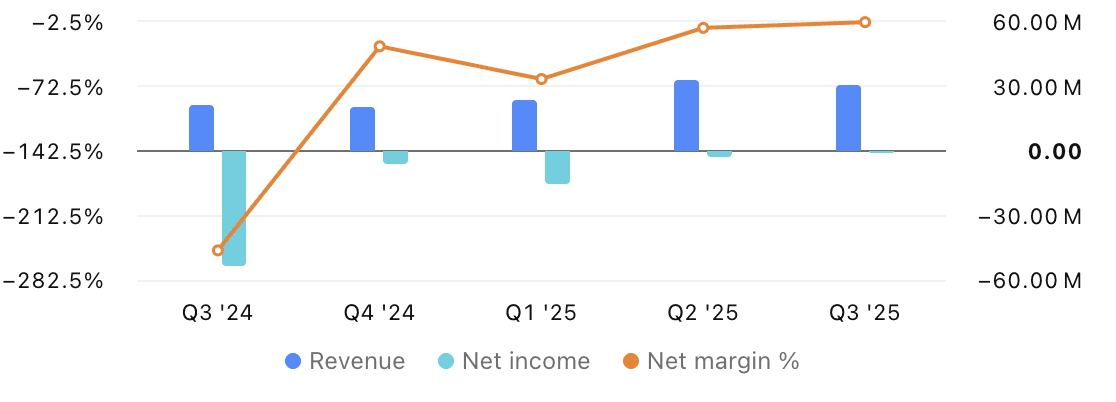

2. Spruce Power ($SPRU)

Spruce Power is a residential solar company focused on owning and operating home solar systems in the United States. Unlike many solar installers, Spruce usually does not sell systems to homeowners. Instead, it owns the panels and sells the electricity or leases the system to the homeowner. It also uses battery storage and system upgrades where it makes sense.

Spruce Power grows mainly by buying existing residential solar portfolios. These are thousands of already installed home solar systems that come with long term customer contracts. By acquiring these portfolios, Spruce gets immediate cash flow instead of waiting years for new installs to pay back.

The company’s business is built around long term recurring revenue. Homeowners sign contracts that often last 20 to 25 years. Spruce collects monthly payments while handling system monitoring, maintenance, and customer service. This makes the business more stable and predictable than pure installation companies.

Interestingly, since its IPO in 2020, Spruce lost about 99% of its value. Then, starting in August, the stock jumped more than 300%. I am not fully sure what caused that move yet. I need to dig into that. This makes the stock clearly speculative.

What makes it interesting though is its the size. Even after the big run up, the company is still valued at under $100M. That is tiny for an energy company with thousands of operating solar assets. Even more surprising, it is likely generating more than that in revenue this year and is close to being profitable. That gap between revenue and market cap is unusual and worth a closer look.

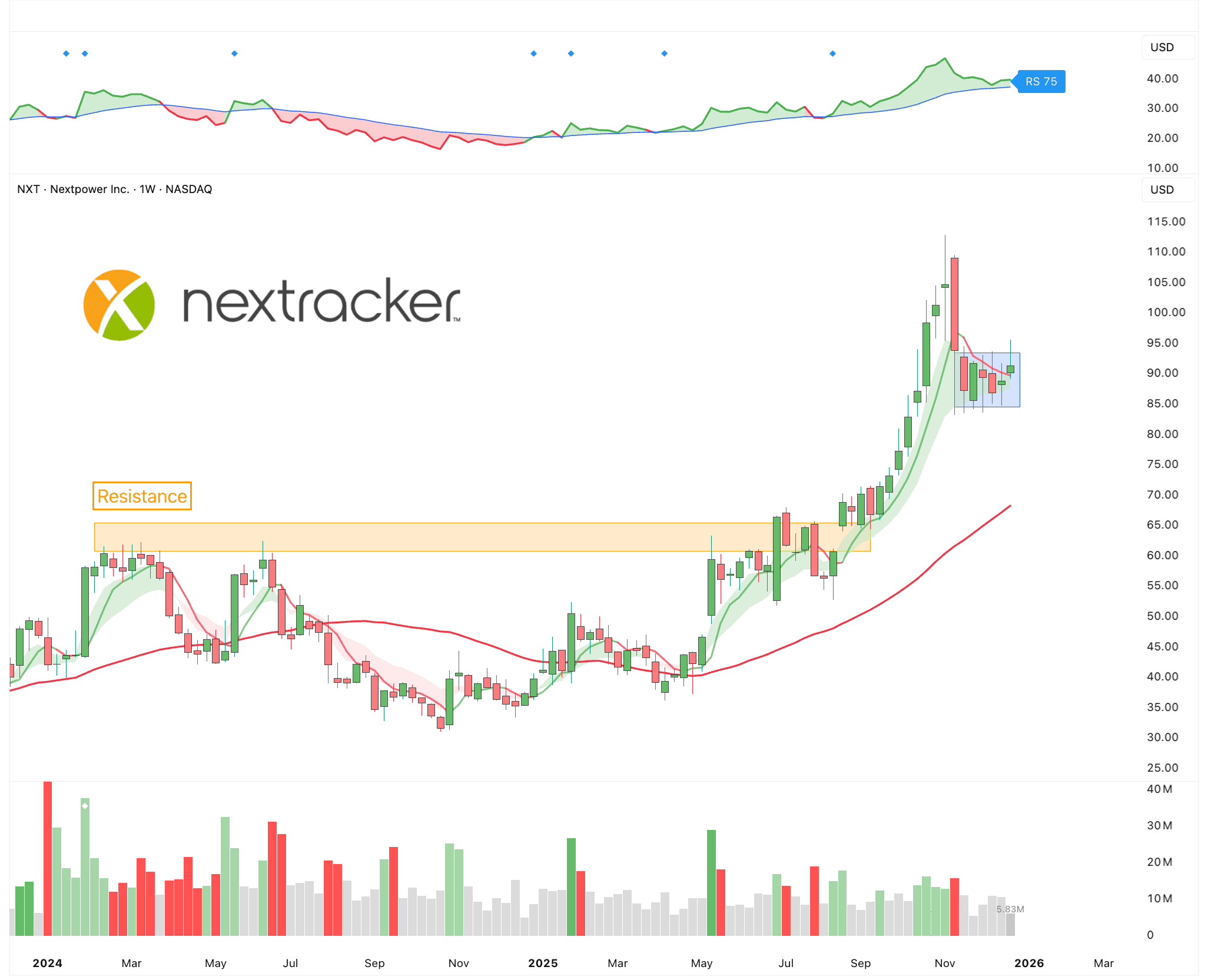

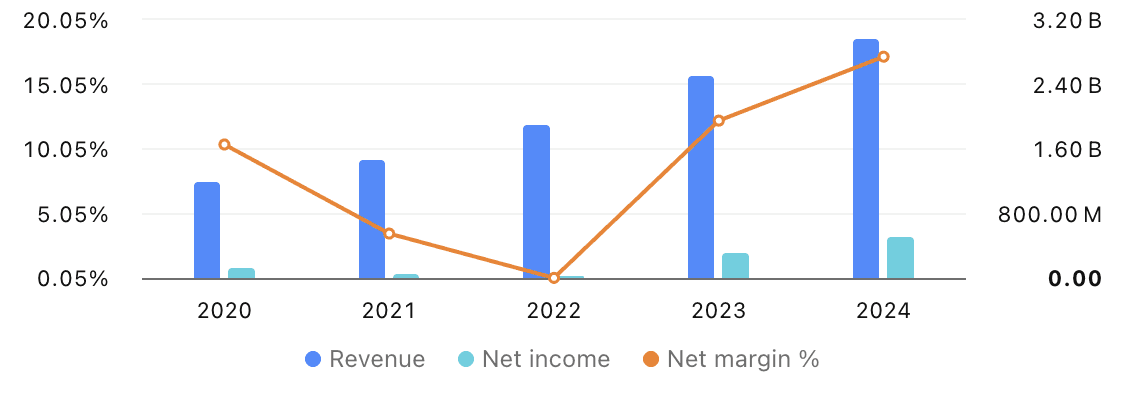

3. Nextpower ($NXT)

I highlighted Nextpower a few weeks ago, but since it fits this theme so well, it does not hurt to mention it again.

Traditional solar panels are fixed, which limits the amount of sunlight they can capture.

That’s where Nextpower comes in.

They build solar tracking systems with intelligent motors and software that make panels follow the sun throughout the day. Each tracker uses sensors, algorithms, and cloud software to adjust in real time for wind, terrain, and sunlight.

The result is up to 25% more energy output from the same panels.

Until now they’ve deployed systems on more than 90 gigawatts of solar projects across over 30 countries. And Nextpower works with many of the world’s largest renewable energy developers and utilities

They are profitable, growing steadily 20% year after year, and trade at a PE of 24.

Lin

Dec 22, 2025

Weekly Market Update: Is Santa Coming?

This week was a whirlwind. I feel like I’m saying this every week now.

But that’s because we’re going through a period of elevated volatility.

The unwind in AI infrastructure names seemed like it was never going to end, and that peaked on Wednesday when news came out that Blue Owl was backing out of its funding to support Oracle’s new 1GW data center in Michigan. This was a big red flag because Blue Owl had been acting as a major lifeline to these AI-centric companies building data centers. When a big lender like that steps away, people start to wonder if these projects are riskier than they thought.

That fear led to more selling.

However, all of that selling came to a screeching halt on Thursday and Friday as many of the high-momentum stocks were bid relentlessly higher.

Why did this happen? There are a few reasons.

News came out that OpenAI is considering raising $100B at a monstrous $830B valuation. This would mean OpenAI will be able to fulfill its obligations to companies like Oracle and CoreWeave. This has been the biggest fear in the AI complex.

On top of that, the recent earnings report from Micron was incredible. This was arguably the biggest and most telling semiconductor quarter we’ve seen since this AI bull market began. They absolutely smashed expectations and guided much higher than what the Street was expecting.

Another signal that the AI boom is still far from over.

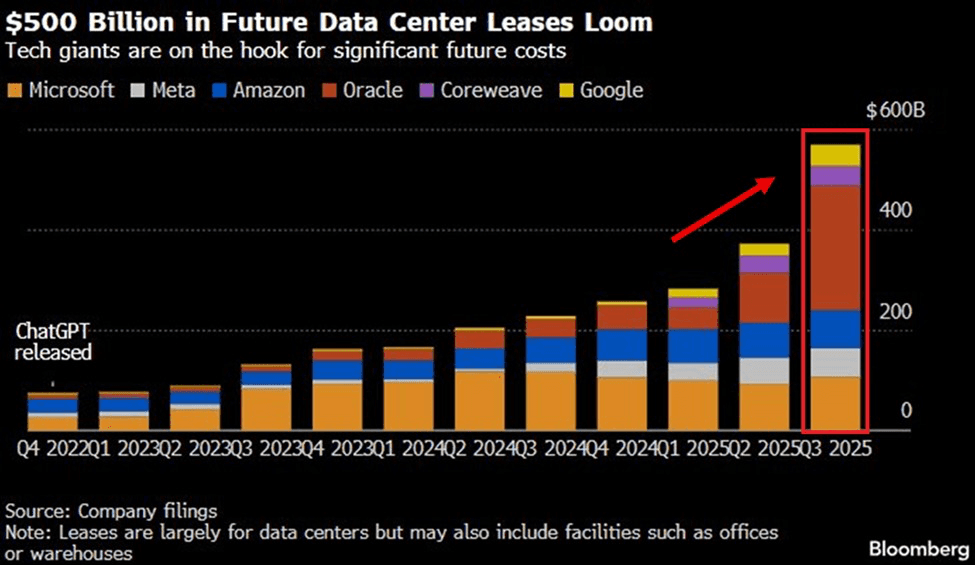

In fact, US tech companies are making massive bets on AI.

They are committing to spend a combined $569 billion on data center leases over the next several years.

This is a $197 billion increase, or a 53% jump, from Q2 2025.

The reason for this continued volatility is simple:

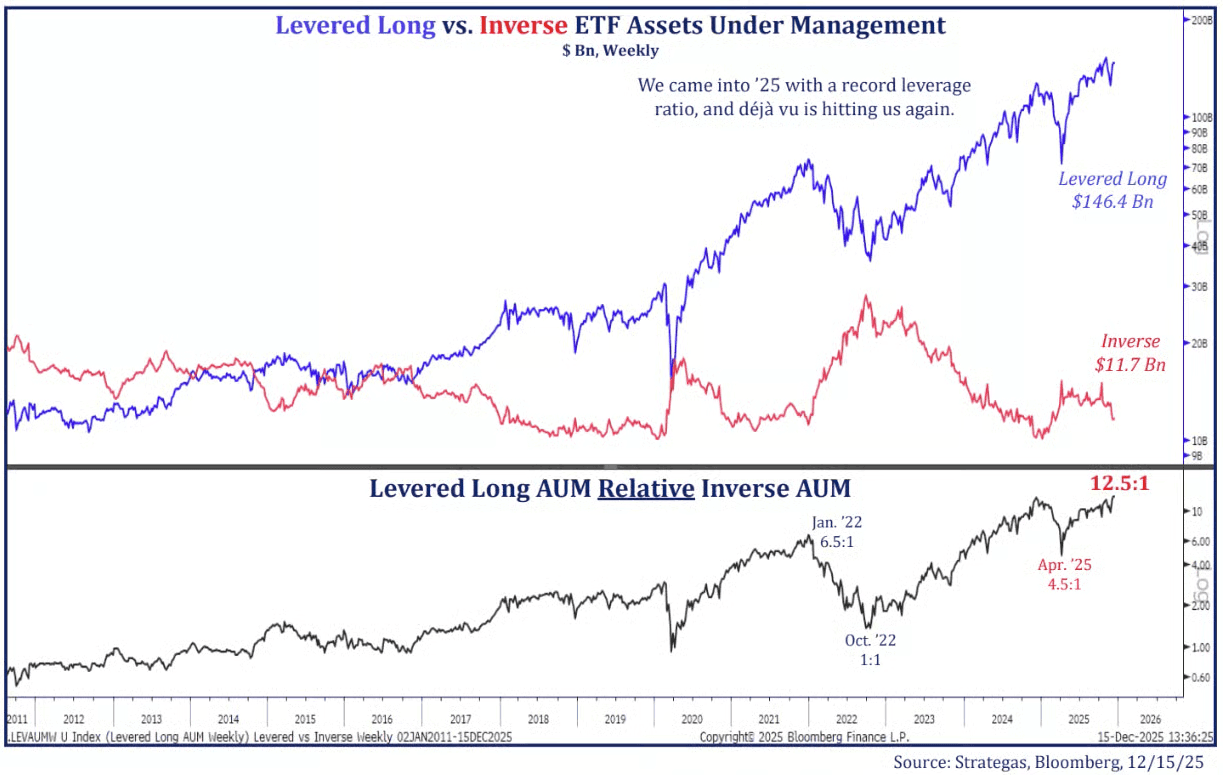

First, it’s leverage.

Right now, there is about a 12.5 to 1 ratio of leveraged long ETFs versus inverse ETFs. This is the highest in over a year. That simply means far more investors are betting aggressively on prices going up than protecting against a drop.

But When the market falls just a little, these big risky bets lose fast. People panic and sell. That selling pushes prices down even more.

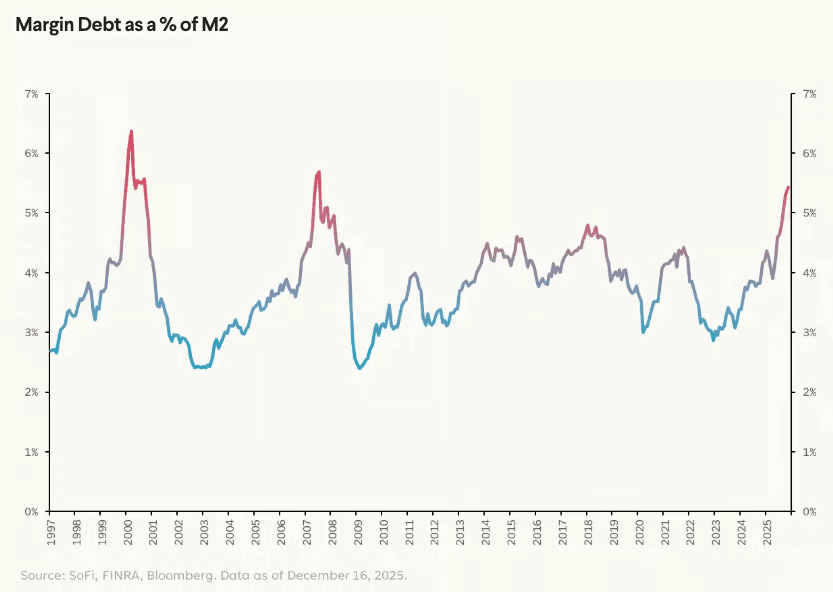

Second, margin debt is rising fast. And this matters more than most people think.

Margin debt means investors are borrowing money to buy stocks. It is leverage. You put down some of your own cash and borrow the rest, hoping prices keep going up.

Right now, margin debt compared to the total money in the system is climbing quickly. That tells us something important. Investors are optimistic. They believe stocks will be higher in the future, so they are willing to take on more risk.

The problem is that leverage only works well in low volatile markets. But when markets get choppy, leverage turns against you very fast. So leverage makes the whole system more fragile. It works great on the way up, but it increases the odds of sharp and sudden corrections.

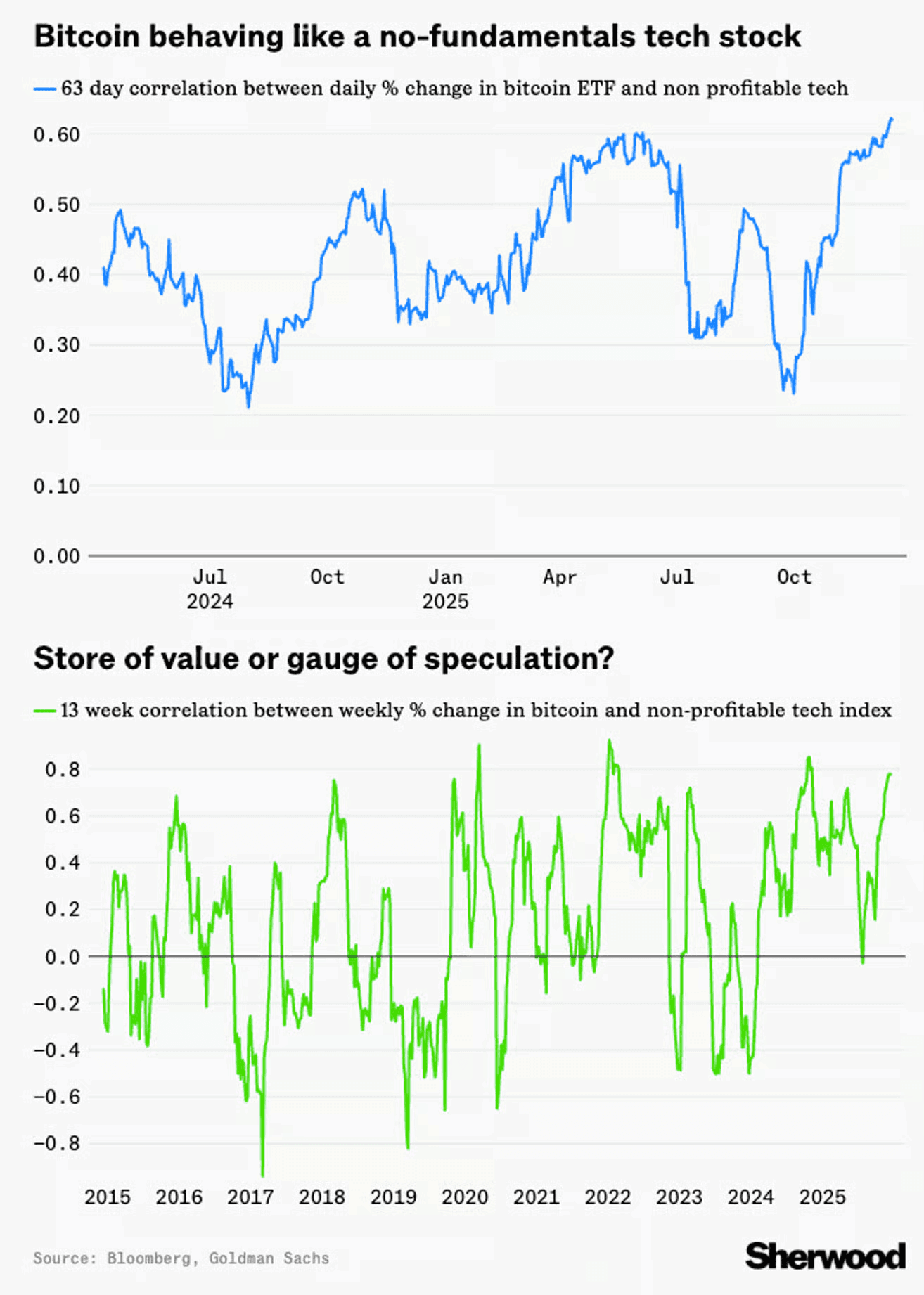

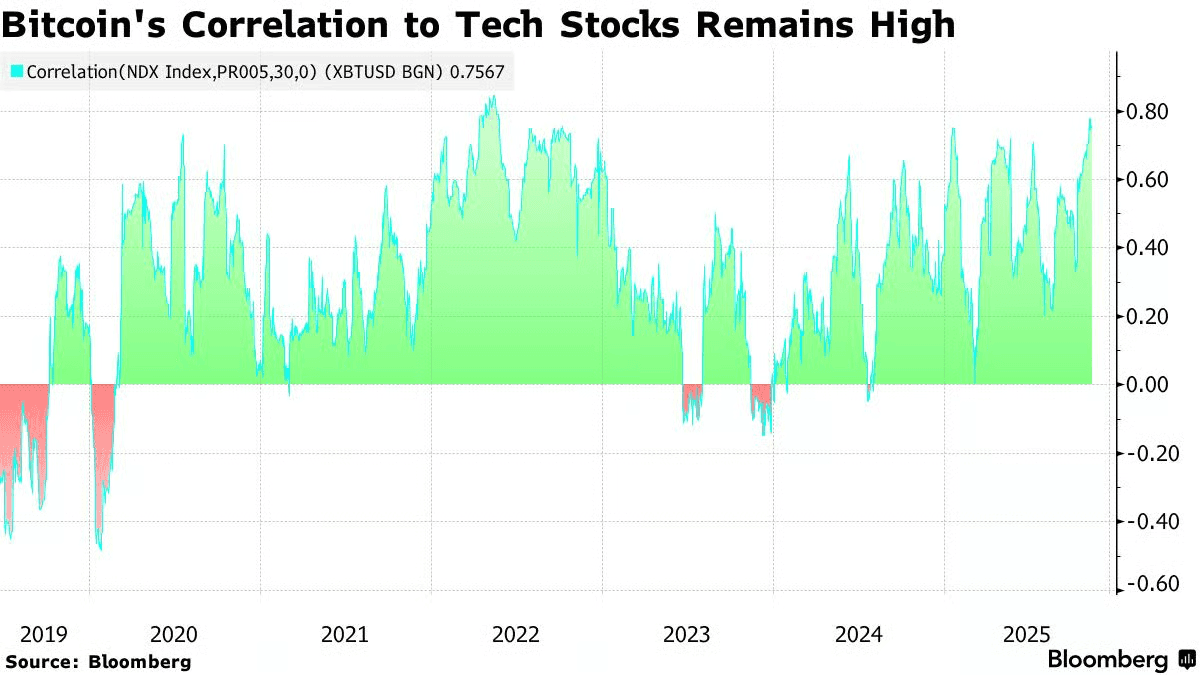

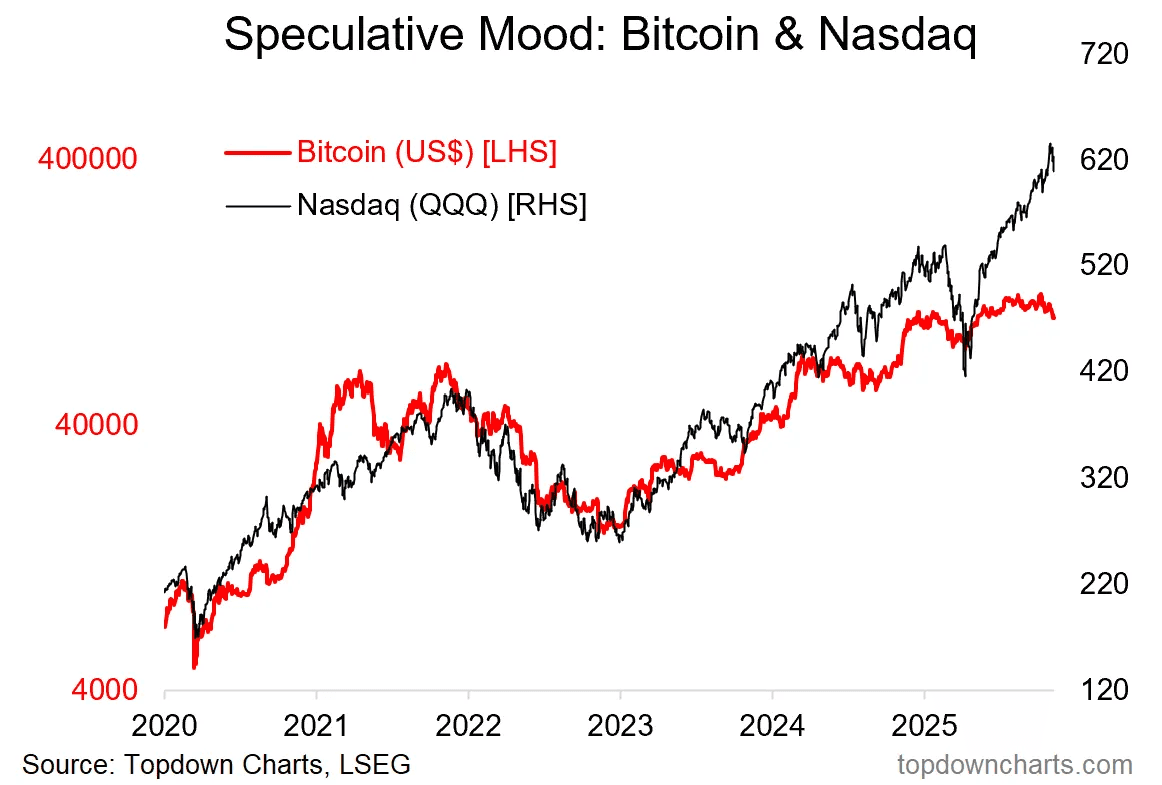

Third, Bitcoin is acting like a risky tech stock, not like a digital store of value.

Over the last 3 months, Bitcoin has been moving almost the same way as momentum names. Which is to say down.

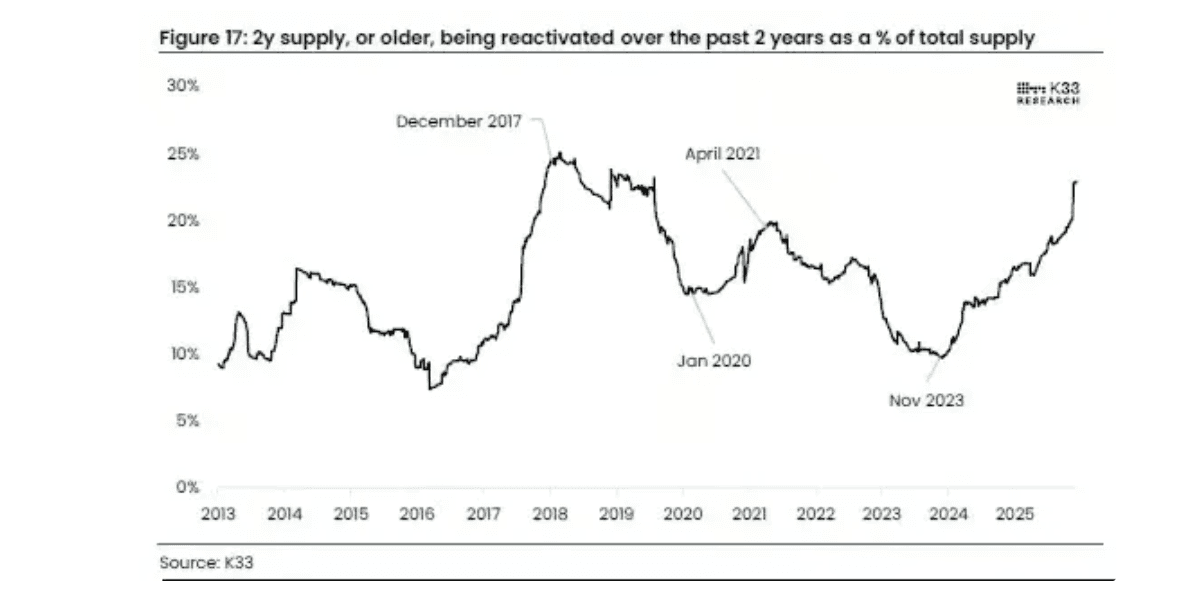

This lead to a lot of selling of long term Bitcoin holders.

Long term holders are people who bought Bitcoin and did not touch it for years. They usually believe the most in Bitcoin and sell last.

Since early 2023, about 1.6 million Bitcoin that had not moved for at least 2 years has been sold. That is around $140 billion worth. That is a huge amount.

Even more important, the last 30 days were one of the biggest selling periods by long term holders in more than 5 years.

The market loves to shakeout the few remaining holders. The bottom could be close.

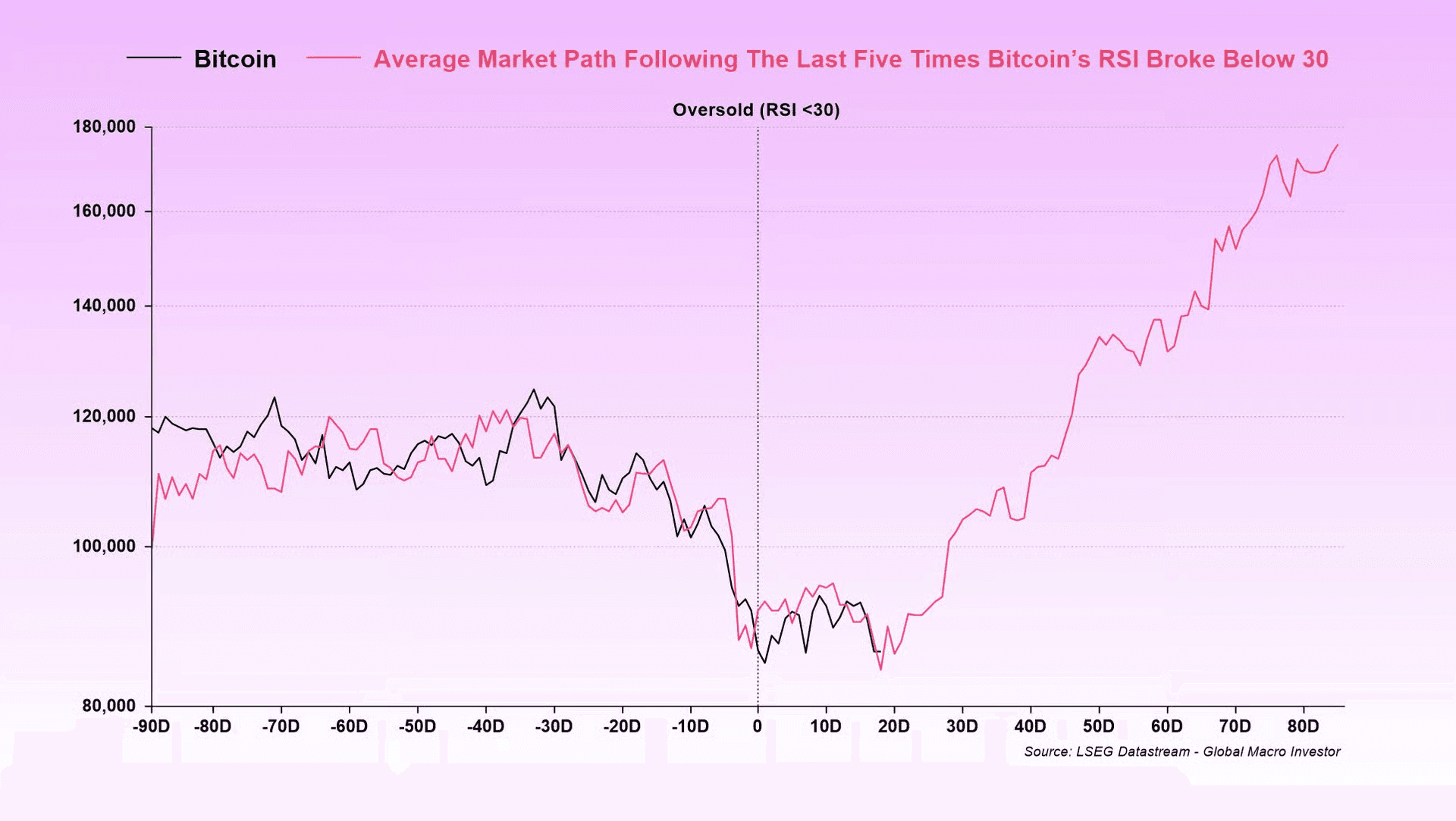

Bitcoin is very oversold.

When the RSI falls below 30, Bitcoin is considered very oversold. And this chart looks at what Bitcoin usually does after that happens.

Historically, after Bitcoin gets this oversold, prices tend to bounce. Not always right away, but often soon after. Selling pressure starts to fade because most people who wanted to sell or were forced to sell already did.

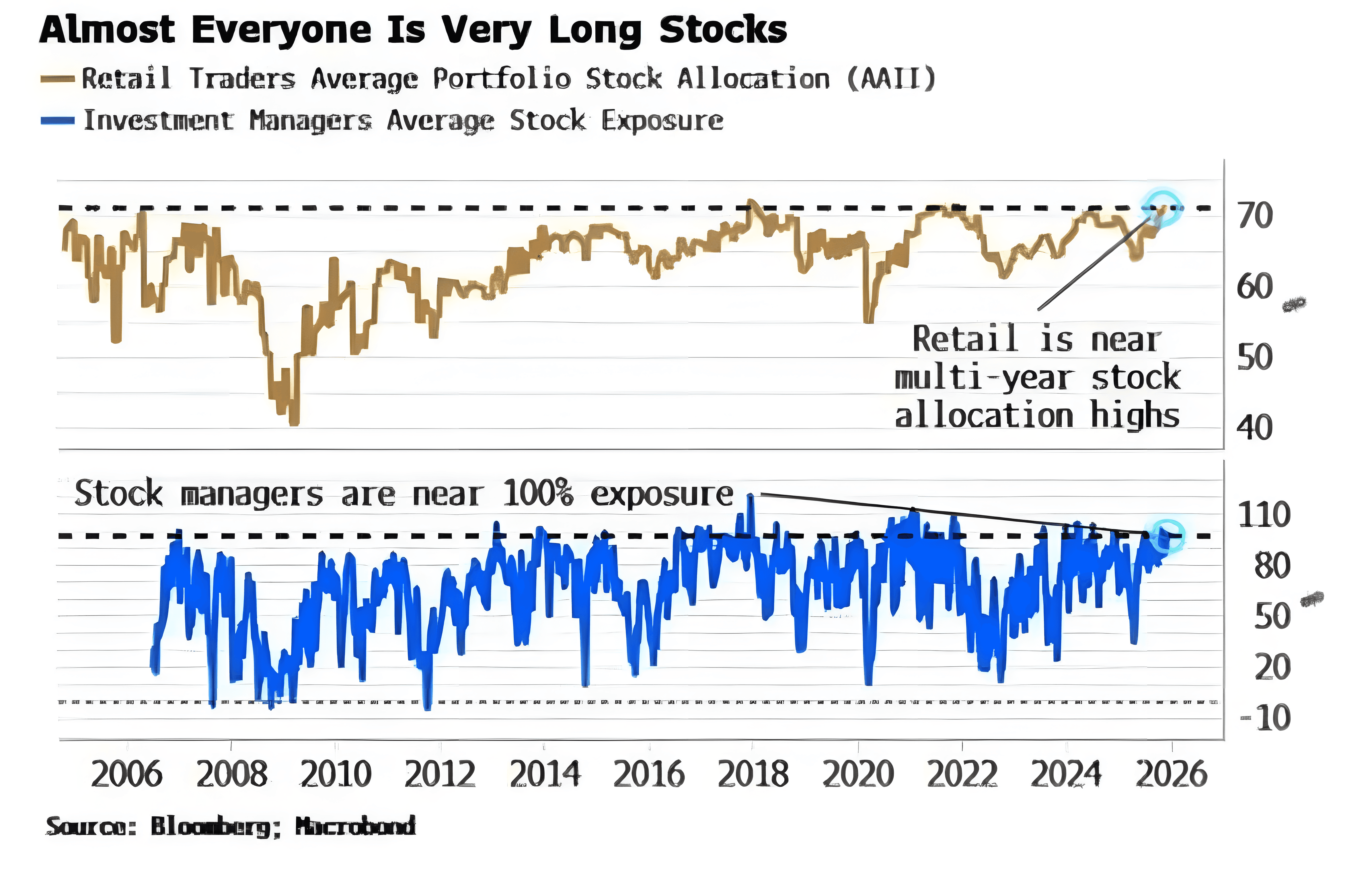

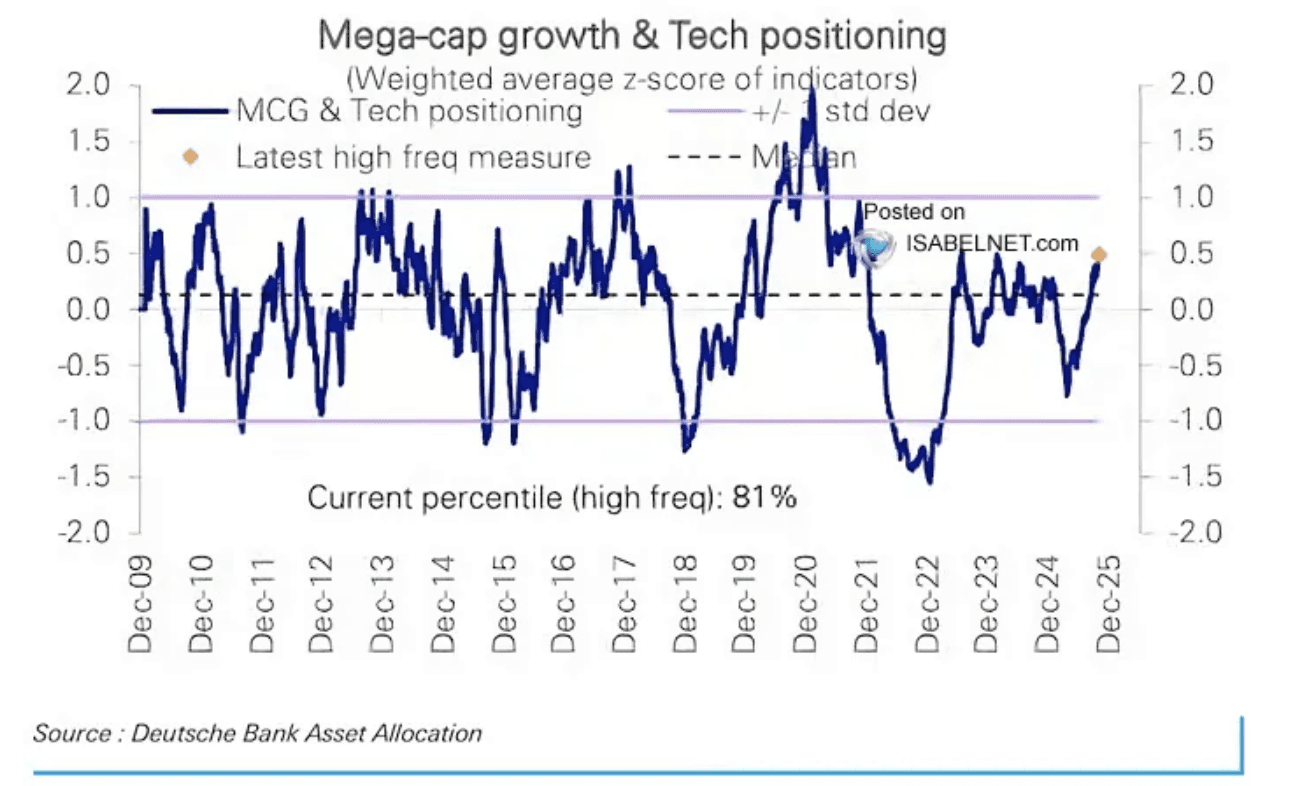

Fourth, the stock market positioning is extremely stretched right now.

Retail investors have about 70% of their money in stocks, near the highest level in 20+ years and similar to the 2021 meme stock period. Professional investment managers are also almost fully invested, with stock exposure close to 100%, which means most investors are positioned the same way.

And when everyone thinks the same, markets get fragile.

Because when something unexpected happens, there are no buyers left. Everyone tries to react at the same time. Even small changes can lead to huge moves.

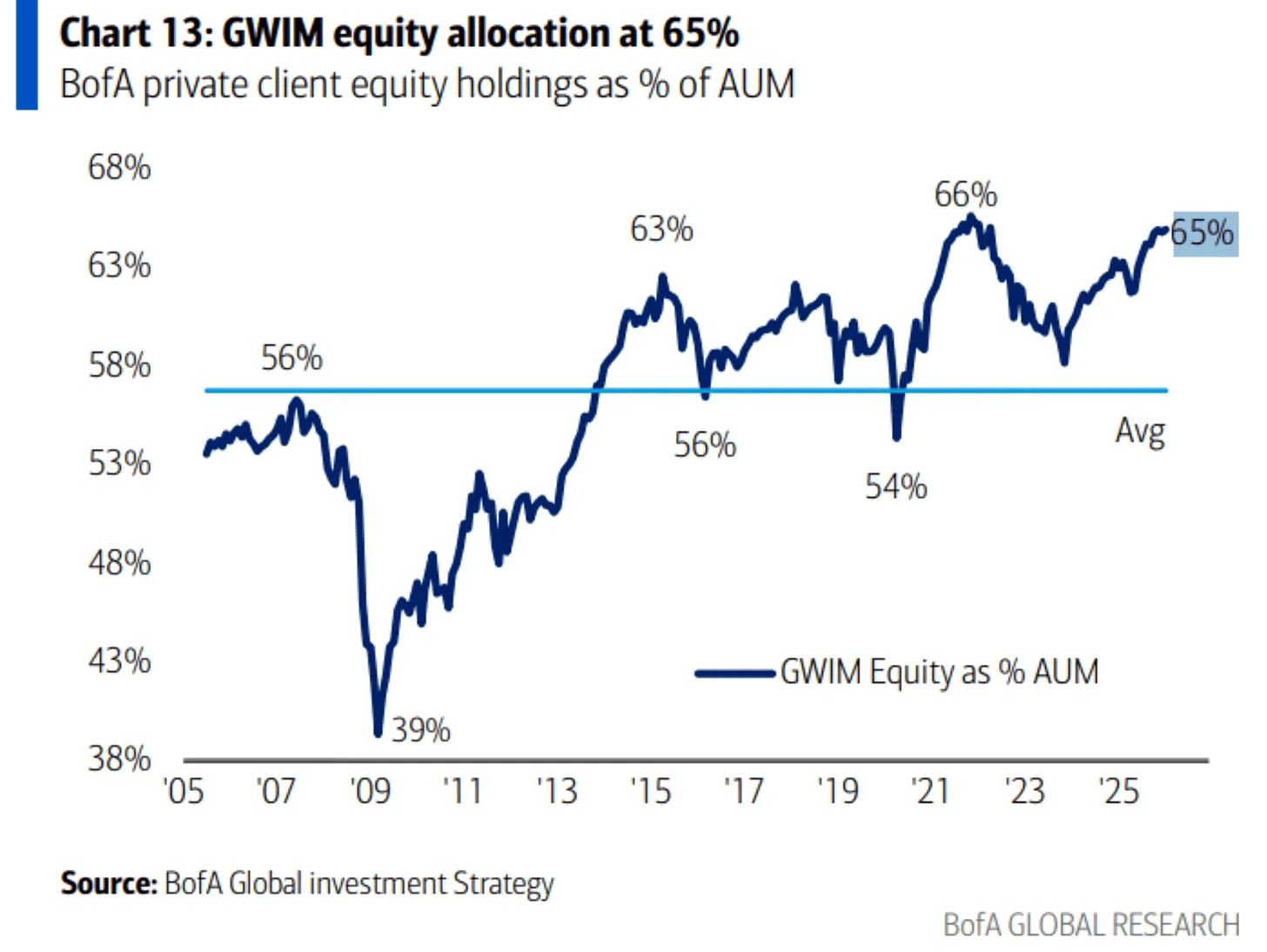

Fifth, Bank of America clients now hold about 65% of their portfolios in stocks. That is very close to a record high.

Everyone is already heavily invested. There is less new money left to push prices higher. A lot of the optimism is already priced in. This data point is not a sell signal by itself. But it’s a good temperature check.

And we know that the market loves to shake everyone out before it reverses higher for the next leg higher.

All of this is to say that there is a lot of leverage in the system right now.

Sooner or later, that has to balance out. Markets cannot function properly when leverage builds up too much, because even small price moves get amplified. Both leveraged long and leveraged short positions get whipped around or even forced to liquidate.

This is why we’re seeing this heightened volatility right now. That is the market’s way of clearing out the imbalance. Volatility flushes out excess leverage and resets the system.

But on the positive front, the overall market is holding up better than many expected. Even after recent volatility, the big indexes have not broken down. Every time the market looked like it might break down, it didn’t. Instead it recovered immediately.

And now, we have seasonality on our side.

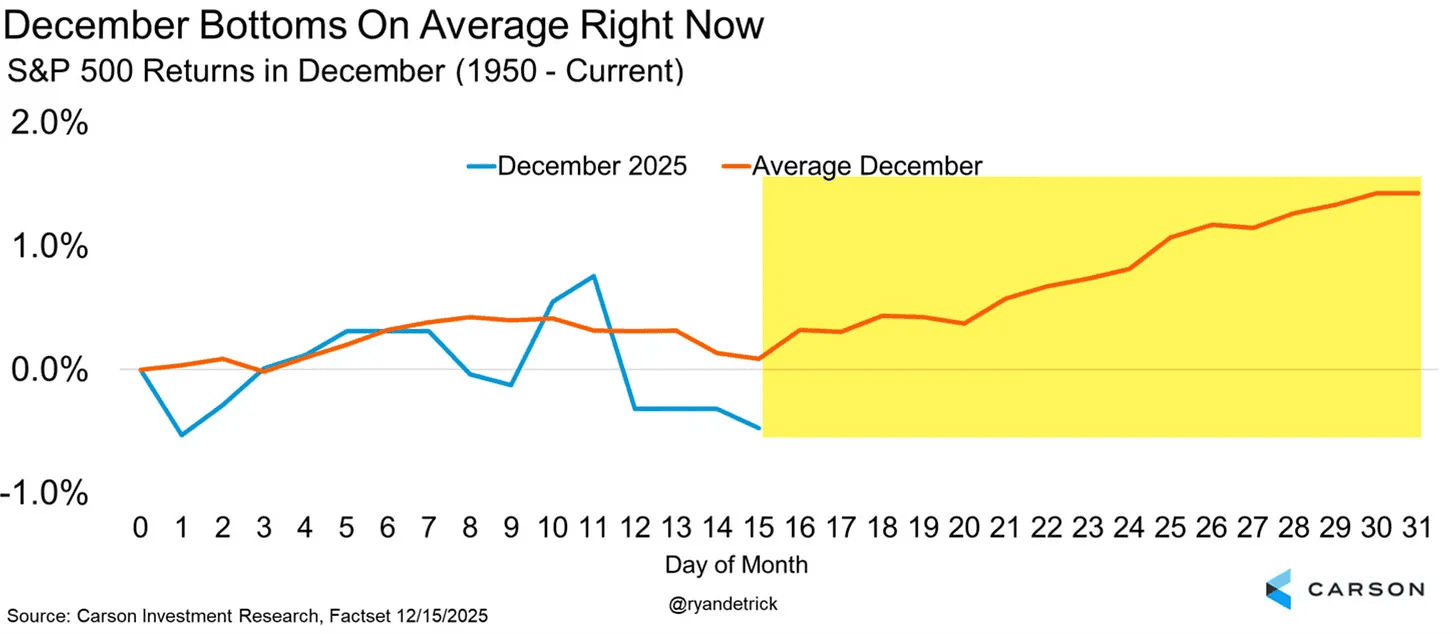

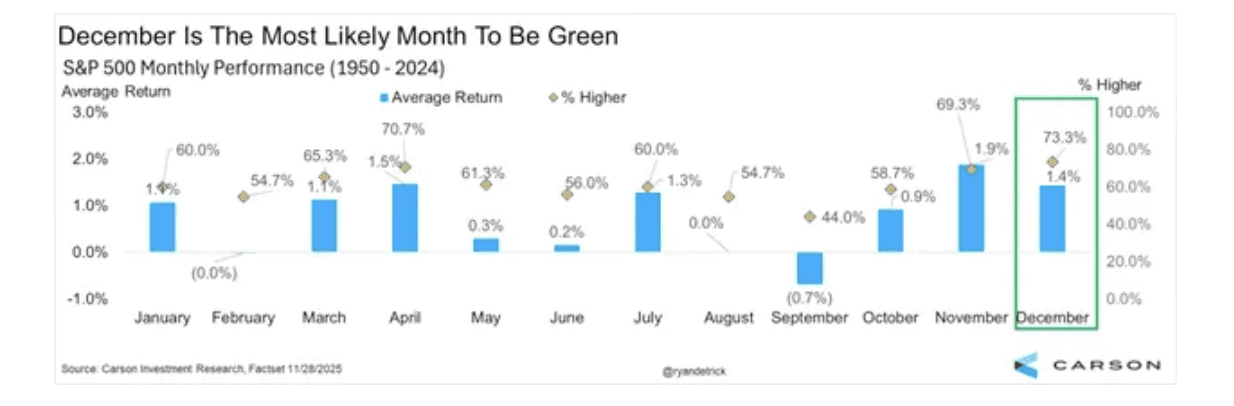

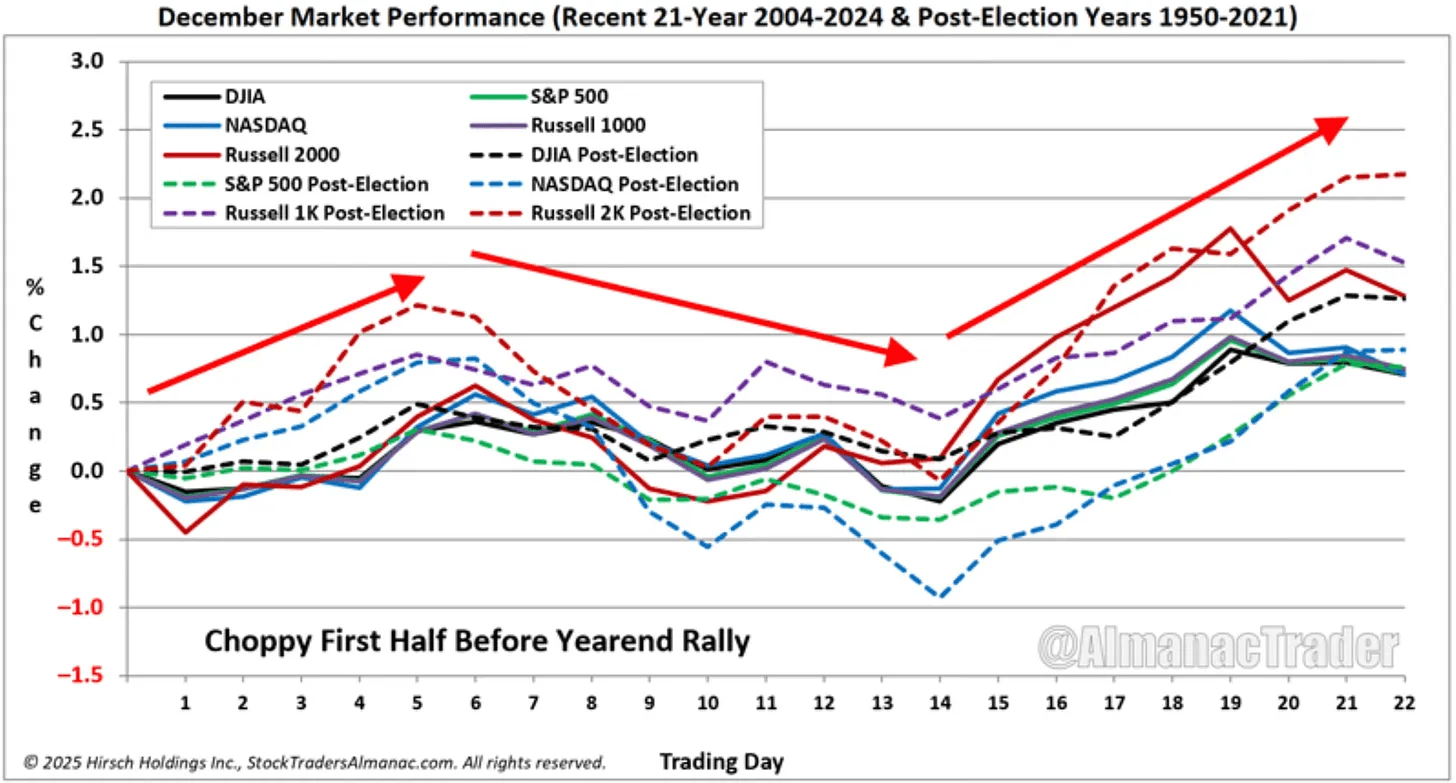

Going back to 1950, this is what the average December looks like.

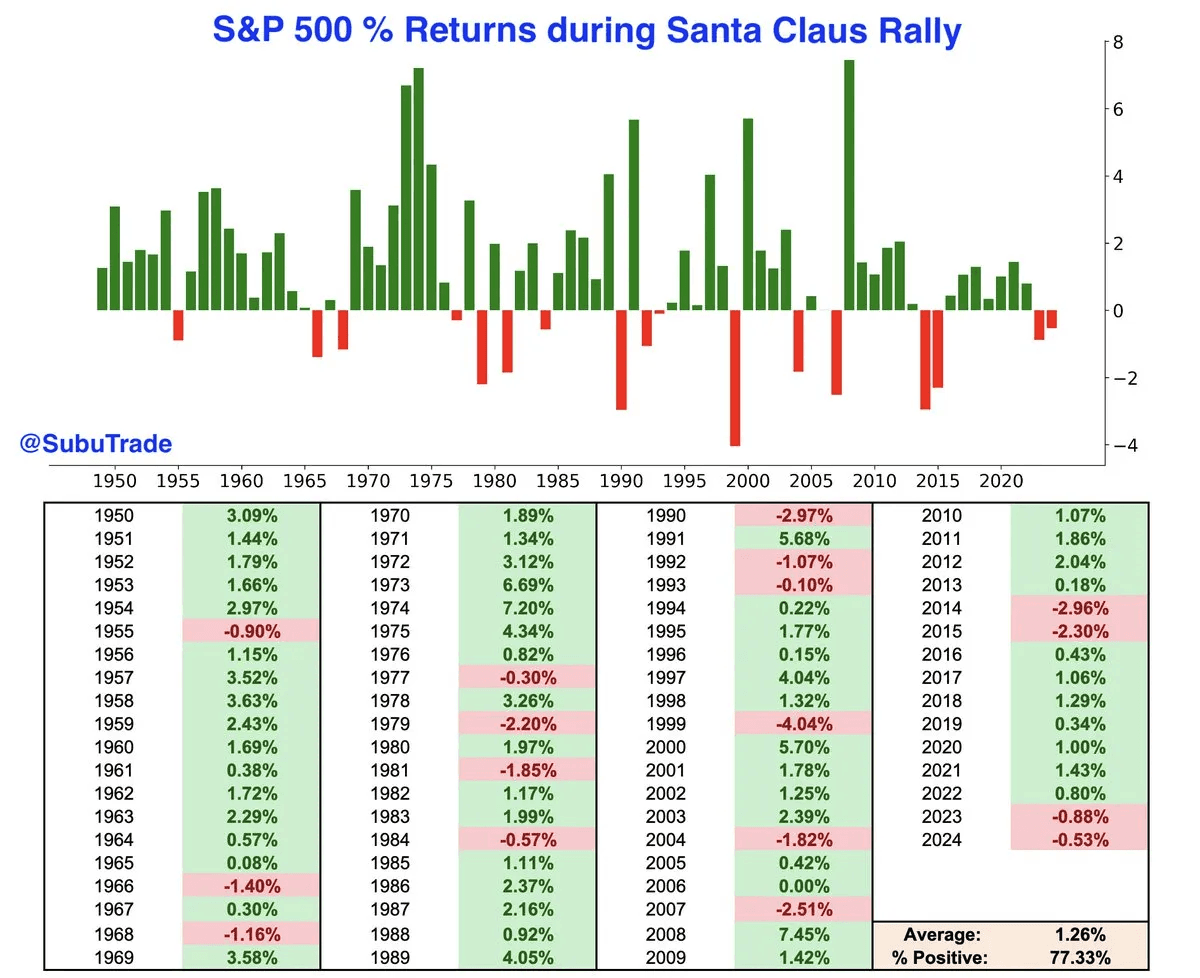

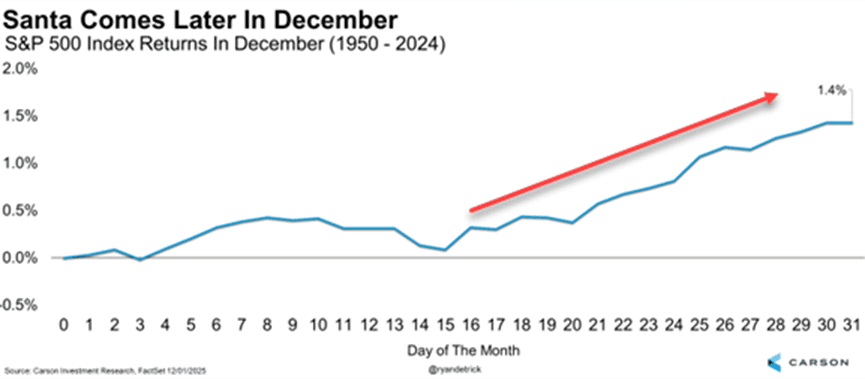

People think the Santa Rally lasts all of December, but in reality it only covers the last few days of December and the first few days of January.

Maybe Friday marked the start of the Santa Rally.

In fact, the S&P 500 is positive nearly 80% of the time during that stretch, making this one of the strongest periods of the entire year.

So there is no reason to be too bullish or too bearish right now. A neutral stance makes sense. It gives you flexibility, enough dry powder to deploy, and enough exposure so you don’t miss out on too much. You are not forced to make rushed decisions, and you can take advantage when good opportunities show up.

2026 will likely be another good year, but volatility is not going away. Large swings will be normal. That makes staying open-minded critical. The last 2 years showed that the biggest gains came from spotting major themes early and staying on top of them. That will matter just as much in 2026. Themes shift quickly, so you need to stay flexible and adapt. But we’ve been able to catch most of the leading themes. And we’ll do our best to do the same next year. I will share the top themes to focus on for 2026 in a separate update.

Lin

Dec 7, 2025

Weekly Market Update: Santa Rally?

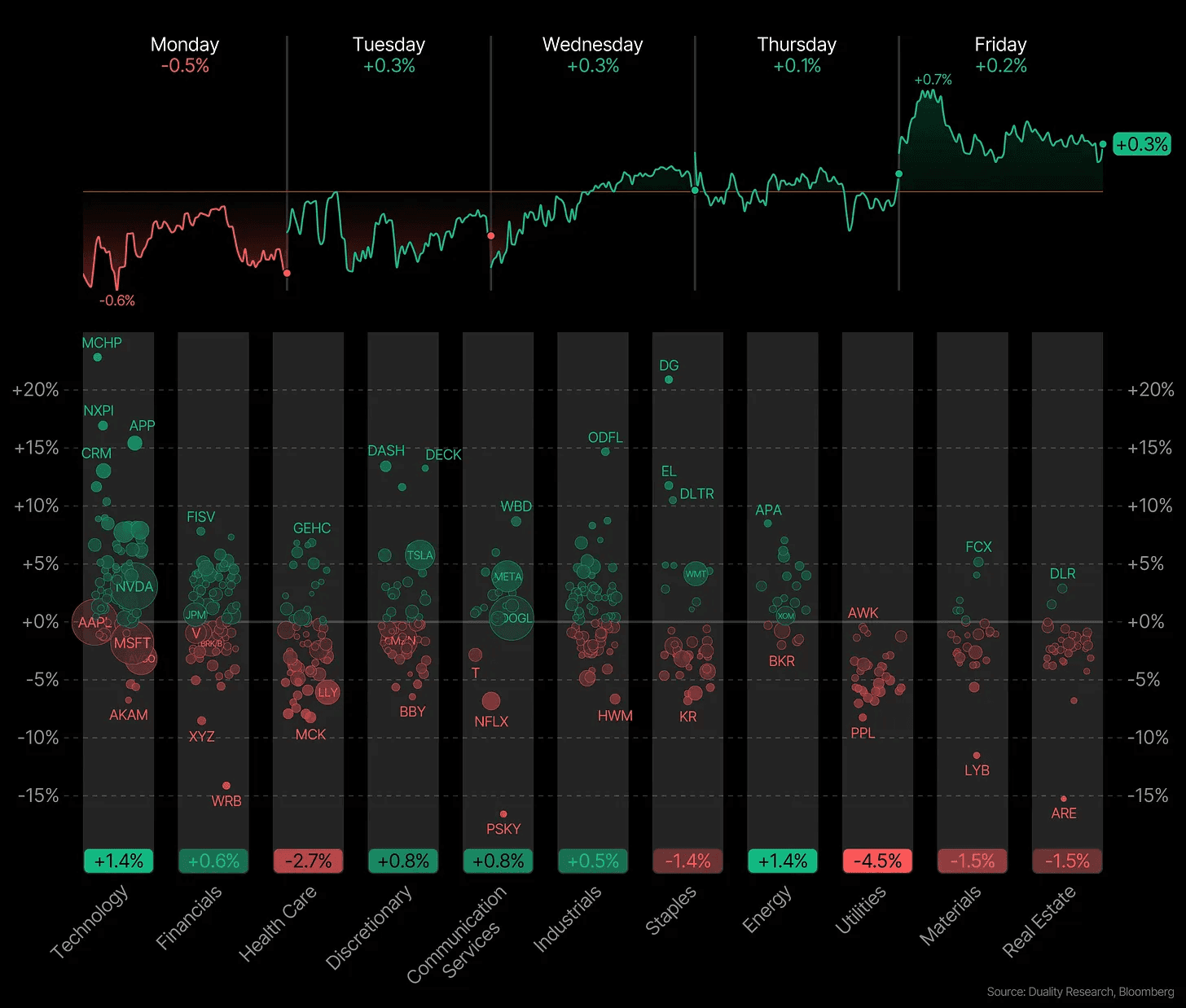

This week looked pretty quiet, but underneath the surface the market had a lot going on.

The S&P 500 is now really close to a new all time highs. Under the surface, rate-sensitive stocks made big moves. Momentum is clearly coming back into the market as we head toward year end.

So, is this the start of the Santa rally?

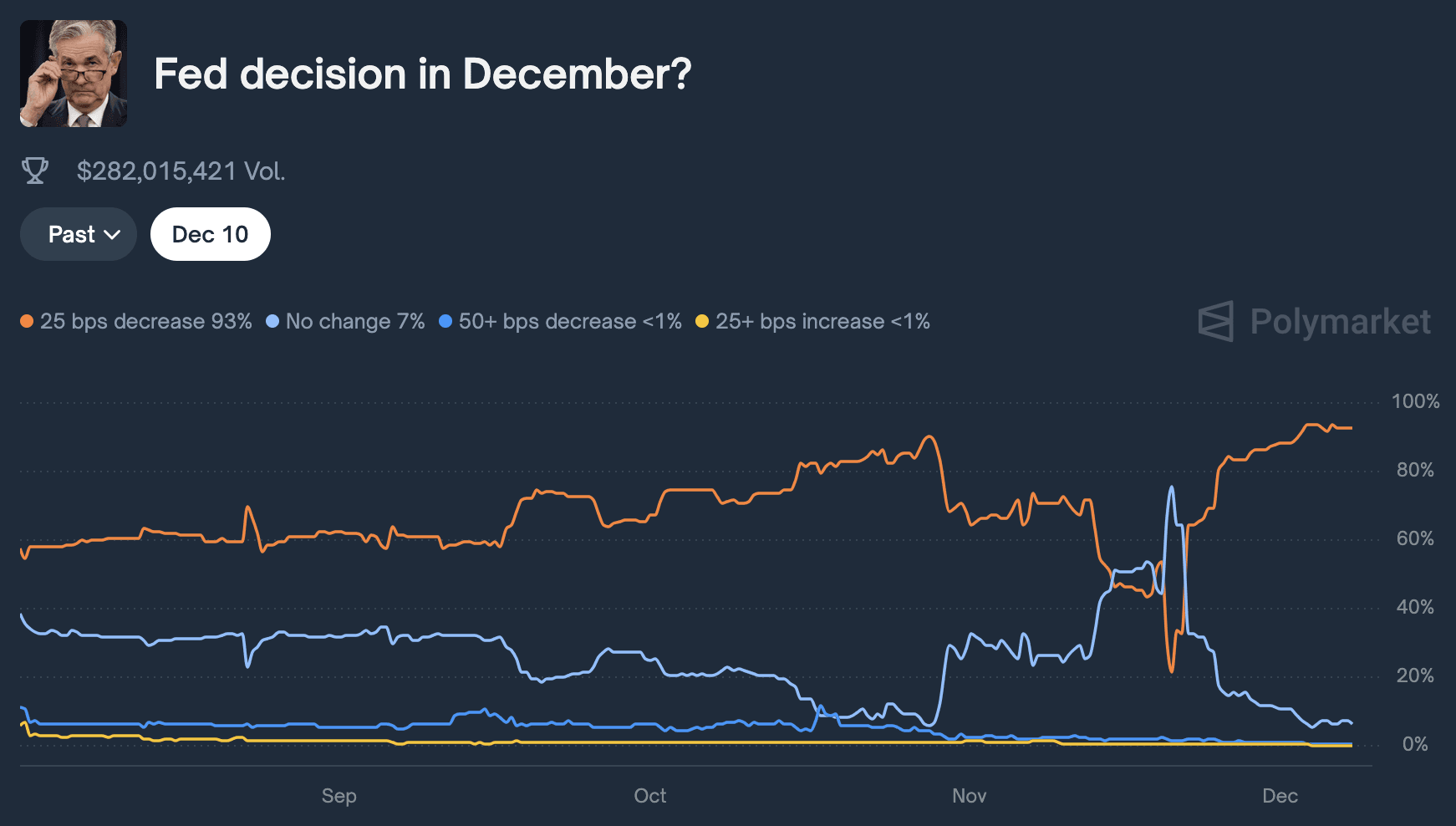

The odds of a December rate cut has jumped significantly, and the market is now pretty certain we’ll get one next week.

And if there is one thing the markets love it’s cheap money. Because it makes borrowing cheaper for companies and consumers. That usually boosts spending, earnings, and overall growth. Lower rates also make stocks more attractive compared to bonds, so money tends to flow back into equities.

That’s why the Russell 2000 and small caps outperformed.

While rate cuts tend to lift most assets, they especially help homebuilders, small caps, industrials, and growth stocks. Seeing those groups lead tells us the rally is starting to broaden, not narrow.

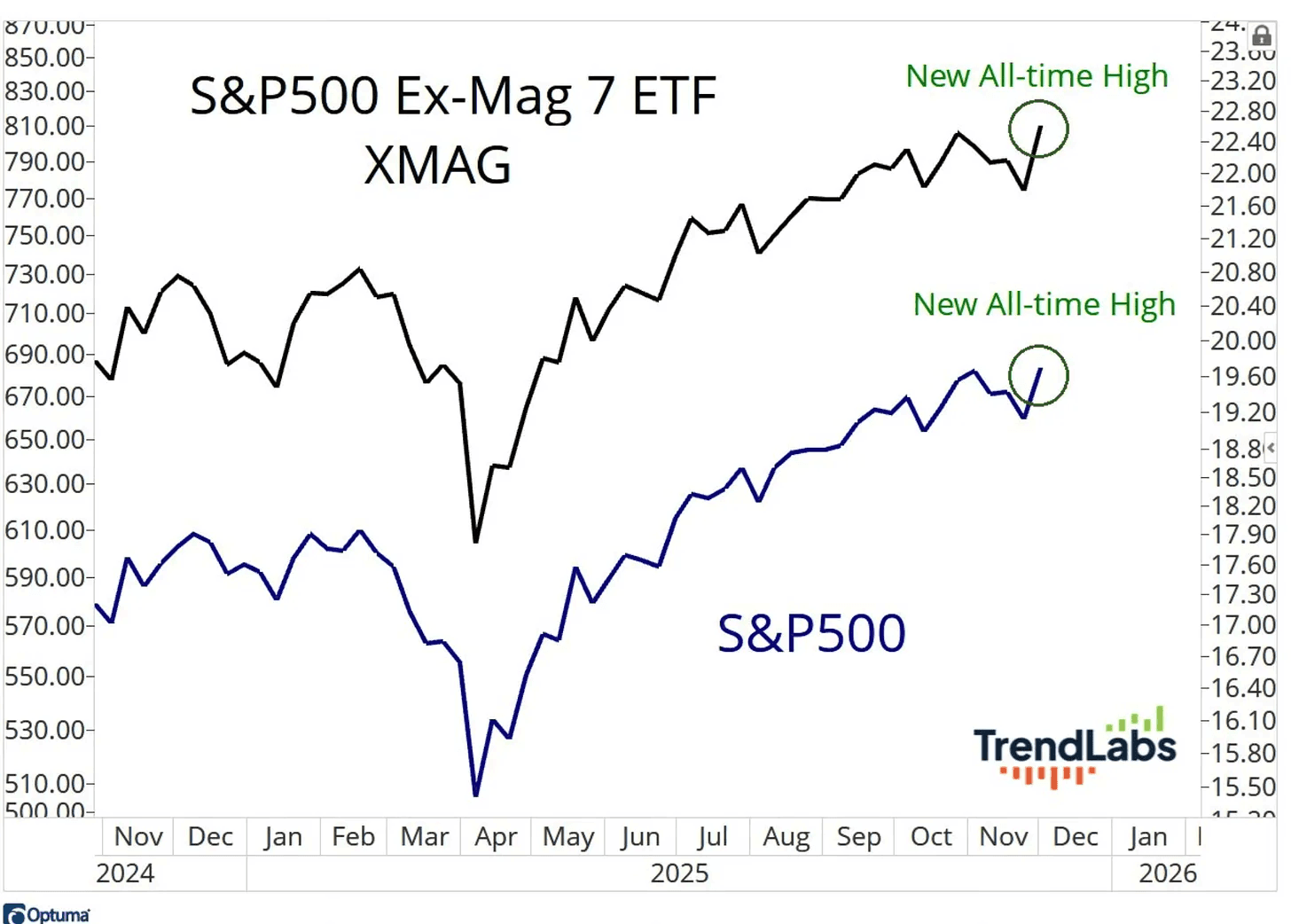

And it’s not just about Nvidia or the Magnificent 7. November already proved that the market can hold up even when those names pull back. Even though Nvidia and others corrected, the S&P barely moved and we saw some rotation into other sectors. That’s exactly what you want to see in a healthy market.

If you take out the Magnificent 7, the rest of the S&P 500 is already at a new high. That should make it clear that the rally isn’t just big tech carrying the entire market.

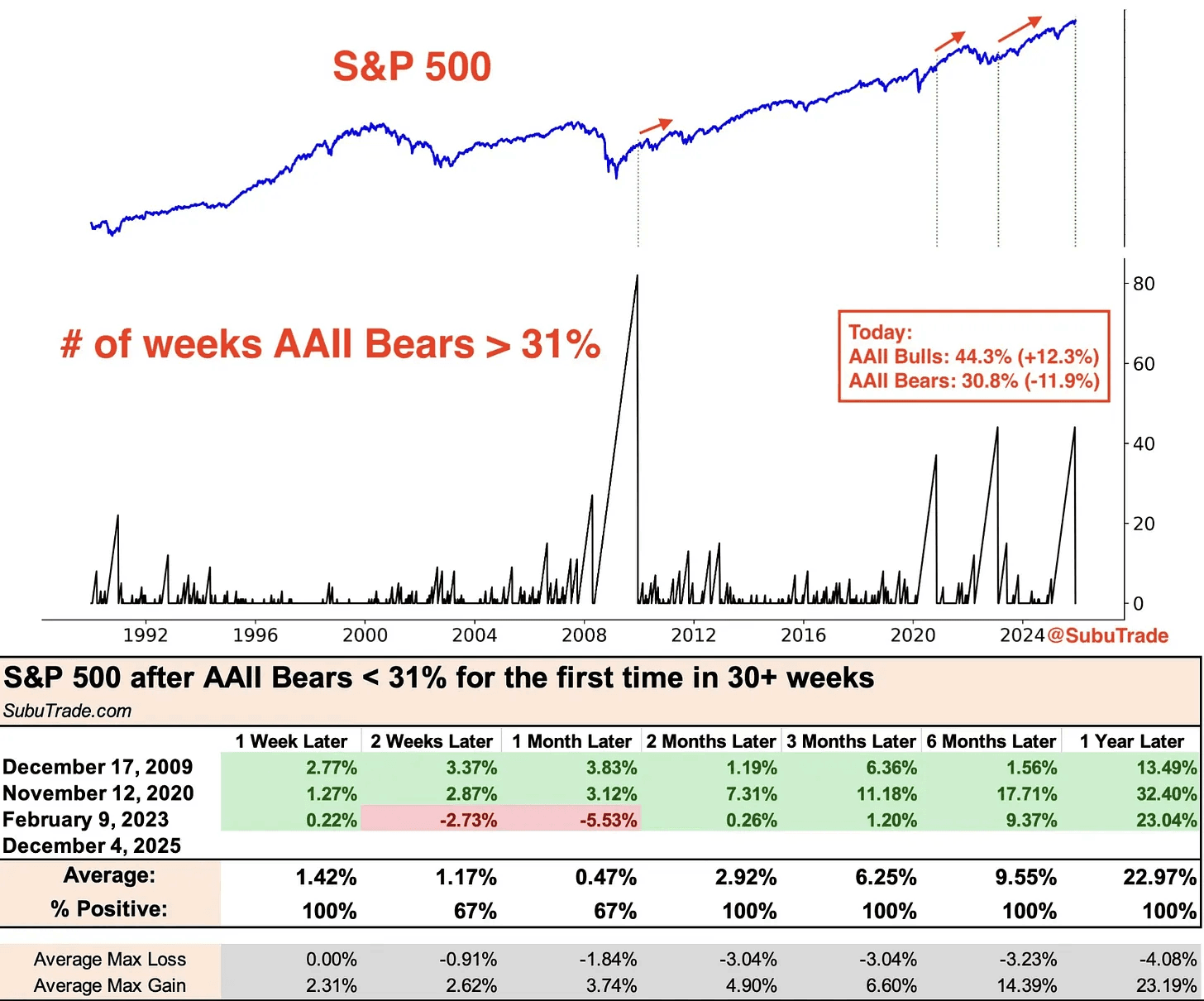

Bearish responses in the AAII survey just fell below 31% for the first time in almost a year. That’s rare. It has only happened 3 other times, and in each of those cases the market moved higher afterward. It’s a sign confidence is coming back to the markets.

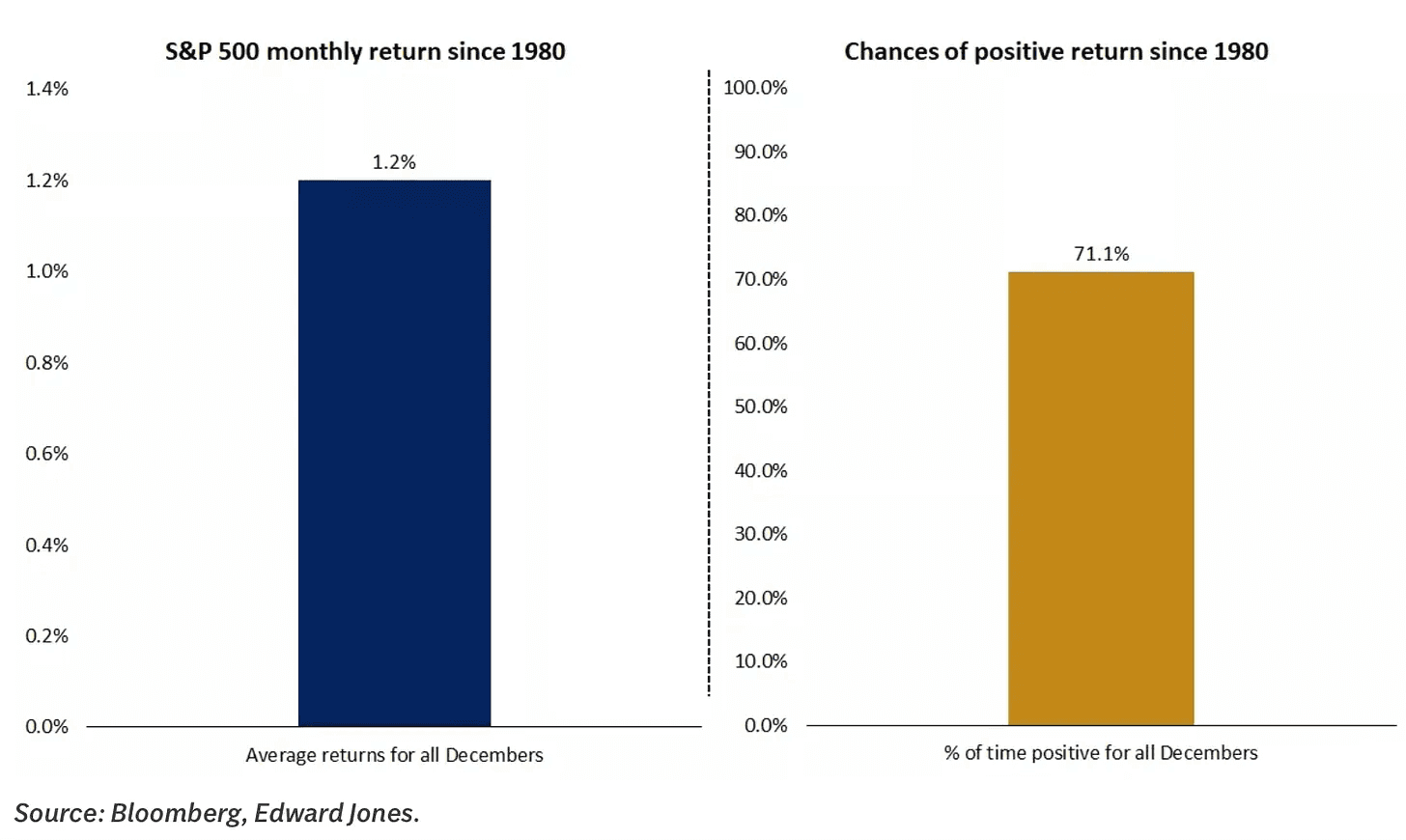

December is historically the strongest month for stocks. It has a better win rate than any other month, with the S&P finishing higher almost 3 out of every 4 years.

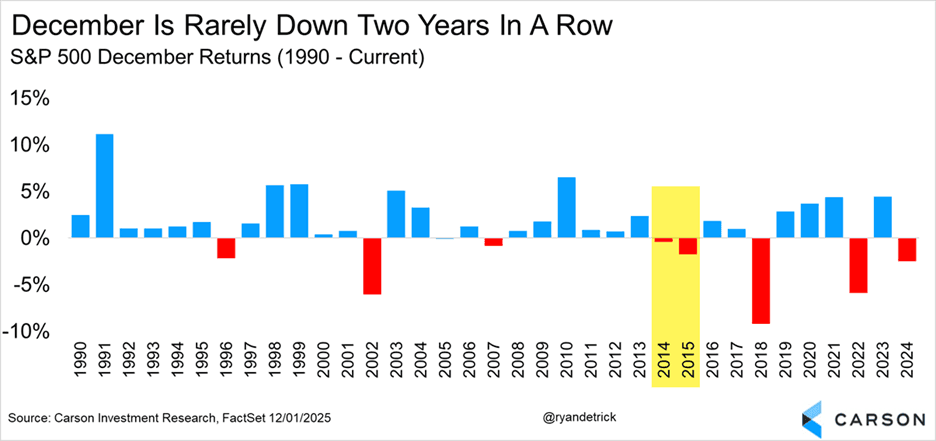

Stocks were lower last year in December. But back-to-back negative Decembers are really rare. The last time we had two in a row was 2014 and 2015, and before that you have to go all the way back to 1980 and 1981. So, the odds are in our favor for now.

The Santa Claus Rally isn’t the whole month of December. It’s only the last few trading days of the year plus the first days of January. So, the first half of December is usually choppy, and the actual rally tends to show up near the end. Hence, near-term volatility should be expected.

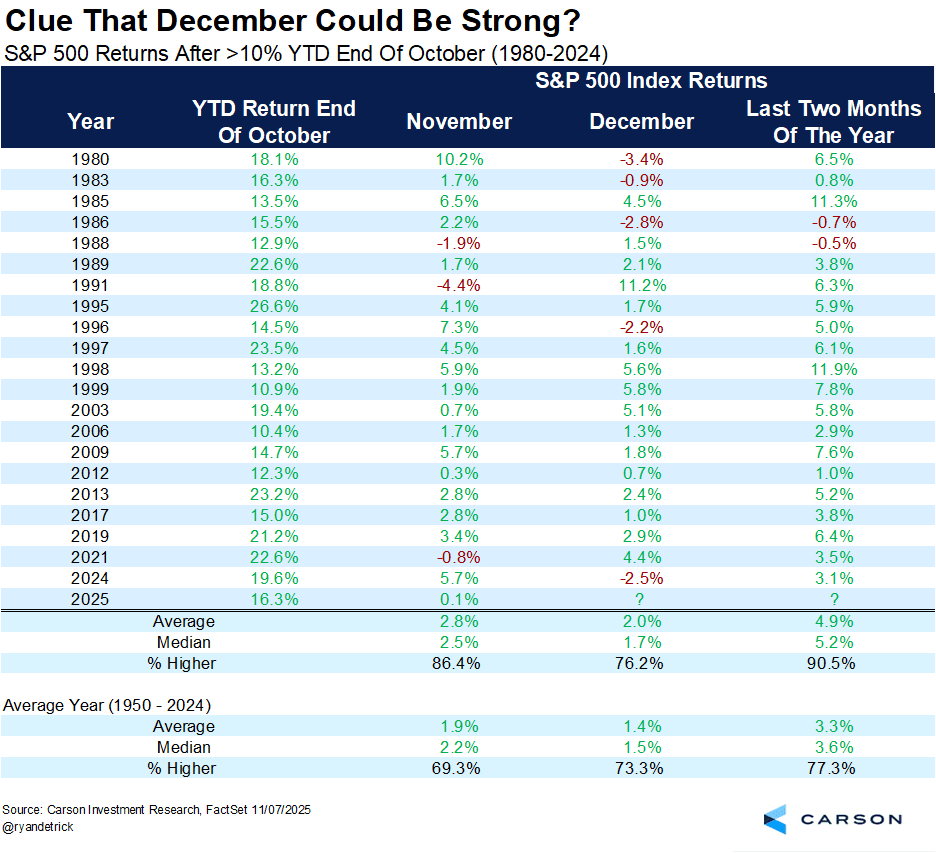

Strength begets more strength.

When the S&P is already up more than 10% by November, it usually keeps pushing higher. In fact, the last 16 times this happened, the final 2 months of the year were positive every single time.

The S&P 500’s YTD return of 17.8% came from:

Earnings growth contribution: +12.2%-points

Multiple growth contribution: +4.2%-points

Dividends: +1.4%-points

Most of the gains this year actually came from earnings growth. About 76% of the S&P 500’s return came from profits and dividends, not just higher multiples. As long as the economy doesn’t fall into a recession, there is no reason to think that this won’t continue.

Profit growth mainly comes from 2 things: higher sales and higher…

Lin

Dec 4, 2025

Market Update: Risk is Back

Two weeks ago I said this correction is probably over. And that turned out to be the exact bottom. Of course, a lot of luck was involved. Nobody can time the exact top or bottom on purpose. But you don’t need to.

What really matters is having a system that keeps you on the right side of the market. There is no certainty in the markets. But if your strategy puts the odds in your favor over long enough period, you’ll win eventually.

Now what we’re seeing is a snapback from many of the growth and momentum names.

AI

Space

Drones

Nuclear

Robotics

Quantum

Rare Earths

So make sure to review the thematic portfolios.

Those are the names that will outperform in a bull market. And make large moves in a matter of weeks or even days.

Though they rarely have strong fundamentals backing them. Instead, they are mostly based on promising, exciting possibilities for the future. That’s why these stocks tend to be incredibly volatile, erratic, and heavily influenced by sentiment and short-term catalysts.

Hence, they are riskier and more volatile. Those are not names you just buy and hold for years. Many of them will not make it. So, you have to manage risk tightly and be disciplined.

That being said they offer tremendous opportunities in the right market environment. And the best time to track them is coming out of a correction. Timing is essential. Waiting for the right moment is key. You don’t to end up chasing late or too early. (More on that in Chapter 3 of the Handbook for that which you can read here.)

So, here’s a quick guide on how to handle speculative names:

Price action: Look for stocks making recent all-time highs or coming out from bases after pullbacks.

Volume: Confirm that the price move is supported by strong volume. Ideally volume should be several times higher than the stock’s average daily volume.

Avoid FOMO: Don’t chase in just because it’s up right now. Wait for the right opportunity.

Position size: Keep it small relative to your overall portfolio (around 1–5%). You don’t want a single bad position to take a big chunk of your capital, especially in volatile names.

Be ready to cut your losses quickly: If the position stops working, cut losses quickly rather than hoping it will recover because corrections can be brutal.

Stop loss: Use tight stops. A good rule is to set stops 5–8% below your entry price or just below a key support level or breakout point.

Take profits in stages: Speculative stocks can move fast. Don’t hold 100% of your position until the top. Sell 25–50% at predefined price targets depending on your risk reward profile (e.g., +25%, +40%, etc.).

Trailing stops: After partial profit-taking, use trailing stops (e.g., 5–10% below the current high or under a moving average like the 10-day EMA) to protect gains while allowing the stock to run.

Watch volume and price action: If volume dries up or price action weakens (e.g., lower highs, a break of a key moving average, bearish reversal candlesticks), consider reducing or exiting.

Don’t let winners turn into losers: If you have a sizeable gain, make sure to book some profits along the way. That gives you some cushion to weather volatility.

Be prepared for volatility: Lastly, expect a healthy dose of volatility and large swings both ways.

Lin

Dec 2, 2025

AAPL

The AI Buildout Is Far From Done

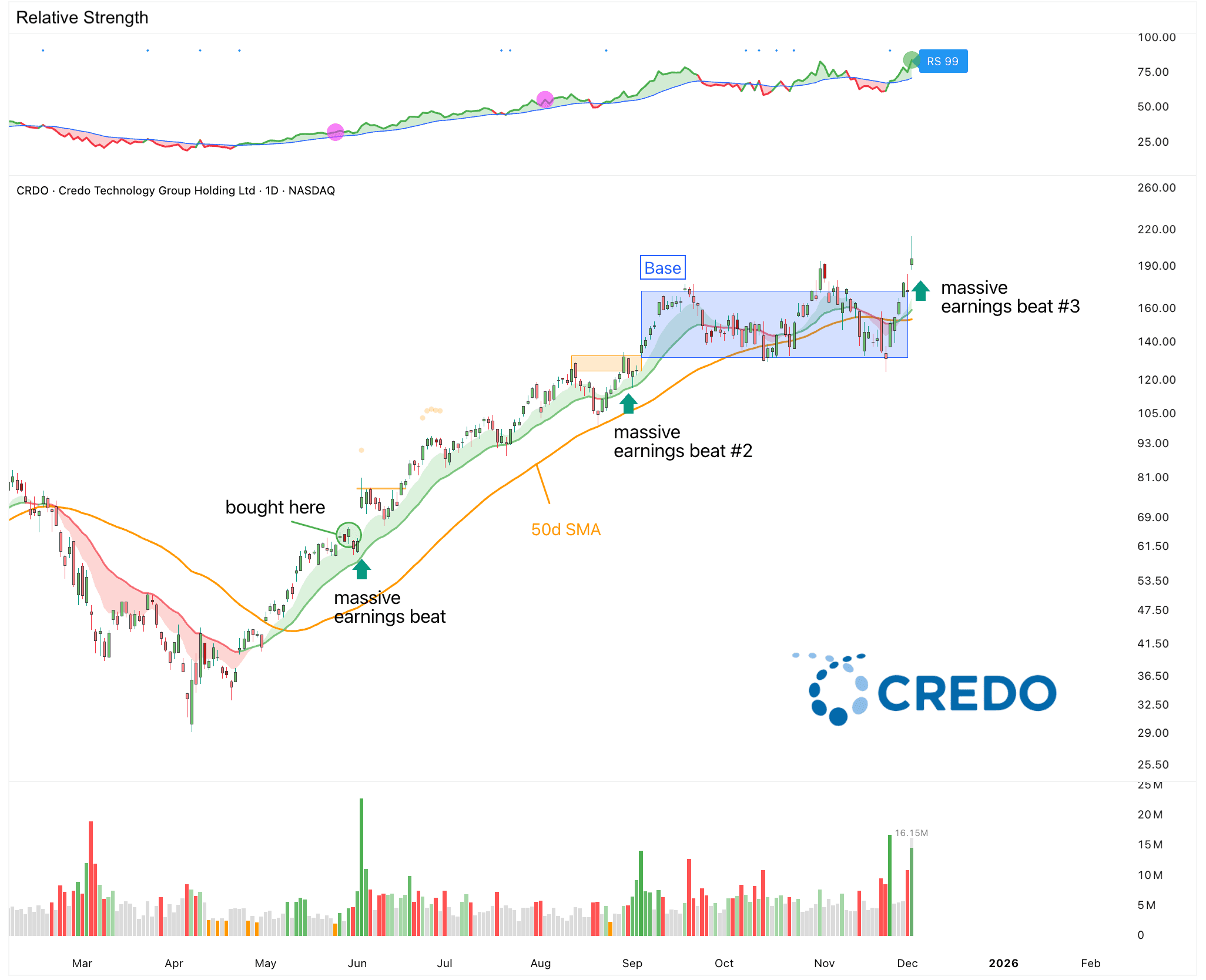

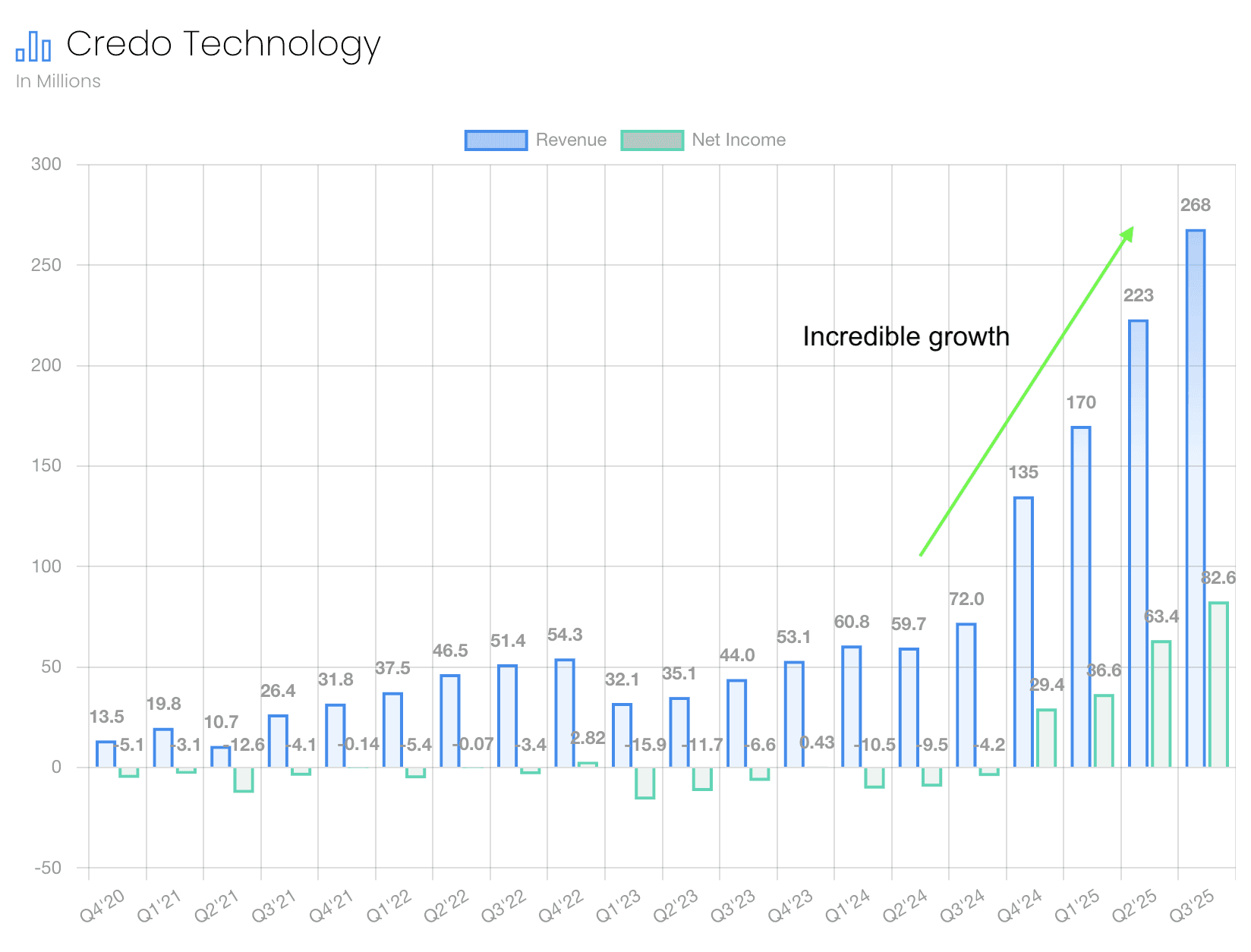

Credo just delivered the strongest quarter in the company’s history.

Q2 revs of $268M vs $235M est. (+14% beat)

Q2 revs up +20% QoQ and +272% YoY

It has been one of our core positions for a while. This is now the third record breaking quarter. And this quarter makes one thing very clear. The build-out of the biggest AI training and inference clusters in the world is nowhere far from done.

It is always the same. Every few months investors get skeptical about the AI buildout. And every time the data proves them wrong.

Credo also gave an incredible outlook.

Guidance:

Q3 revs of $340M vs $247M est. (+37% beat)

Q3 revs guidance implies +27% QoQ and +152% YoY

It's safe to assume CRDO will beat their Q3 guidance which means they probably do at least $365M+ which would be +36% QoQ and +170% YoY.

There is a reason why it’s up almost 300% and one of the best performing stocks over the last year.

It’s not a cheap stock by any means but they deserve to trade at a premium with these growth numbers plus 31% net income margins and gross margin guidance coming in 120+ bps above street estimates.

These numbers tell a pretty clear story.

But I keep seeing discussions about AI that focus almost only on chatbots and demand is limited. That view is too narrow. When you look at what is happening inside data centers and large tech companies, the long-term demand for AI compute is coming from areas that are rarely part of the public conversation.

The first area is basic data center compute. This is already close to $100B dollars per year. It includes data processing, pipelines, analytics workloads, risk models, and internal machine learning jobs. None of this feels new or exciting, but much of it will move to accelerated architectures over time because they offer better speed and lower cost. Even without consumer-facing AI, this creates a large and steady demand for AI-class hardware.

The second area is recommender systems. This is the part of the internet that drives most of the revenue. Examples include Google Ads, YouTube, Instagram, TikTok, Amazon search, Spotify, Netflix, and e-commerce funnels. The economic value here is in the range of a few hundred billion to around one trillion dollars. The next generation of these systems will use GenAI models rather than older methods. This shift is not a small change. It affects the core business models of trillion dollar platforms.

The third area is physical AI. Robotics, autonomous systems, warehouse automation, delivery robots, agricultural machines, drones, and home devices all fall into this category. These systems rely on continuous real-time inference. The compute load is very high and can exceed chat-style workloads by a wide margin. If this sector grows as expected, it could become the largest source of demand for AI compute.

When you consider these three areas together, it is clear that the AI story goes far beyond chatbots. Large parts of modern computing are shifting toward models that need far more acceleration. And there is almost no limit for the AI compute. Text, images, videos, simulations, science. There are so many use cases that are not quite feasible or that could use billions of tokens of compute.

The AI buildout is just getting started.

Lin

Nov 30, 2025

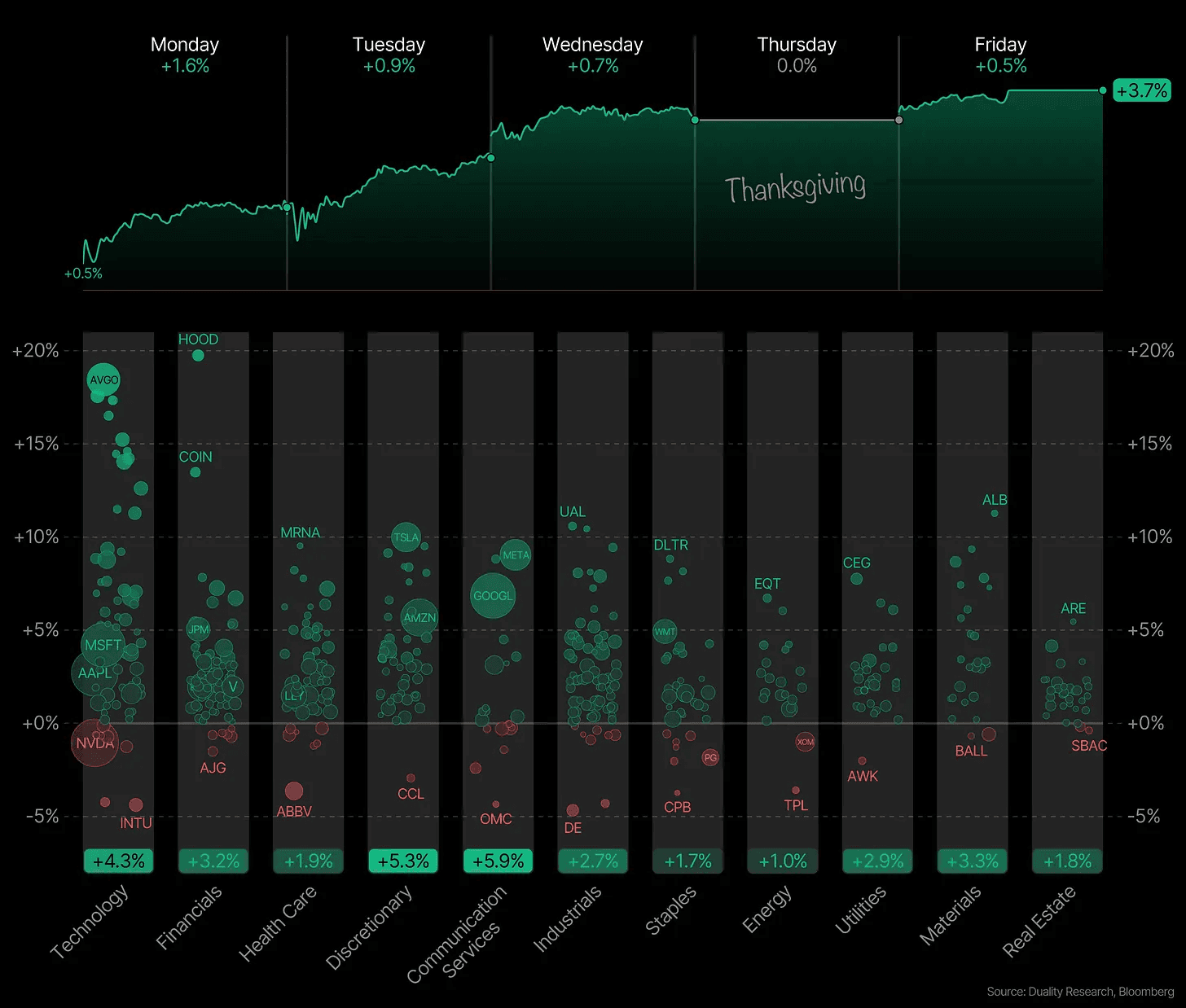

Weekly Market Update: Thanksgiving Week

Thanksgiving week gave investors a lot to be thankful for.

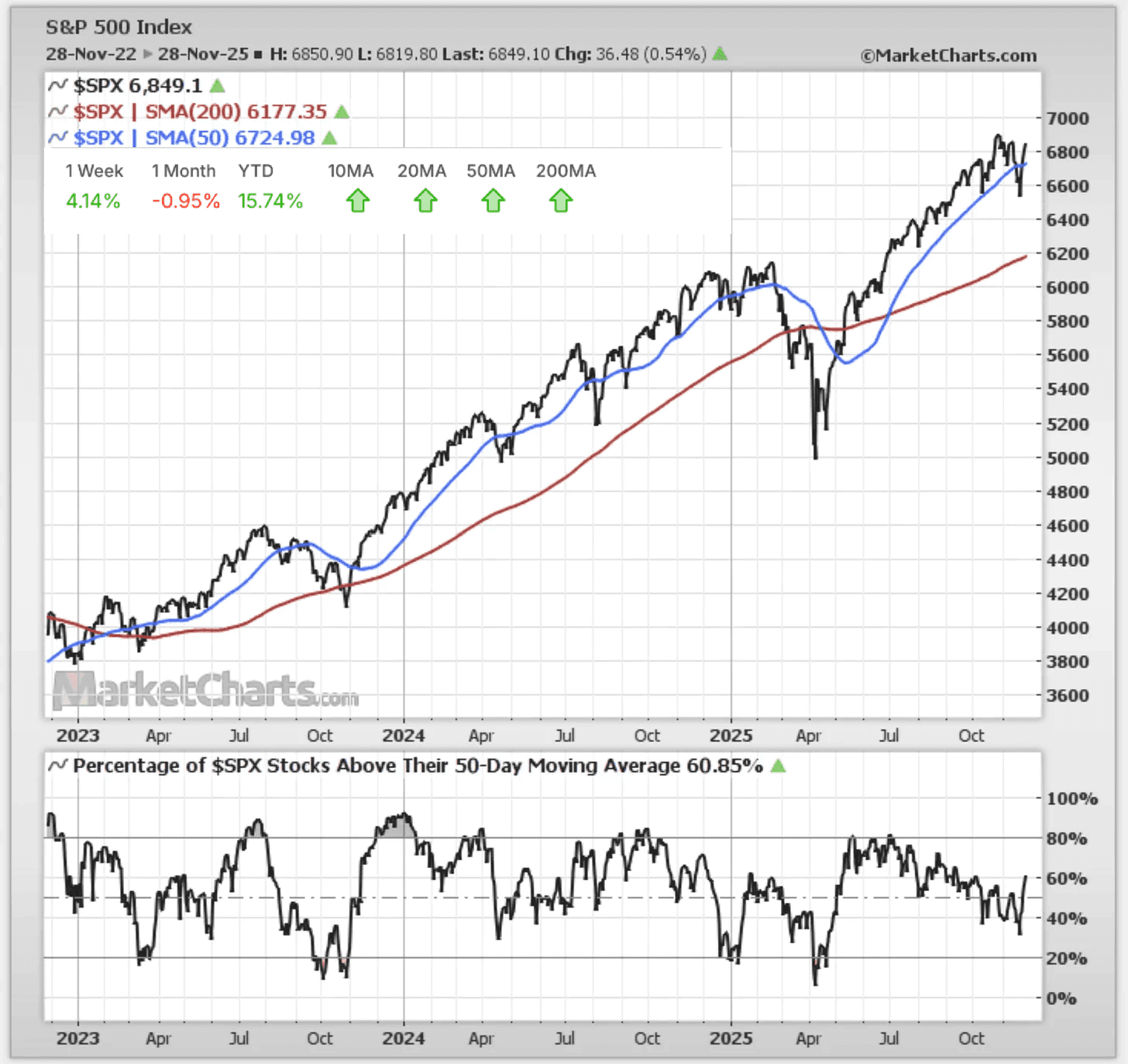

The S&P 500 dipped below the 50 day moving average last week, but it recovered quickly. This is exactly the type of reaction you want to see in a strong market. As I have noted many times, the longer the index sits below the 50 day, the more caution is required. But this bounce is a very positive signal.

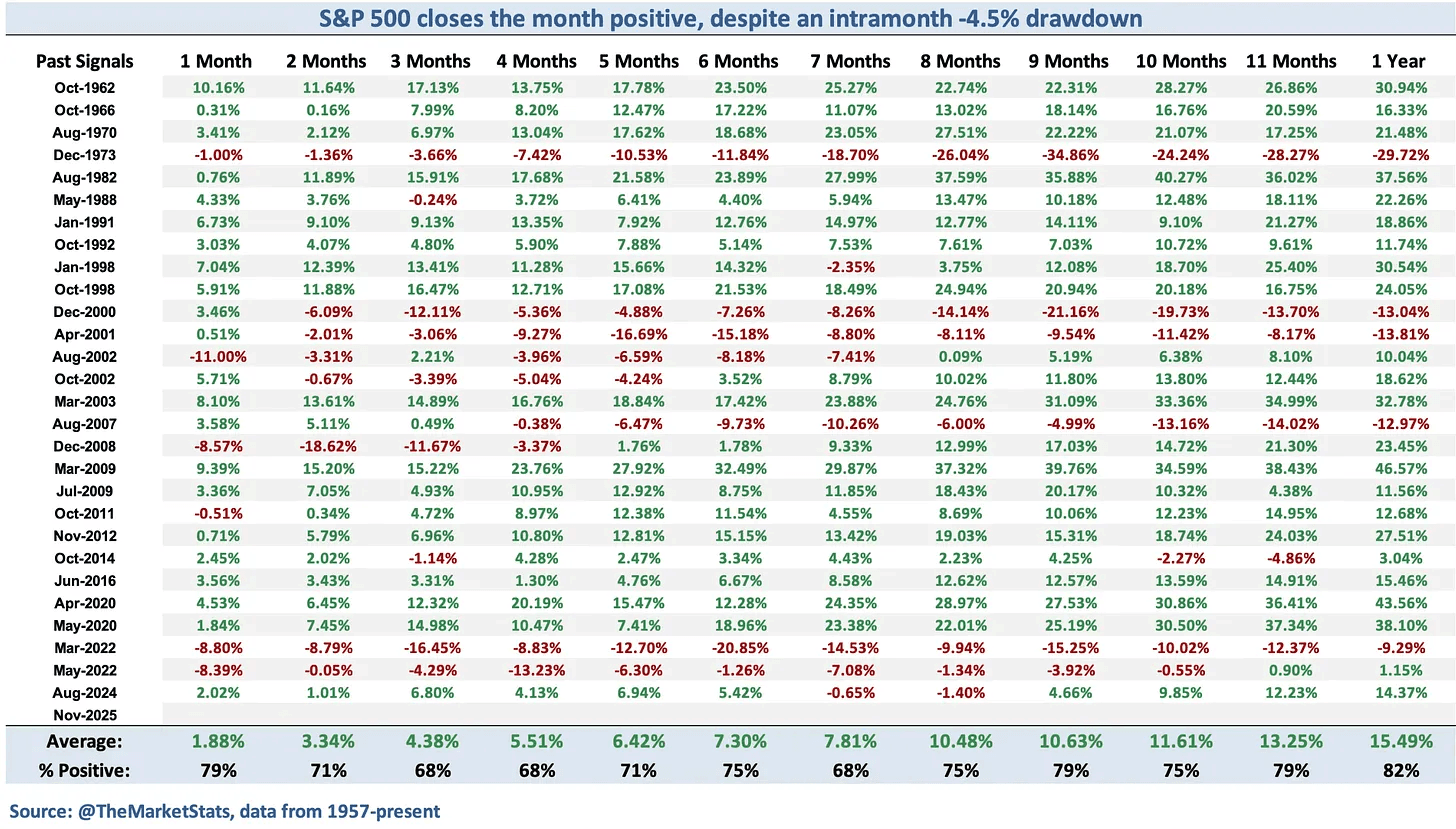

Even though the index fell almost 5 percent during the month, buyers stepped in quickly and regained control. The market finished November positive.

And here is an interesting fact going into December:

When the S&P 500 closes positive for the month despite a drawdown of at least 4.5 percent, the next month is higher 79 percent of the time.

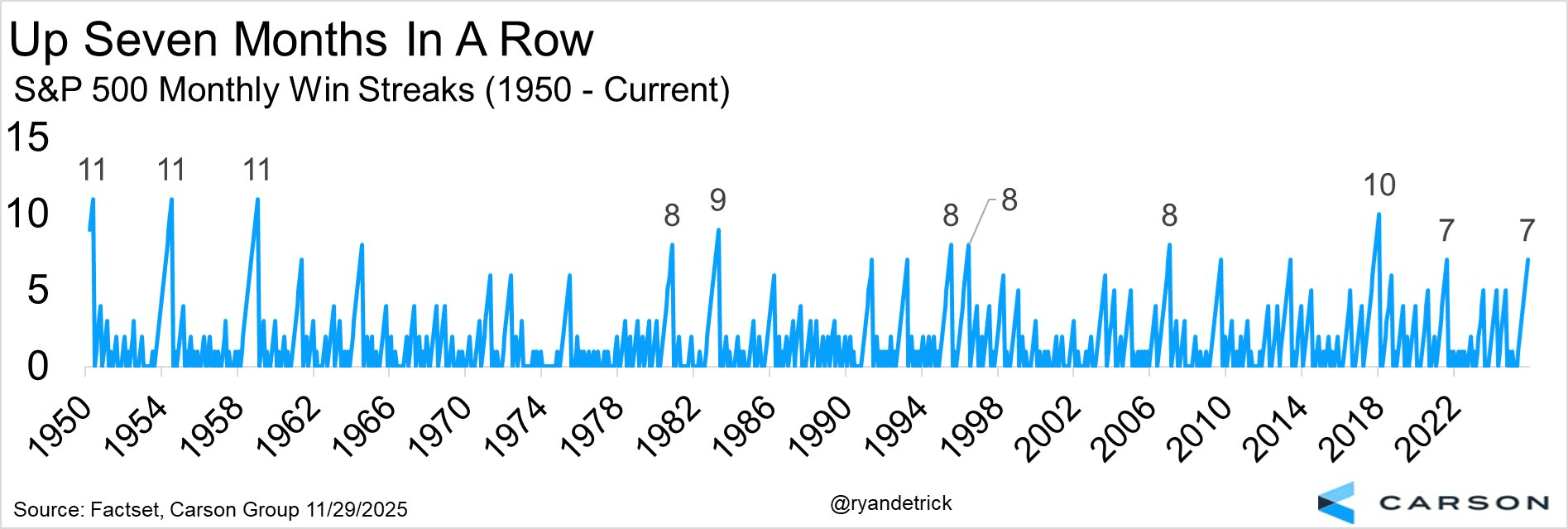

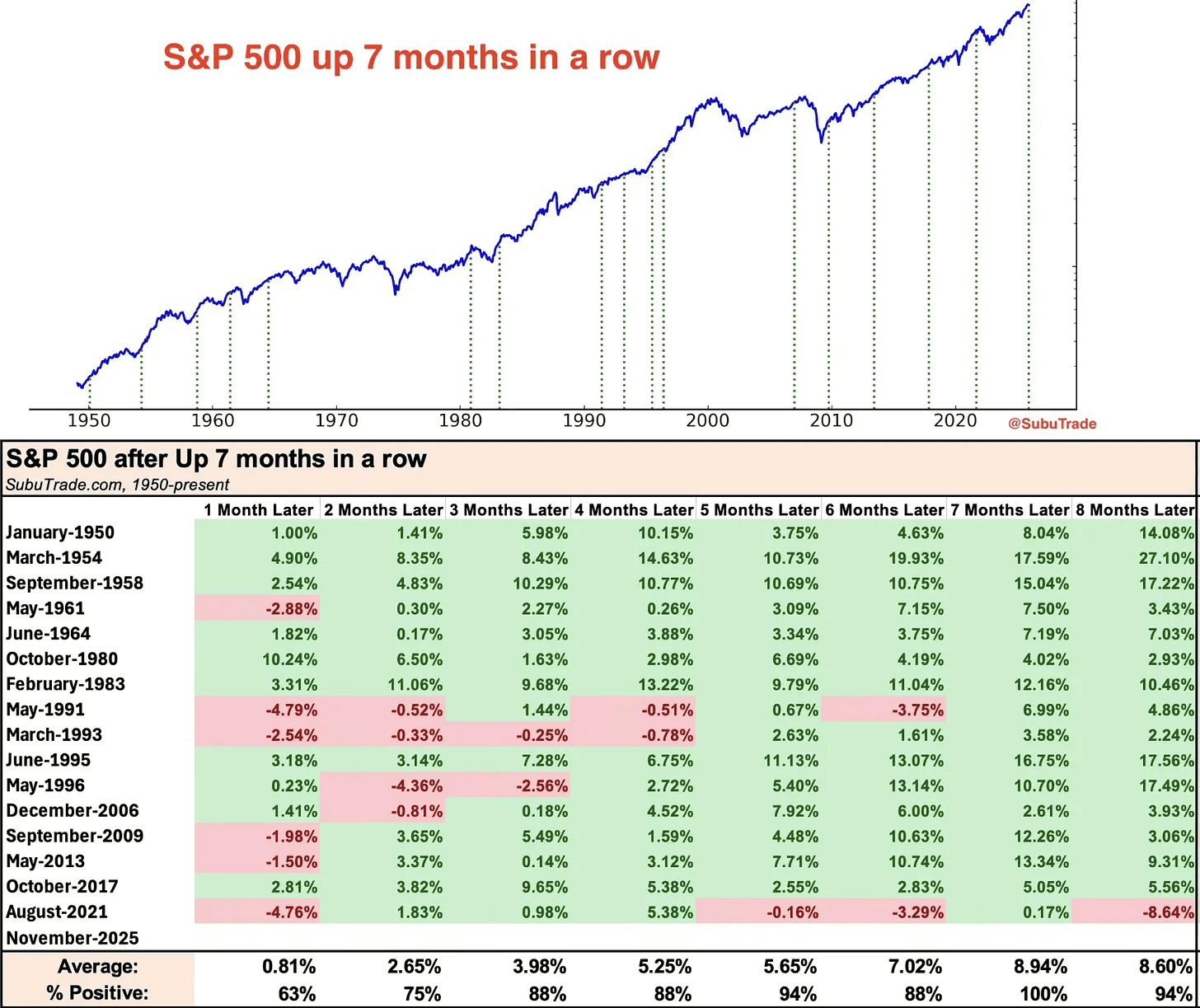

The S&P 500 has now been up every month since April. That is seven straight months in a row. This type of streak does not last forever. It will end at some point.

But…

…looking out this is very positive news for the markets.

Strong markets tend to remain strong longer than people expect. So, while there might be some short-term turbulence, they just don’t die suddenly. It’s hard to kill a bull.

And the market internals are improving steadily too.

Several breadth indicators have turned higher which means the rally is broadening. More stocks are participating, not just a few large names. This is what you want to see in a healthy uptrend. They are not perfect. No indicator is infallible, this is a pretty good track record.

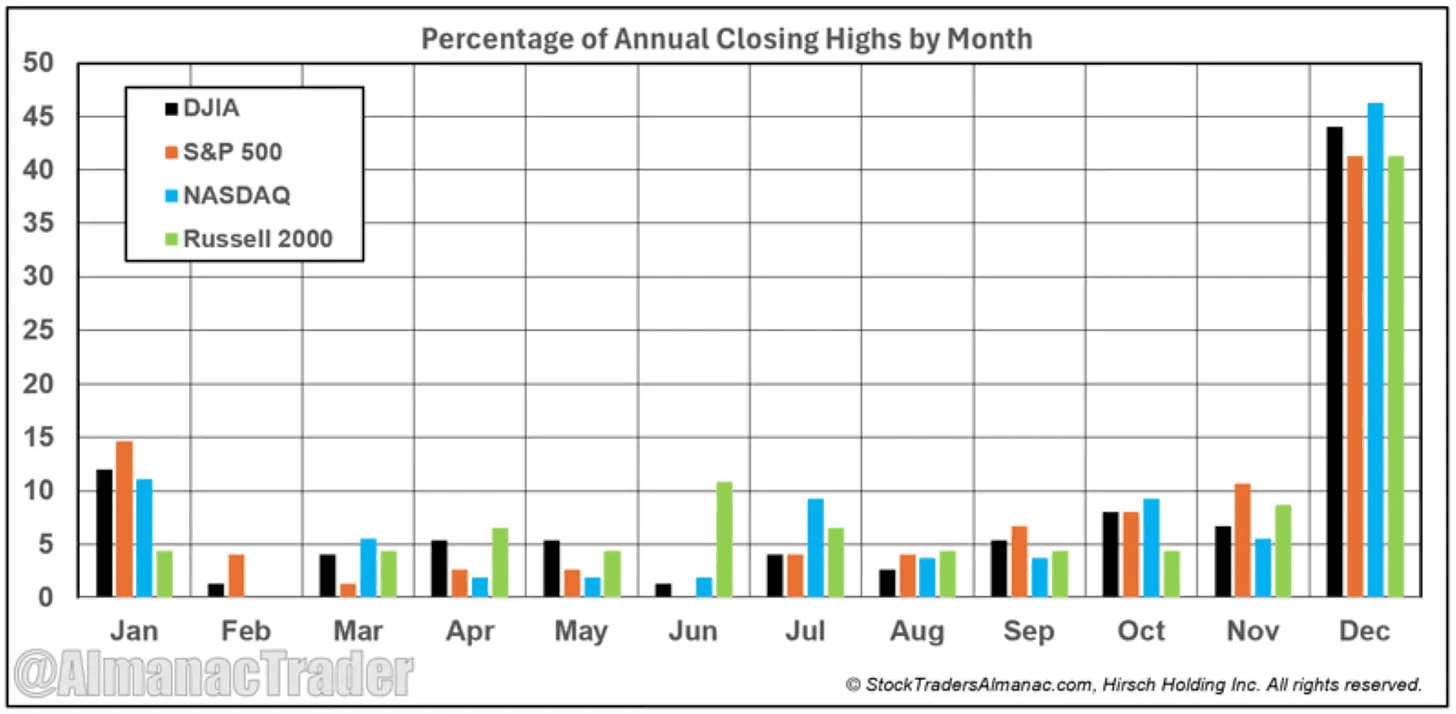

December has historically been one of the best months of the year for equities:

46.3 percent of Nasdaq’s annual highs since 1971 happened in December.

Since 2003, all major US indices made their annual highs in December eleven times.

Since 1980, the S&P 500 has finished December green more than 70 percent of the time.

However, sometimes the first half of the month can be choppy until the Christmas rally starts in the second half.

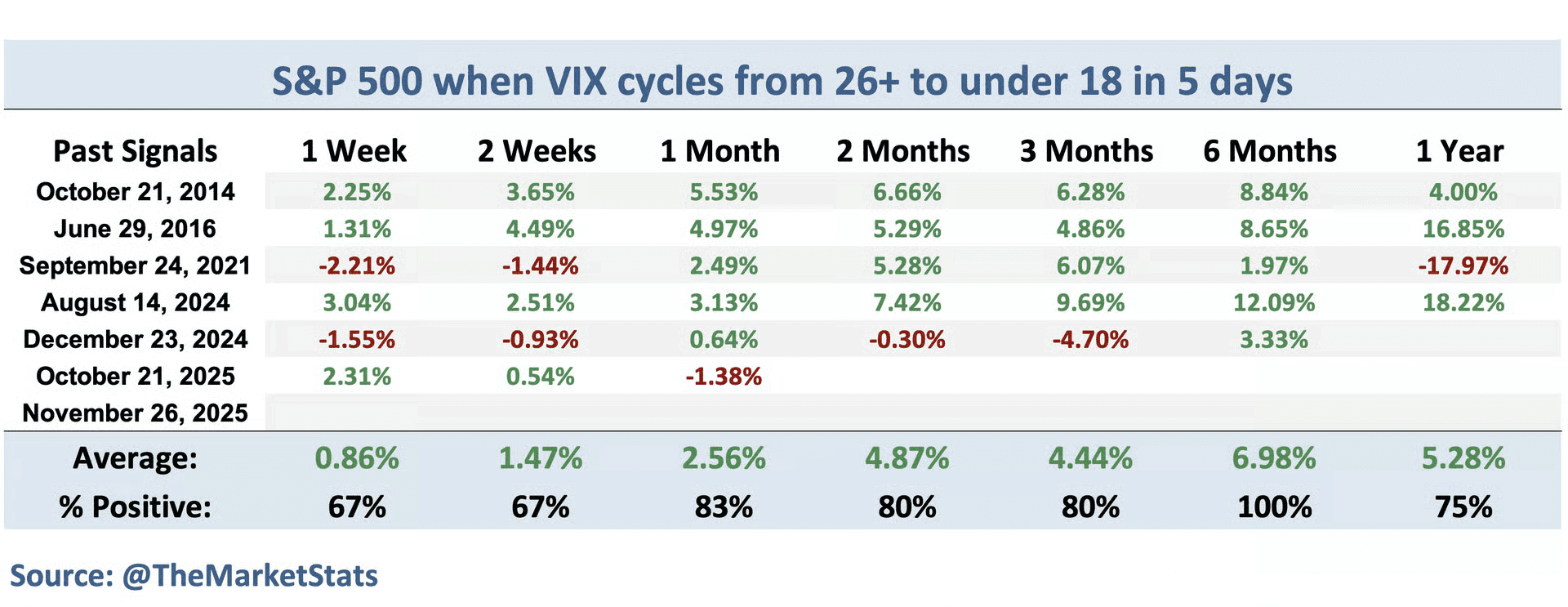

Volatility also dropped sharply. The VIX moved from above 26 to below 18 within four days. This is critical because lower volatility often creates a more stable environment especially for risk-on assets.

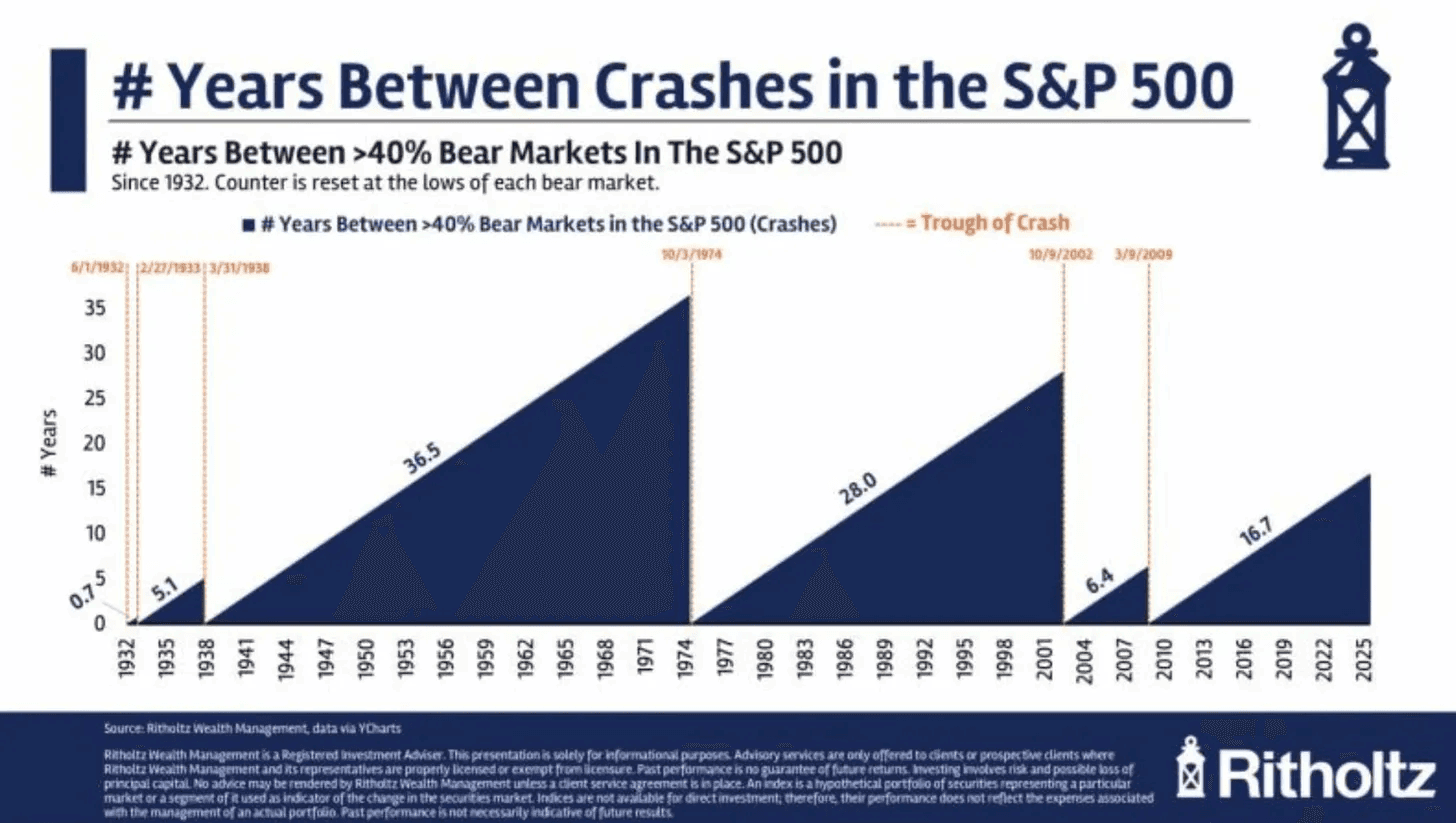

Another important reminder. If you only listen to headlines, it can feel like the market faces a crash every year. The data tells a different story. Severe bear markets are rare, and the time between them is usually much longer than people think.

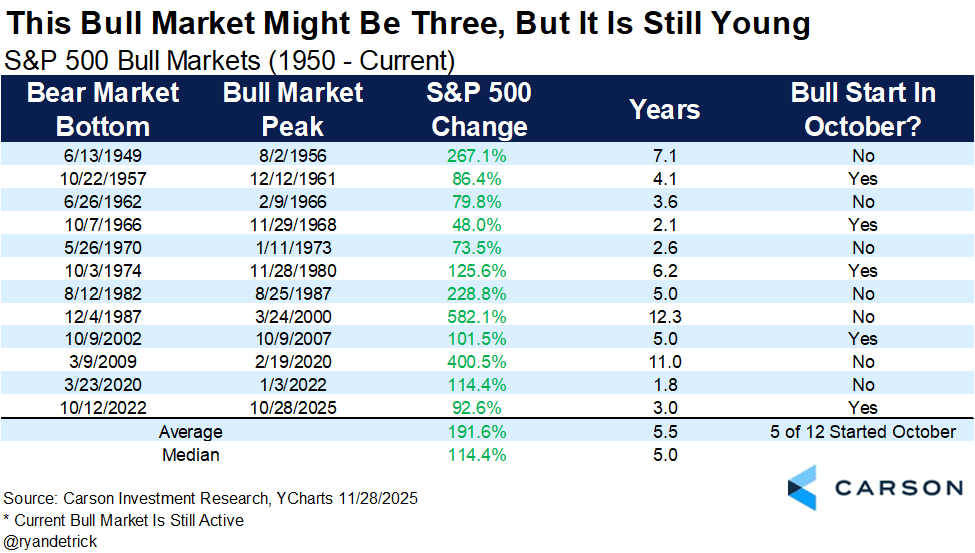

Good time to remember this bull market is only about three years old. Also, up 92% is still very low compared with other bull markets.

There is a common belief that only a handful of mega caps drive the entire US market. The numbers do not fully support that view.

The top 10 stocks account for about 40 percent of market cap. That sounds high, but it was 39 percent last year and the market performed well. Compared globally, the United States is actually one of the least concentrated…

Lin

Nov 23, 2025

Weekly Market Update: Is this the Bottom?

The S&P 500 officially closed its most volatile week since April.

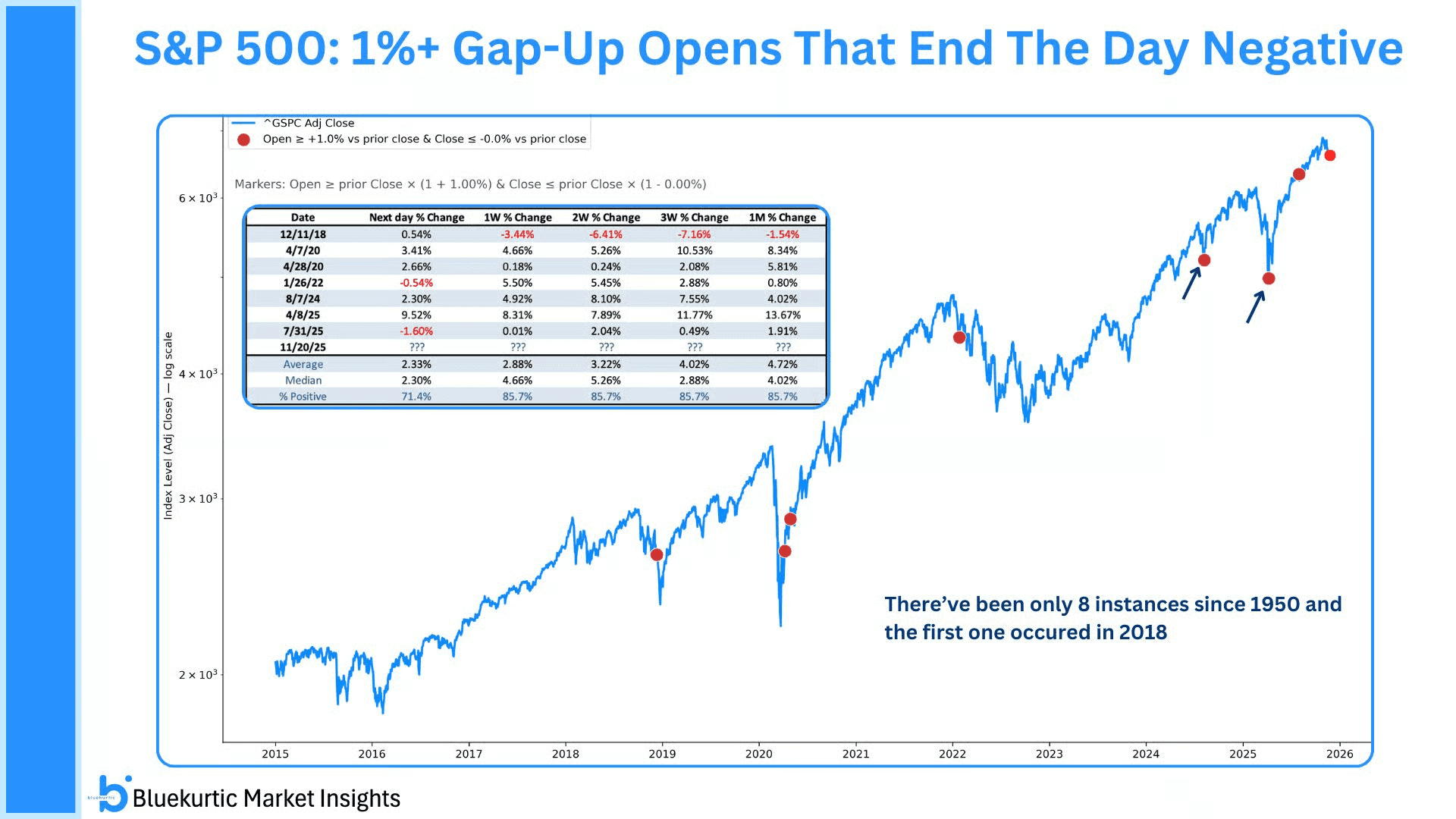

It made a bit of unwanted history on Thursday. On Thursday it opened up more than 1.5% and then closed down more than 1.5%. It was only the 4th time ever that the S&P 500 experienced an intraday swing of that magnitude.

And if you look at the times since 1950, there have been only 8 days where the index opened more than 1% higher but still finished red.

One month later the S&P 500 was higher in 6 of the last 7 cases. The last 3 times this happened marked the bottom.

Even Nvidia’s incredible earnings could not stop the pullback.

The numbers were off the charts. No other company on earth is growing at this scale. Jensen said it well: “AI is going everywhere, doing everything, all at once.”

AI is not hype. It is a multi trillion build out. But that does not mean it will go up in a straight line. There have already been several big drawdowns. And there will be many more. Each time the sceptics said the AI bull market was over. Each time they were wrong.

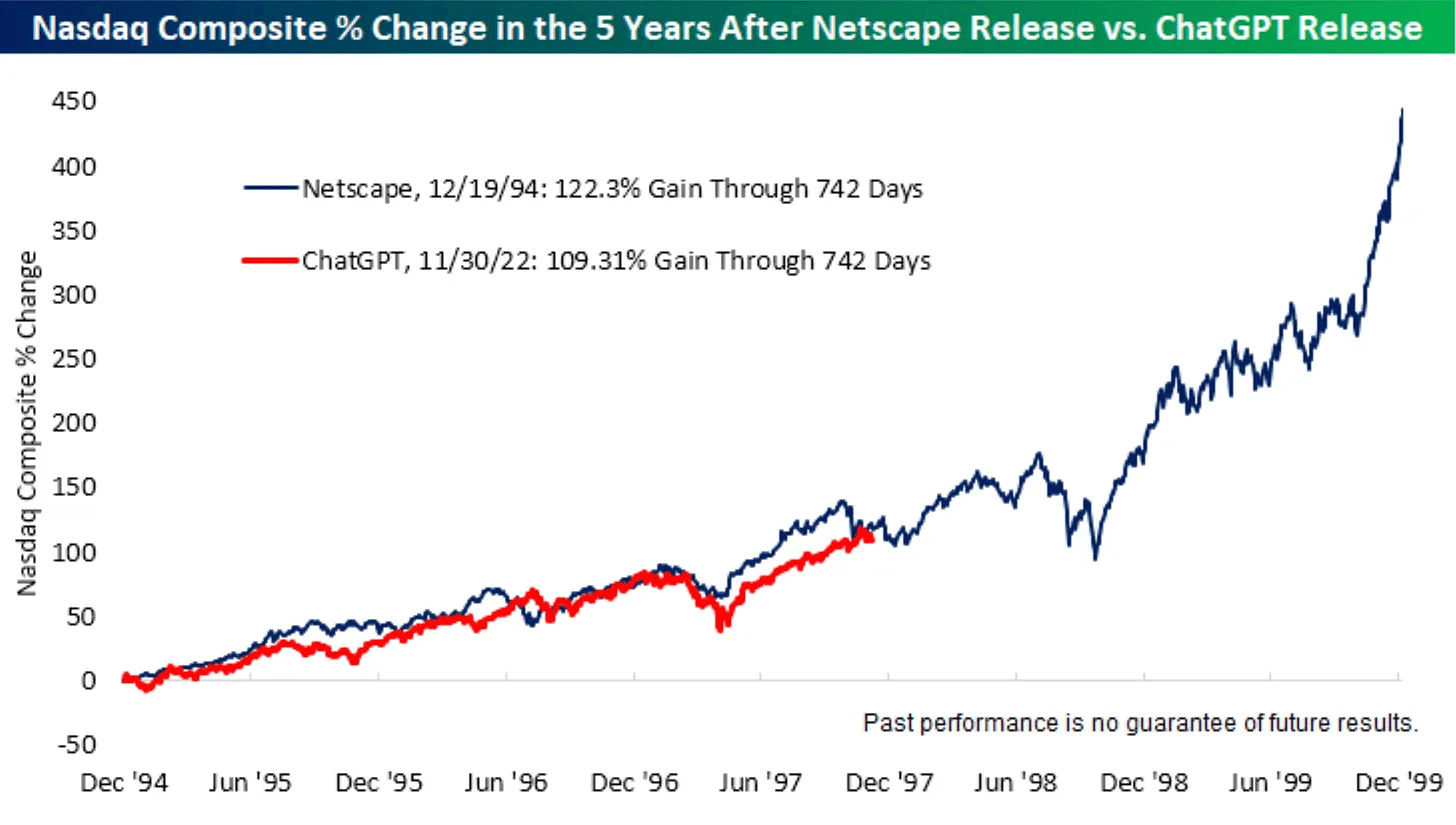

Sometimes it helps to zoom out and look at the long term chart. When you compare this to the dotcom bubble, we’re still only in the third inning. There is still room to run. And the actual big moves happen much later.

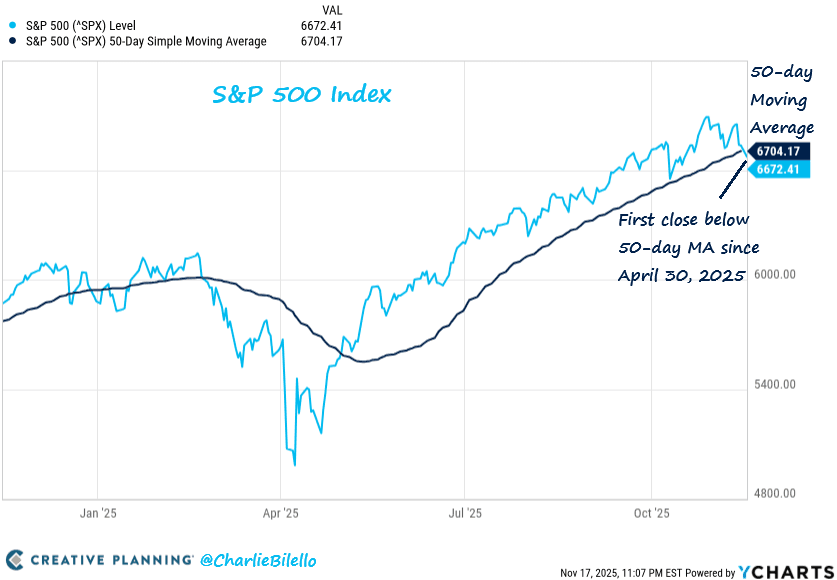

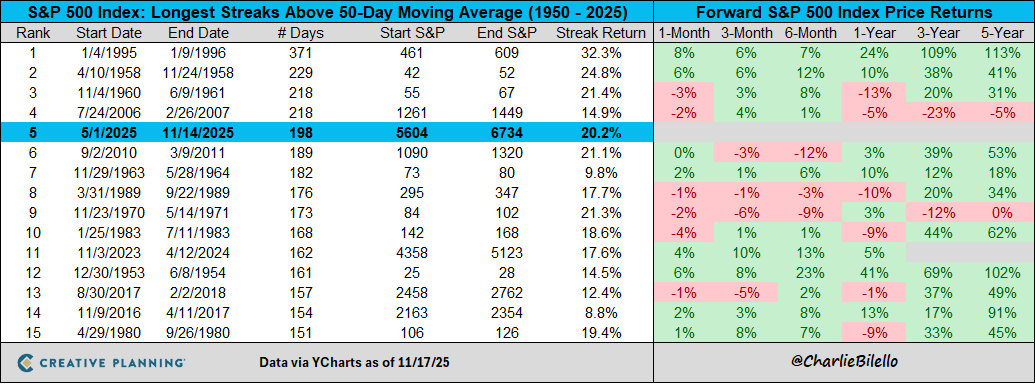

Last week the S&P 500 closed below its 50 day moving average for the first time since April 30.

That ended a 198 day uptrend. It was the fifth longest since 1950. This is why trend following matters. It keeps you safe from the worst drawdowns while still catching the big upside with zero guesswork.

So what now.

The most likely outcome is that volatility comes back. The rally since April was almost too smooth. It ran more than 40% without a simple 5% pullback. That is not normal.

We pulled back about 5.8% from the October high. Since the 2009 low we have seen 31 corrections bigger than 5%. Every single one came with scary headlines. Every single one felt like the end of the world. But the world did not end and the market made new highs each time.

Bitcoin has been crushed and is now the worst performing major asset in 2025. It is down about 36% from its all time high and even down for the year. That has never happened before. So either the rest of the market…

Lin

Nov 18, 2025

Market Update: Patience

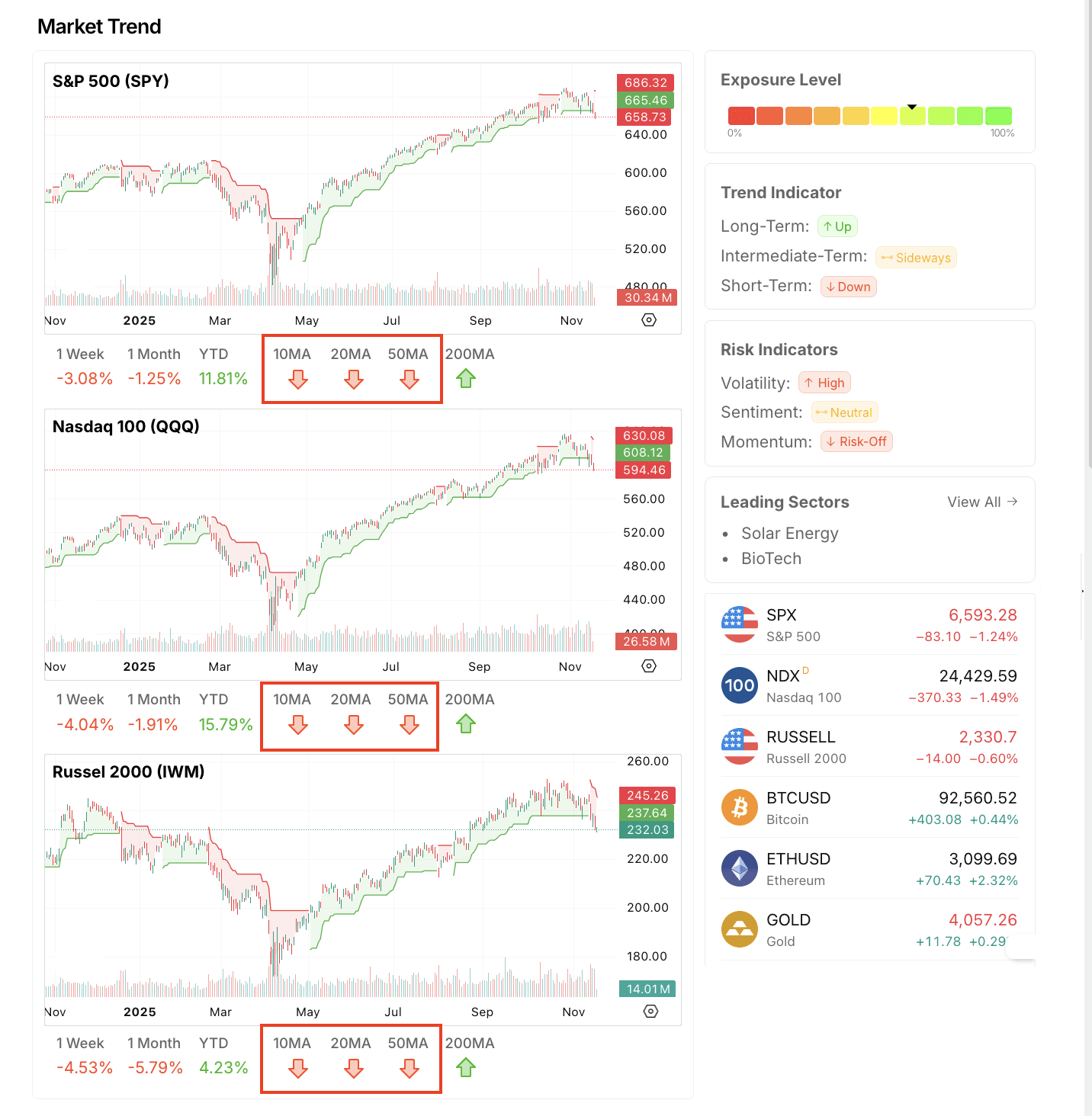

This is the first time since April that all the major indices are sitting below their 10, 20, and 50 day moving averages. That’s an important detail to notice. It tells you the tone of the market changed.

If you look at the move since April it has been almost straight up. Very clean trend. Now we finally see real weakness across the board. That alone is a good reason to be a bit more cautious.

You can avoid a lot of unnecessary stress if you wait for things to settle. The first sign of stability is the market reclaiming the 50 day. That one level filters out a lot of noise. If it manages to do that soon the bottom is likely in for this correction. But the longer it lives below it the risk is getting higher. Getting back above all of them would be ideal, but the 50 day is the key one to watch.

Until that happens it makes sense to stay a little more careful.

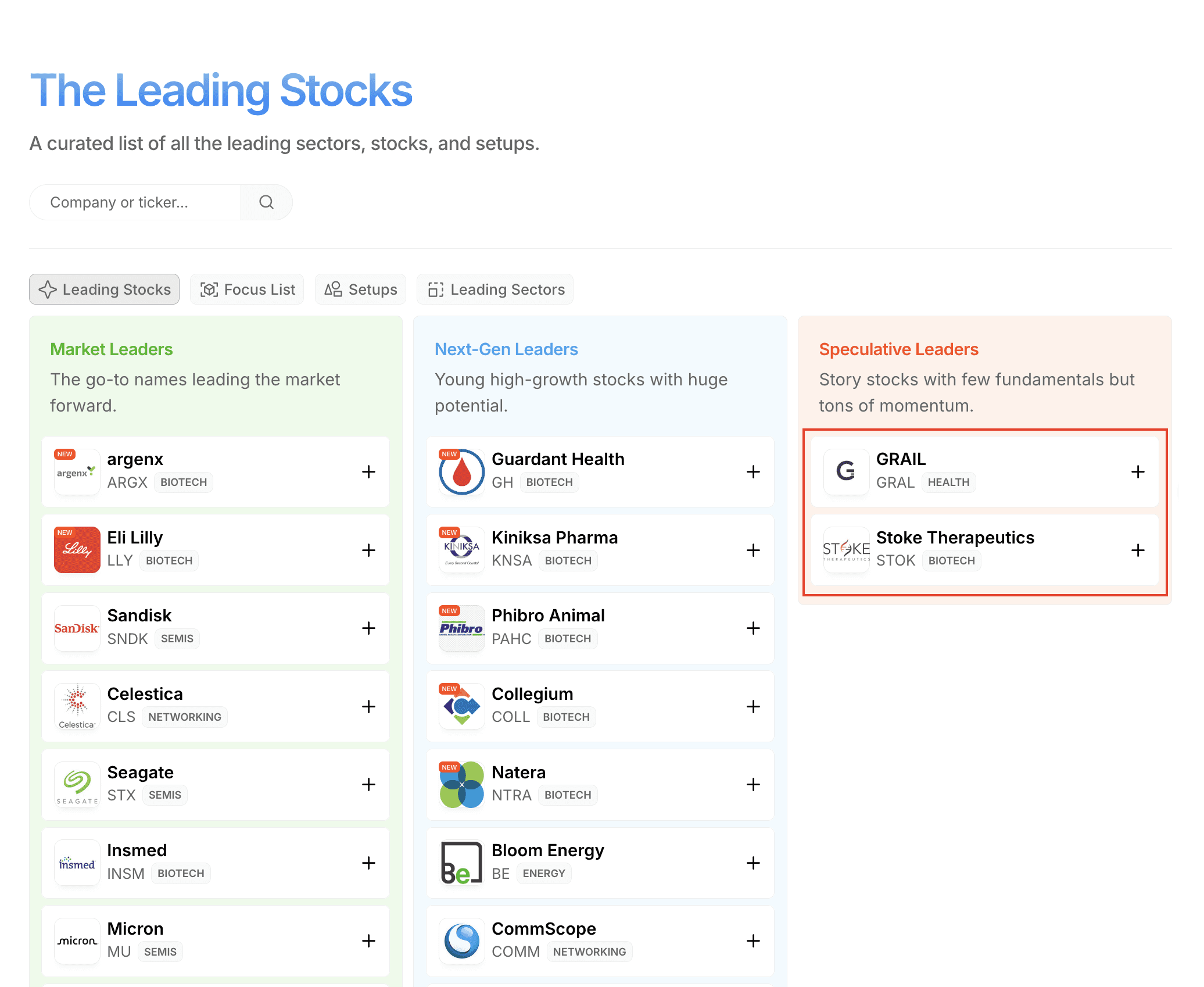

On top of that there is almost no interest in speculative names right now. There is basically zero appetite for risk. Just a few weeks ago this list was full of names. Now it is down to 2. It has been a complete washout for momentum names.

The only positive thing is that there are still a few leaders holding up. But even that group is getting smaller and smaller. It shows how selective the market has become.

All of this basically tells you to stay patient.

There is no reason to guess what comes next. When things turn it will be clear. Once the market improves you will get a ton of opportunities. You will almost feel overwhelmed because everything starts working at the same time.

It is so much easier to make progress when the market is in a healthy environment. You just need to be patient and wait for that window to open again.

Here are a few signs to watch for:

• A clear catalyst

• A strong and steady uptrend

• Major indices trading back above key moving averages

• Several themes working at the same time

• Big gap ups on strong volume

• Gaps holding instead of fading

• Follow through days

• Little volatility

• Pullbacks on low volume

• Pullbacks getting bought quickly

• Strong closes near the highs

• Positions starting to work almost right away

• You feel like there are almost too many opportunities

• Your equity curve is moving up steadily

These periods don’t come often. When you spot one you have to lean in and be aggressive because that is when you make real progress.

This is not that kind of environment right now.

Maybe Nvidia earnings will change the mood. We’ll find out soon. But that part is pure guessing. What you can do is to be prepared.

The next window of opportunity will come. It always does. And when it does you want to be ready to take advantage of it.

Lin

Nov 16, 2025

Weekly Market Update: No Appetite for Risk

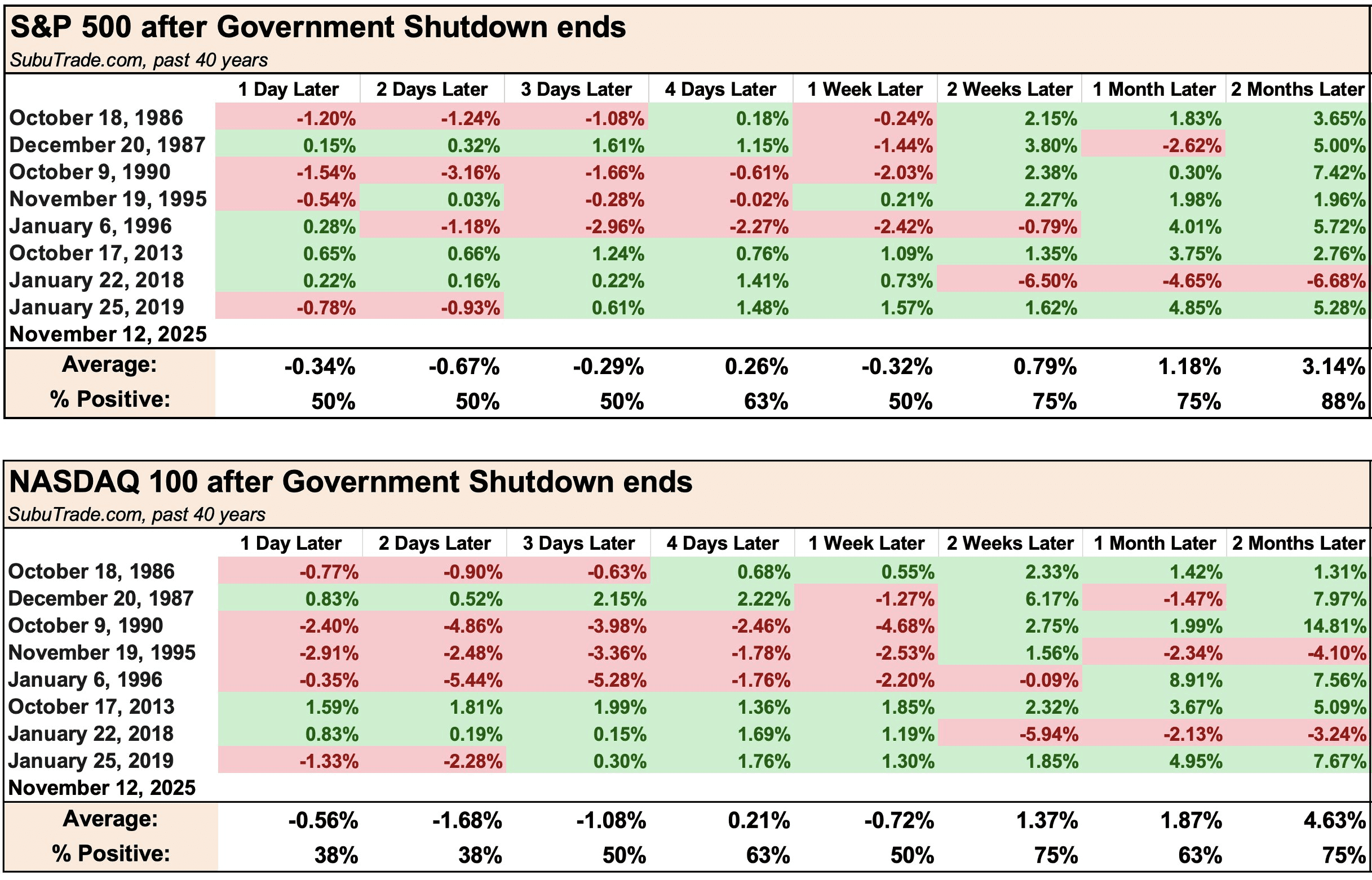

The longest government shutdown finally ended this week. It ran for 43 days from October 10 to November 12. And funny enough the S&P 500 still went up 2.4 percent during that time. If you only check the main indices you would think nothing happened, but below the surface volatility was intense.

And right after it ended the market kept selling off, which is not that surprising. A bit of downside volatility after a shutdown ends is pretty common. But if you look a few weeks out the market usually finds its footing again and turns back up.

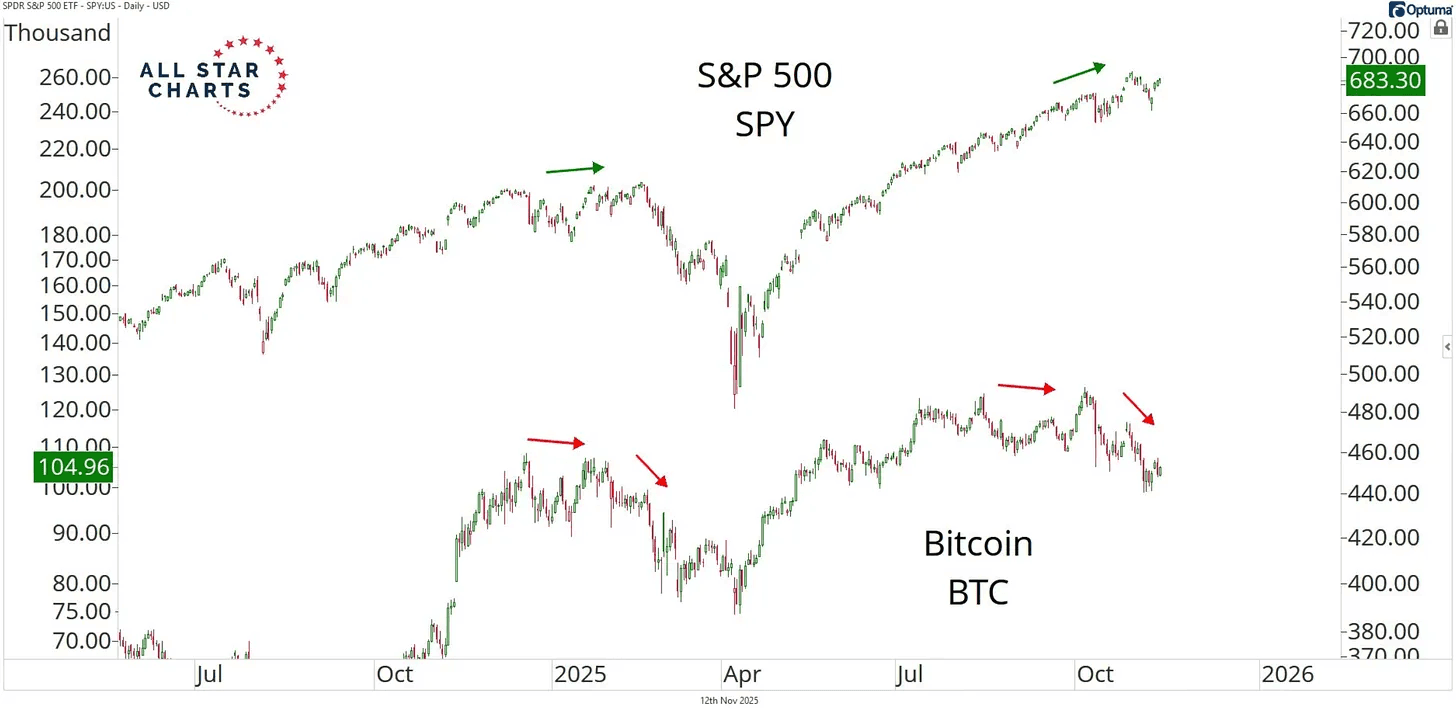

Bitcoin is still the best real-time indicator of how much risk investors want to take.

The S&P is sitting close to all-time highs, but Bitcoin actually topped in October and has been sliding since then. It is now down about 25% from its peak. And the weakness has spilled over into tech stocks as well.

Bitcoin is moving almost in sync with tech right now. The correlation is very high. So if Bitcoin keeps dropping it will likely pull tech lower as well.

Bitcoin is now sitting right on an important level.

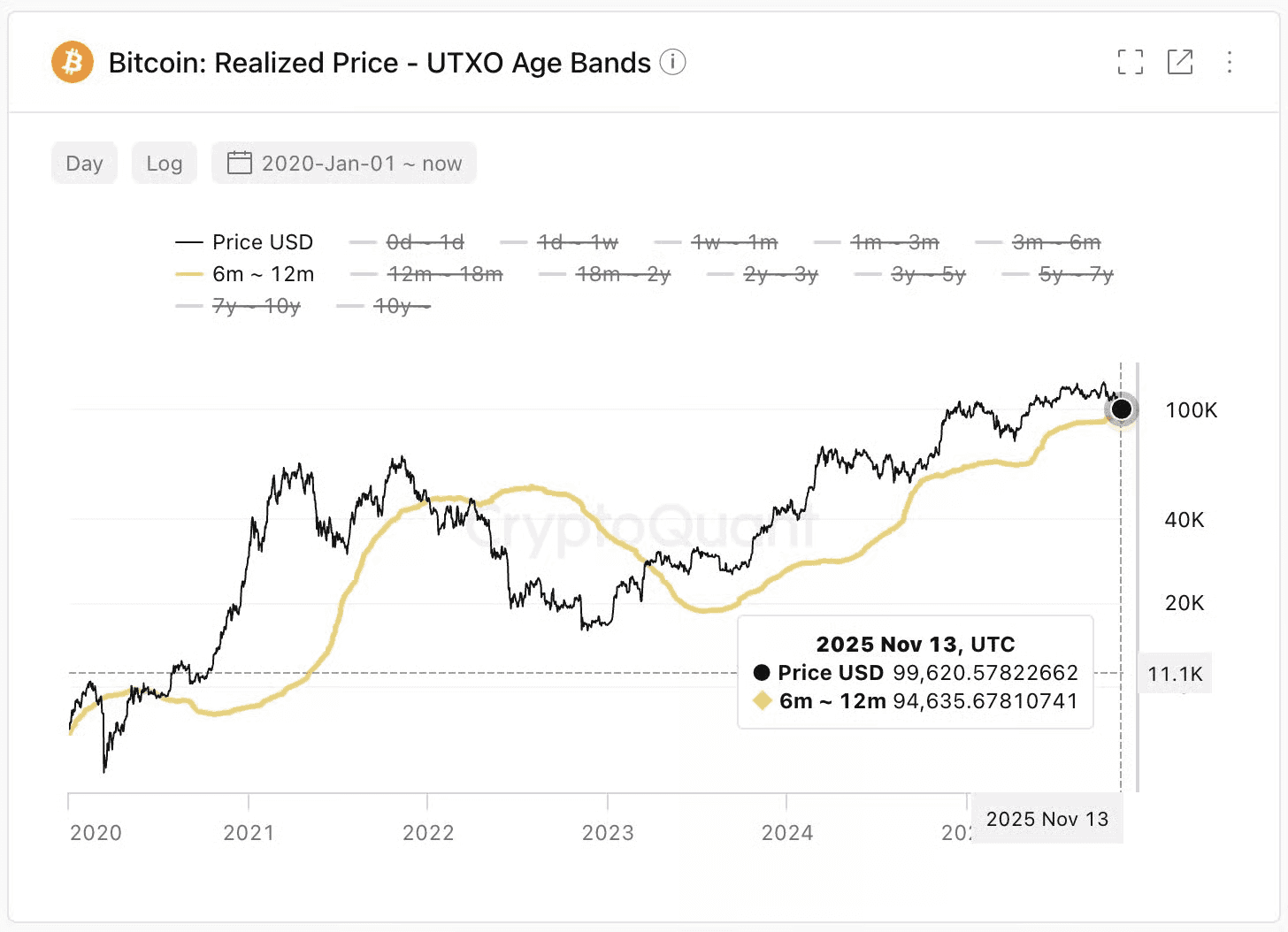

It just fell under 94,000, which means it has basically gone nowhere over the past year. It is trading right around the average price people paid in the last 6 to 12 months. This level needs to hold. If it drops much further it could trigger another large wave of sellers.

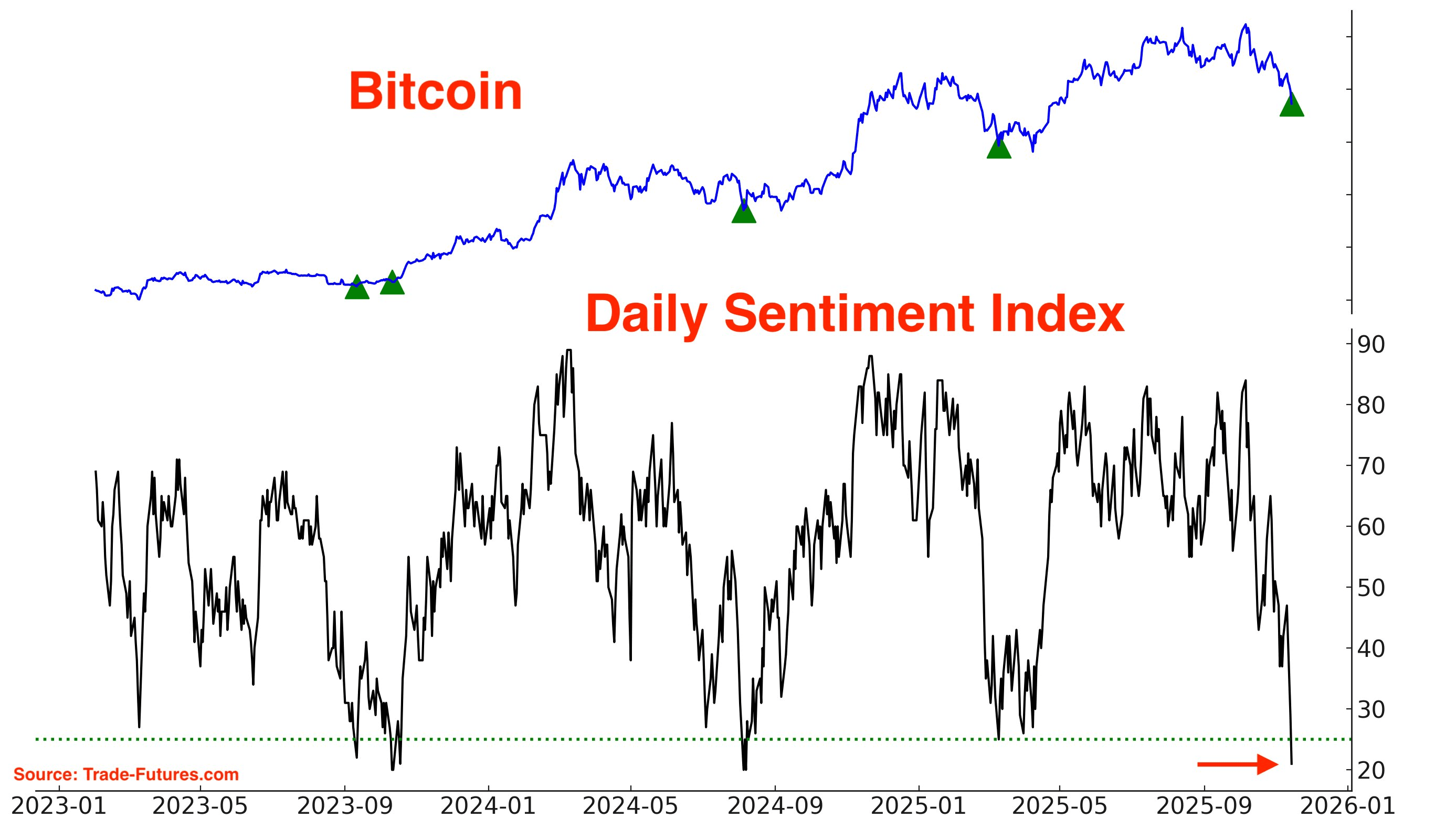

But sentiment is already very negative. In fact it is the lowest it has been in over a year, which sometimes sets up a rebound. So maybe this is where it finally finds a bottom. This is a do or die moment.

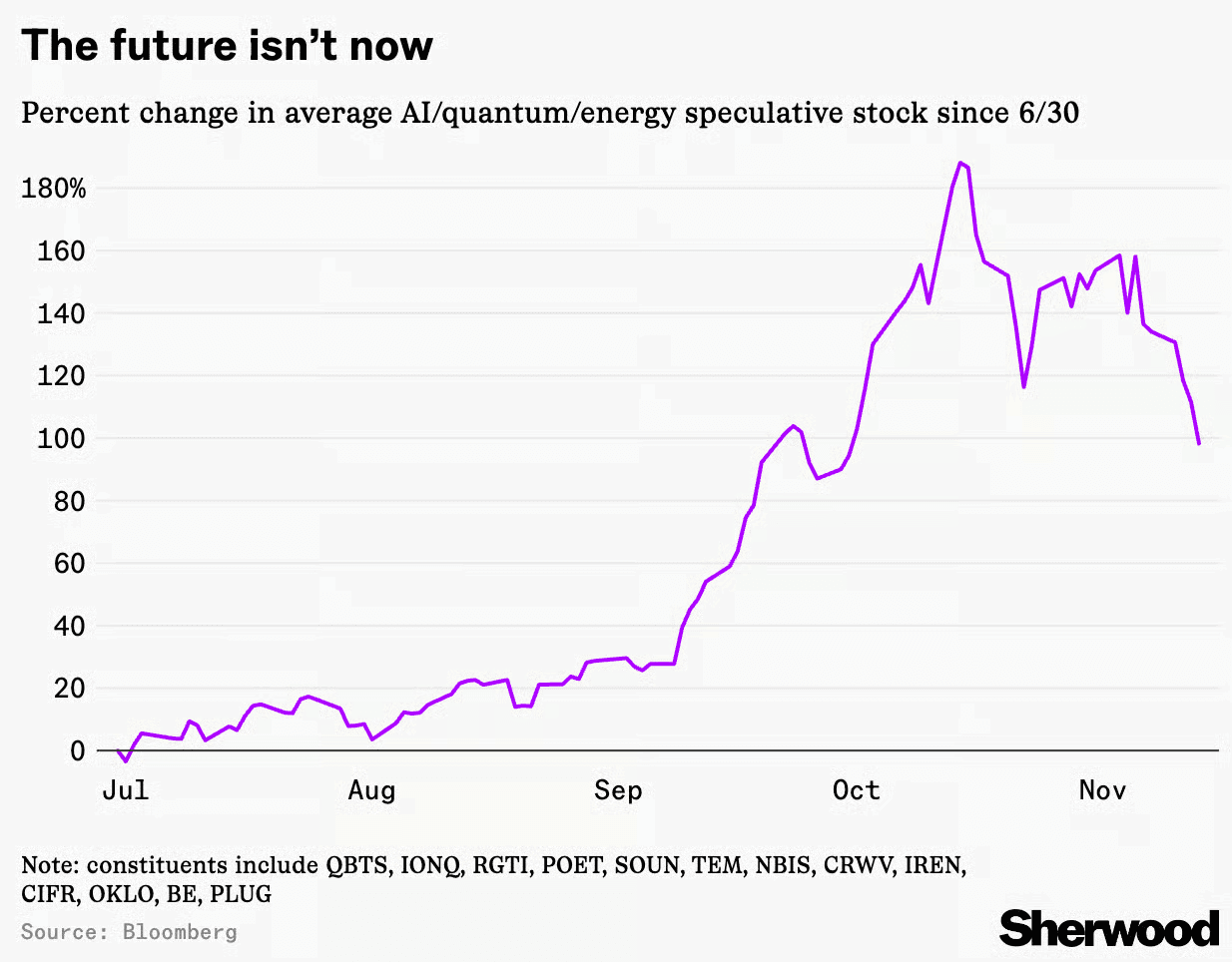

At the same time we have seen a sharp drop in many speculative stocks.

The high fliers in AI, quantum, and nuclear have taken big hits over the past month. To be fair many of them doubled or even tripled since the bottom in April, so a pullback was pretty much guaranteed. But still pullbacks can brutal if you bought near the top. This is why risk management matters so much and why staying in sync with the general market is so important.

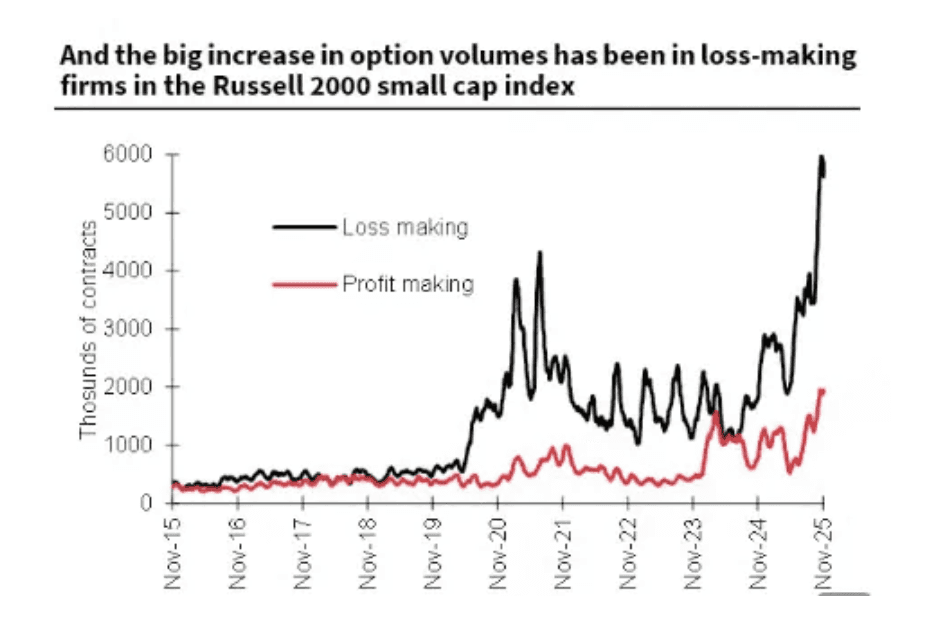

A lot of these big swings are tied to large amounts of leverage.

There has been massive buying of options. The problem with that much leverage is that it makes the market very sensitive to even the smallest moves. Every little drop gets amplified and turns into forced liquidation. That selling then creates even more volatility, and that is how we end up with the sharp drops we are seeing now.

The good news is that these corrections are healthy although painful. They wash out the excess leverage and reset the market so it can move higher again later.

So now investors are hiding in the biggest stocks again and treating them like a safe haven. This is classic megacap positioning. Everyone is crowding into the familiar winners because they feel safer than everything else right now.

But this chart is a good reminder that even the biggest stocks in the world are not safe from volatility. If you look back at 2022 you can see how far those names actually dropped. Nothing is immune when the…

Lin

Nov 10, 2025

AAPL

Buy

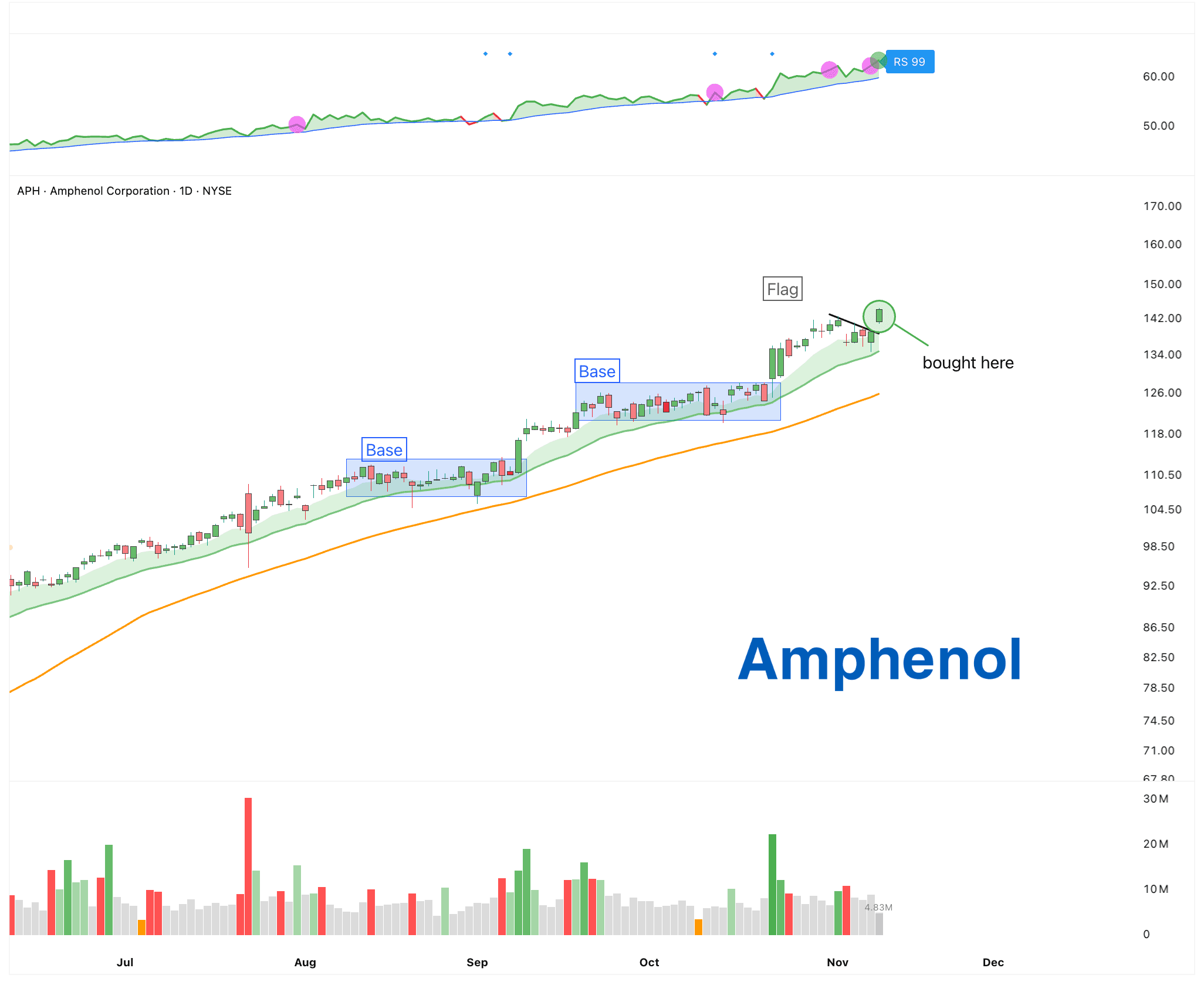

Buy: $APH

Amphenol is one of the companies that makes AI hardware actually work.

AI data centers and GPU servers need to move huge amounts of power and data very quickly. Amphenol makes the physical parts that make those connections possible. They build the high-speed connectors, cables, and sensors that sit between GPUs, memory chips, networking switches, cooling units, and power systems.

AI hardware is very demanding.

Signals move at extremely high speeds and temperatures inside the servers is intense. A weak connector can cause data errors, overheating, or even full system failure. AI simply doesn’t work without stable connections. Amphenol specializes in building those critical components that are strong, stable, and most importantly very reliable.

When someone like Amazon, Microsoft, Nvidia, or Tesla needs a new custom connector or cable system, Amphenol can design it, test it, and produce all in-house. Once those parts are designed into a server or device, they usually stay there for years. That makes the business steady and recurring.

As AI models get larger, data centers need more GPUs, more power, and more high-speed communication between chips. Every step of this growth requires more connectors and more interconnect systems. Amphenol doesn’t have to guess which AI company becomes the winner. They sell to all of them. They benefit from the entire wave of AI expansion.

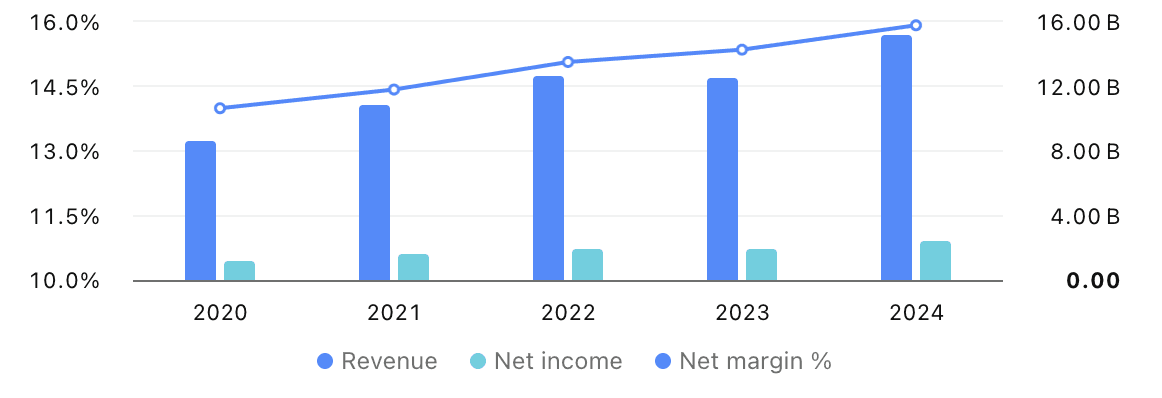

Similar to Celestica, Amphenol has been growing steadily for years with strong margins. But the AI boom has taken that steady growth and pushed it into a new gear. The demand for high-speed data connections inside AI servers is exploding.

Lin

Nov 10, 2025

AAPL

Watch

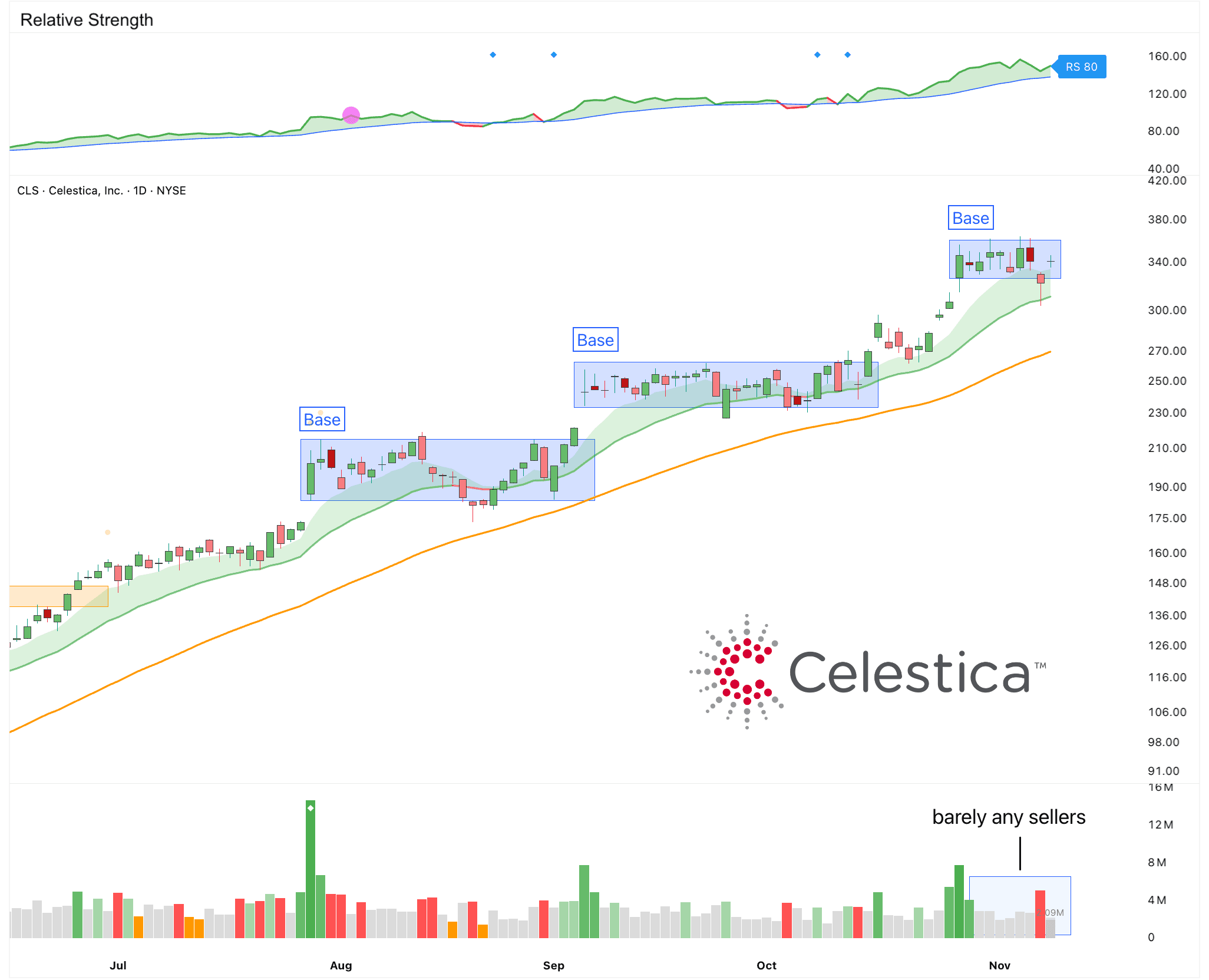

Stock to Watch: $CLS

AI data centers are being built everywhere.

But someone has to actually design and assemble the hardware that makes them run. And only a small number of companies in the world can do that at scale.

Celestica is one of them.

It specializes in designing, sourcing, assembling, and testing the systems that power large-scale computing.

They manage the entire process: engineering the hardware, securing the components, coordinating suppliers, and then manufacturing and delivering finished systems.

Their focus is not on low-cost consumer devices. They build high-performance, high-reliability equipment where quality and precision matter.

Because of this, you do not see their brand on the products. They are the partner behind the scenes.

When companies like Nvidia, AMD, Microsoft, Amazon, or large enterprise customers need a custom server architecture built and delivered globally, they go to Celestica. These customers rely on Celestica to get the design right, source the right materials, solve production bottlenecks, and scale output quickly.

Right now, the most important part of the business is AI data center infrastructure.

AI hardware has become much more specialized and extremely power-dense. Cooling and power delivery are now as critical as the chips themselves.

Celestica builds the server racks, power units, cooling systems, and networking hardware that companies like Nvidia, AMD, and major cloud providers rely on to train and run large AI models.

It had already been growing steadily, but the AI supercycle has accelerated that growth in a major way. And even during the recent correction, it held up while many others sold off.

Lin

Nov 9, 2025

Weekly Market Update: The Price of Admission

What a week.

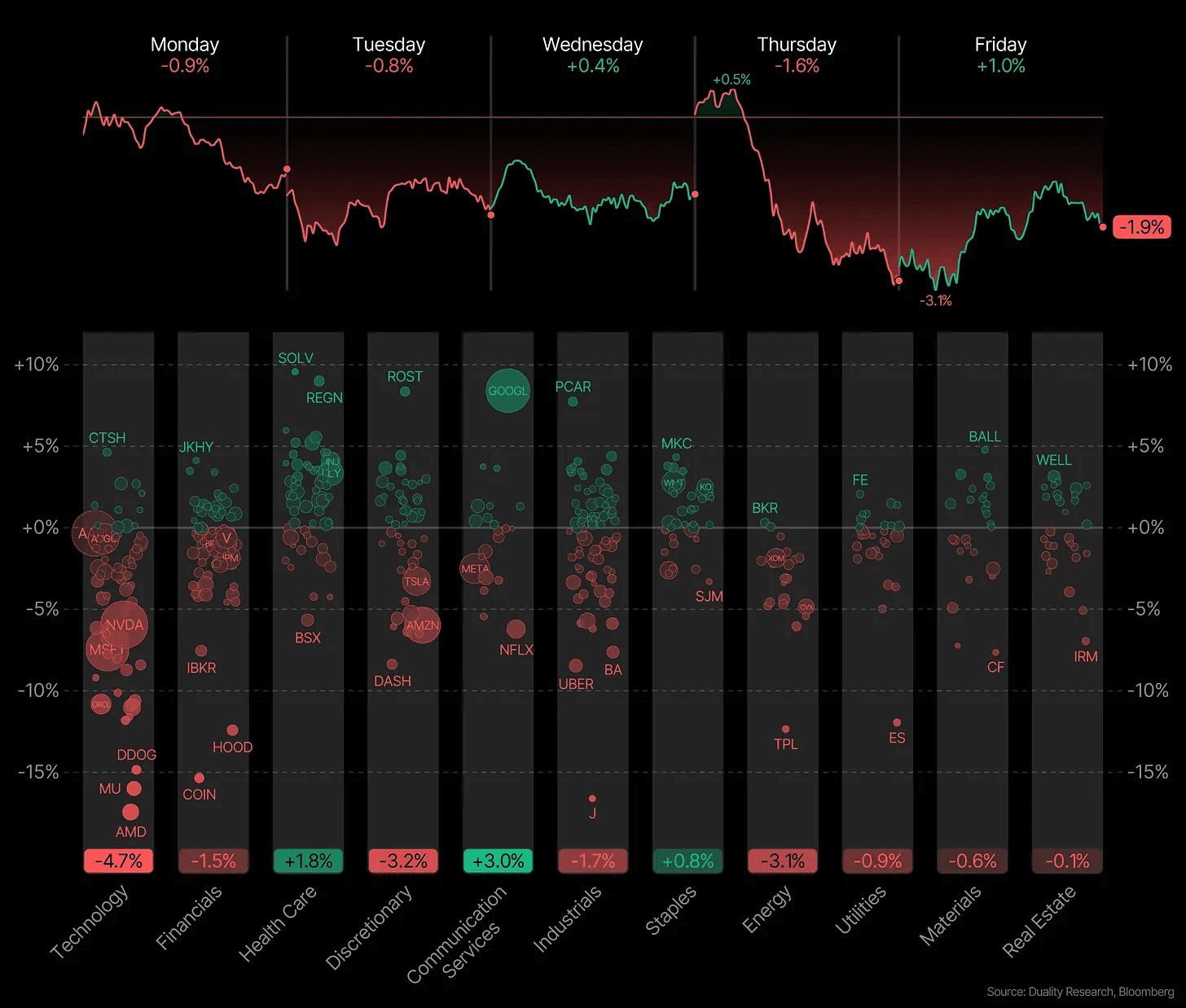

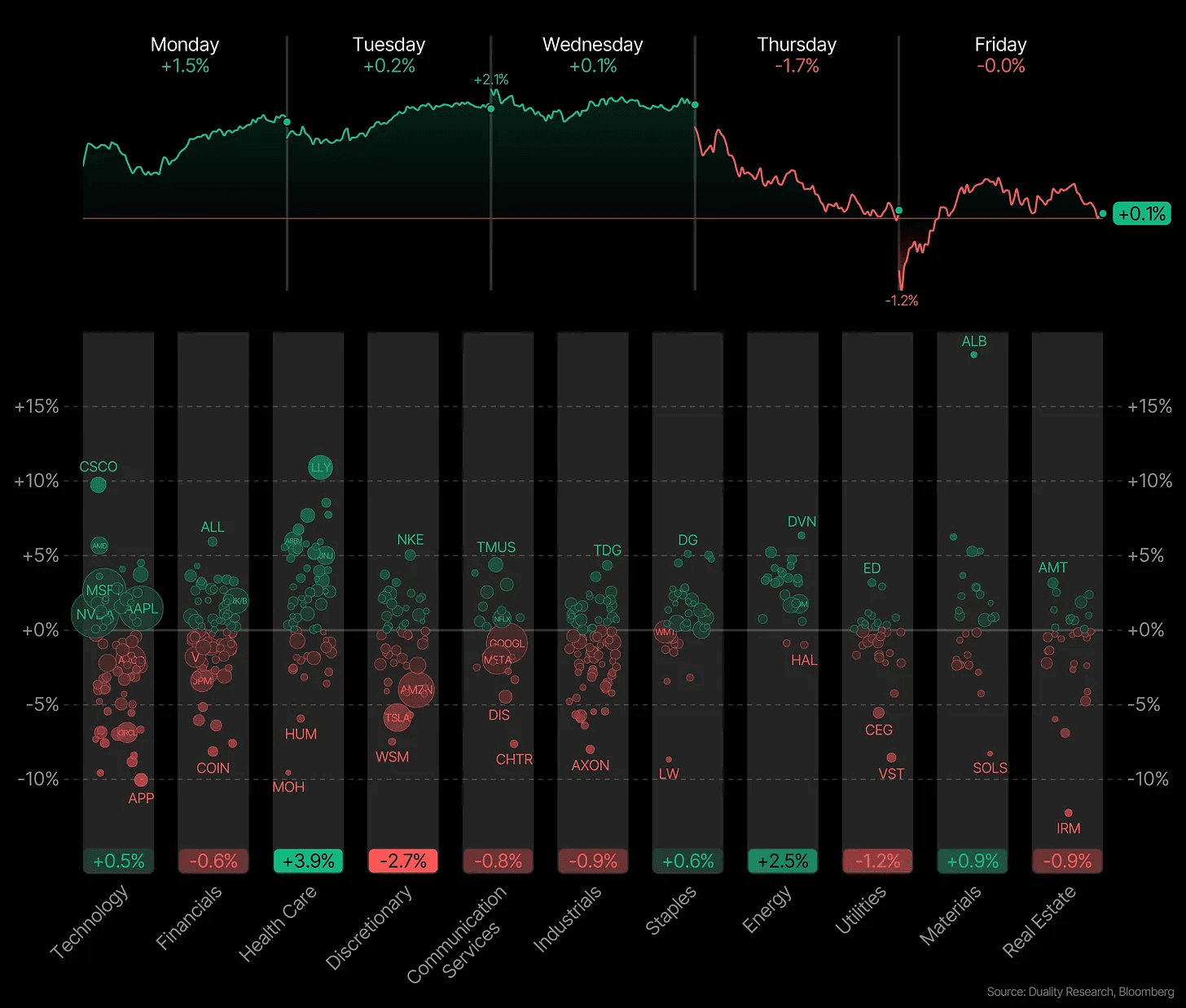

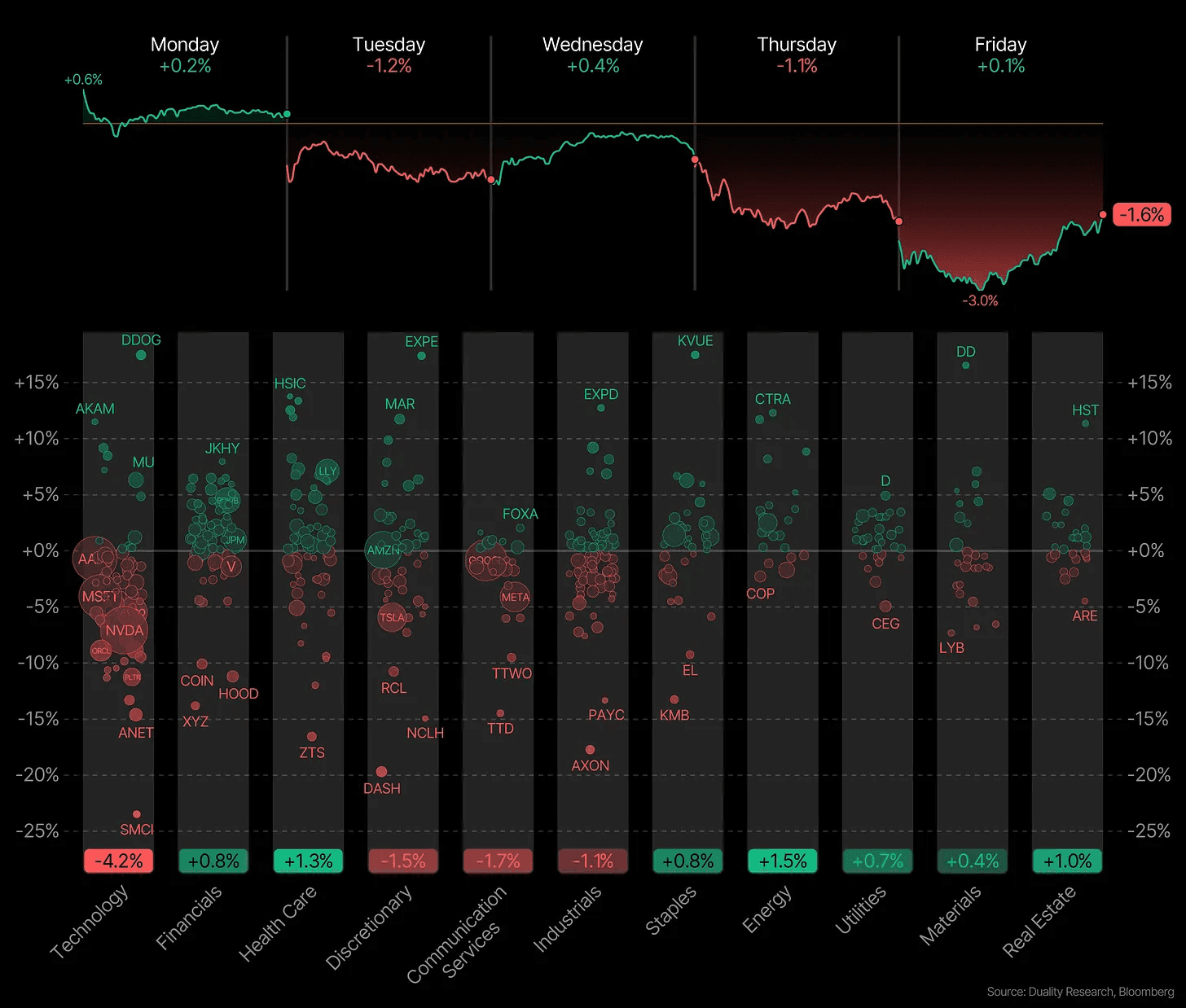

Monday opened strong and sold off. Tuesday gapped down. Wednesday recovered. Thursday gapped down again. Friday opened lower but finished flat. In the end, the S&P closed the week down about 1.6%.

But the index is hiding what’s happening underneath.

The S&P 500 is down at the lows 4% and 6% for the Nasdaq 100.

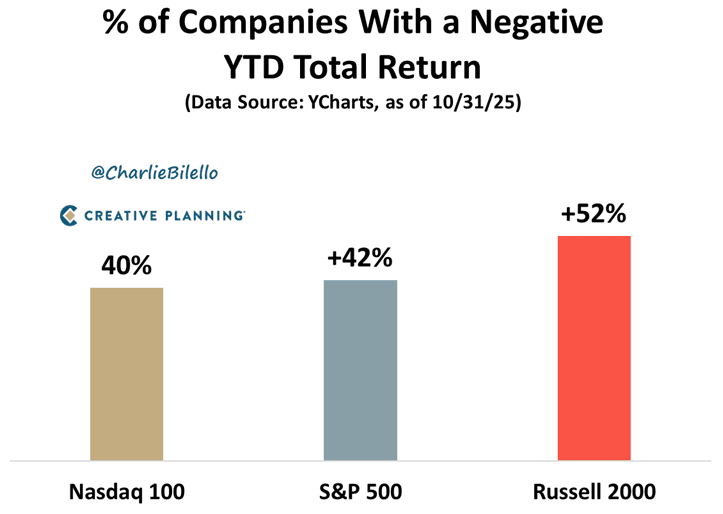

Earlier this year, roughly two-thirds of the index was positive year-to-date. Now, even with the index still close to its highs, only about half of the stocks are still up YTD. A smaller group of names is doing most of the work.

This isn’t new. In October, the major indices hit new highs while a large share of individual stocks did not. About 40% of the Nasdaq 100, 42% of the S&P 500, and more than half of the Russell 2000 were negative for the year at that point. The market has been getting narrower for months.

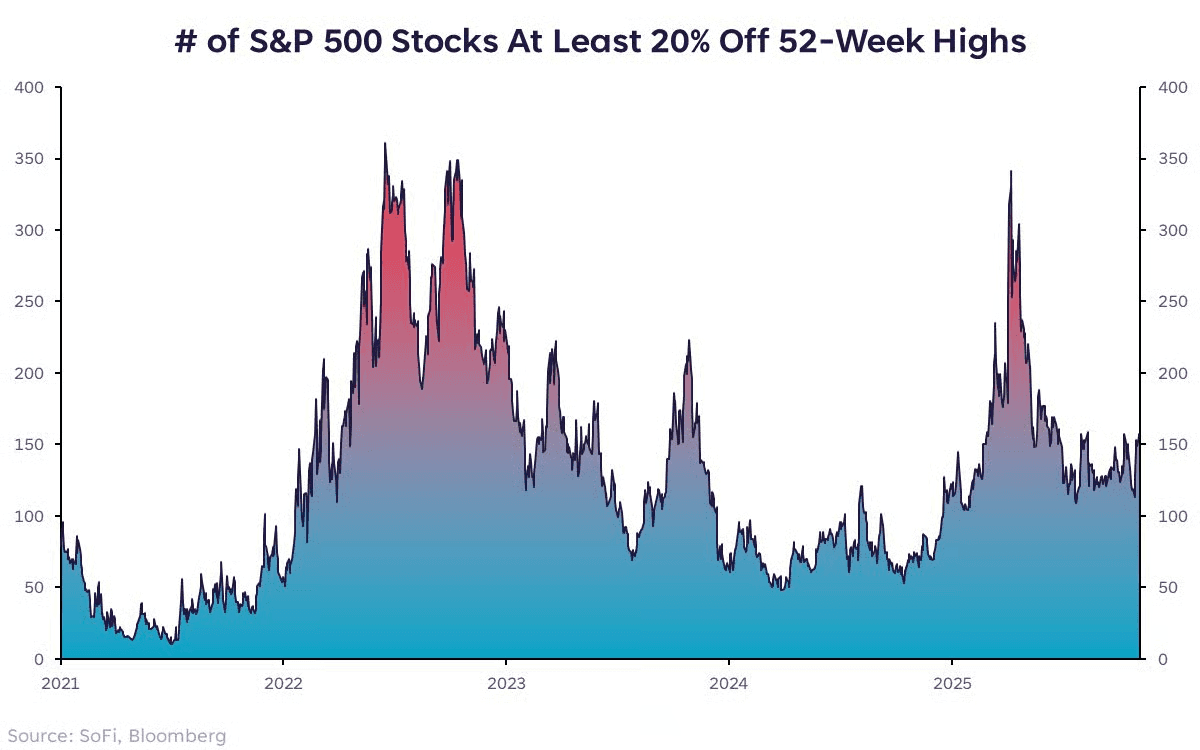

You can see it in the decline from recent highs. More than 150 stocks in the S&P 500 are down at least 20% from their 52-week highs. That is nearly double what we saw last year. Leadership is concentrated in only a handful of names.

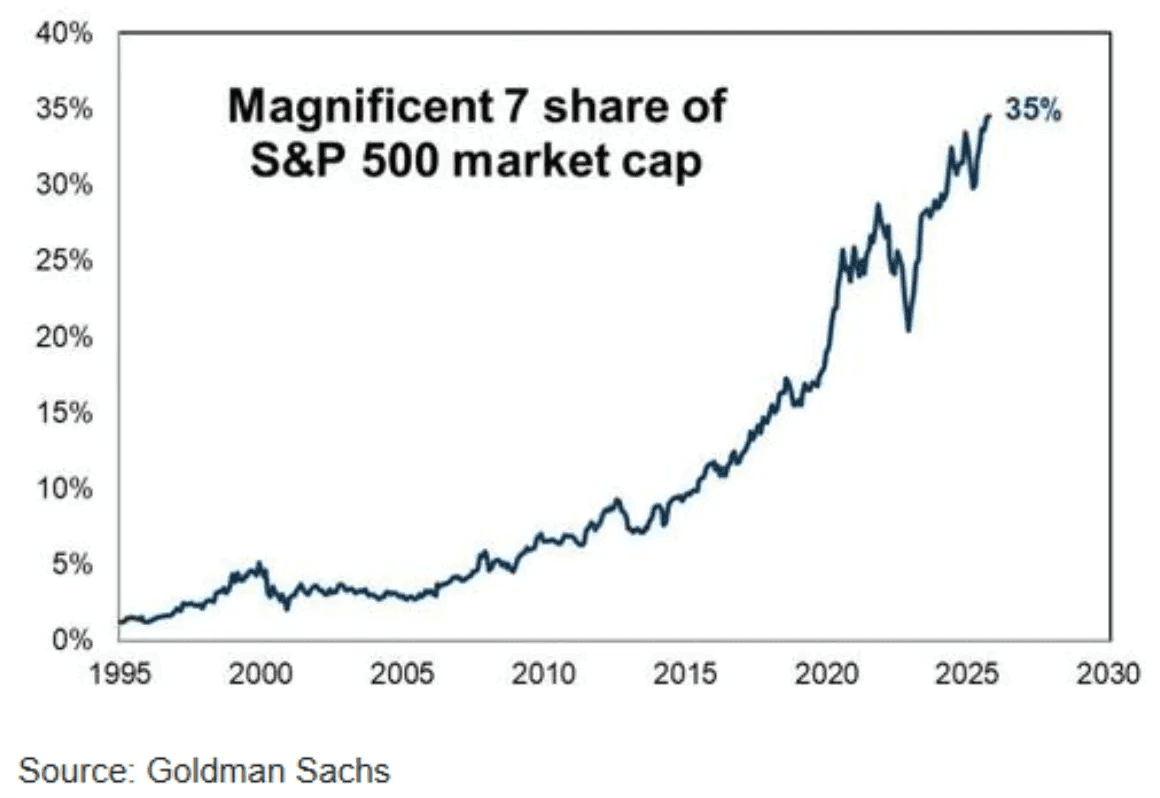

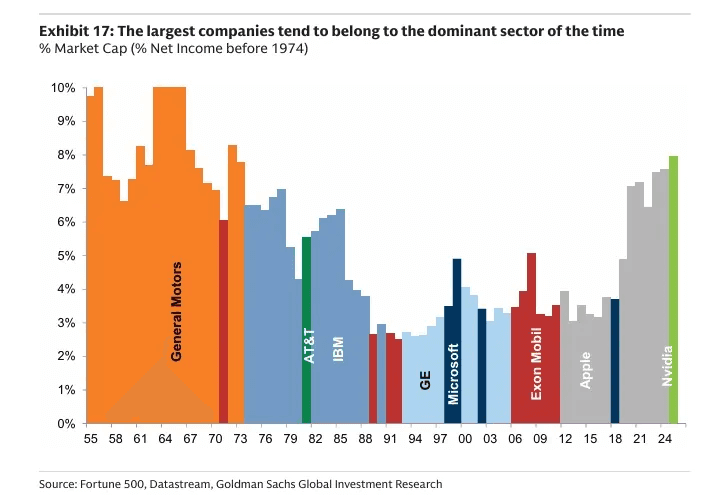

The market has been carried by just a few giants. The Mag 7 now make up more than 35% of the entire index. But this is not the same as the market being held up by one narrow theme or one risky bet. These companies run huge, diverse businesses. They touch cloud, AI, chips, hardware, software, and massive consumer platforms. They are some of the strongest and most durable companies in the world.

We’ve seen this before. When cars became popular, General Motors became the biggest company and stayed on top for years. When computers took off, IBM did the same.

If AI is a real, lasting shift, then companies like Nvidia will stay on top for a long time. The demand for AI chips and infrastructure is only just getting started. If this trend continues even halfway as expected, they remain the center of the new economy.

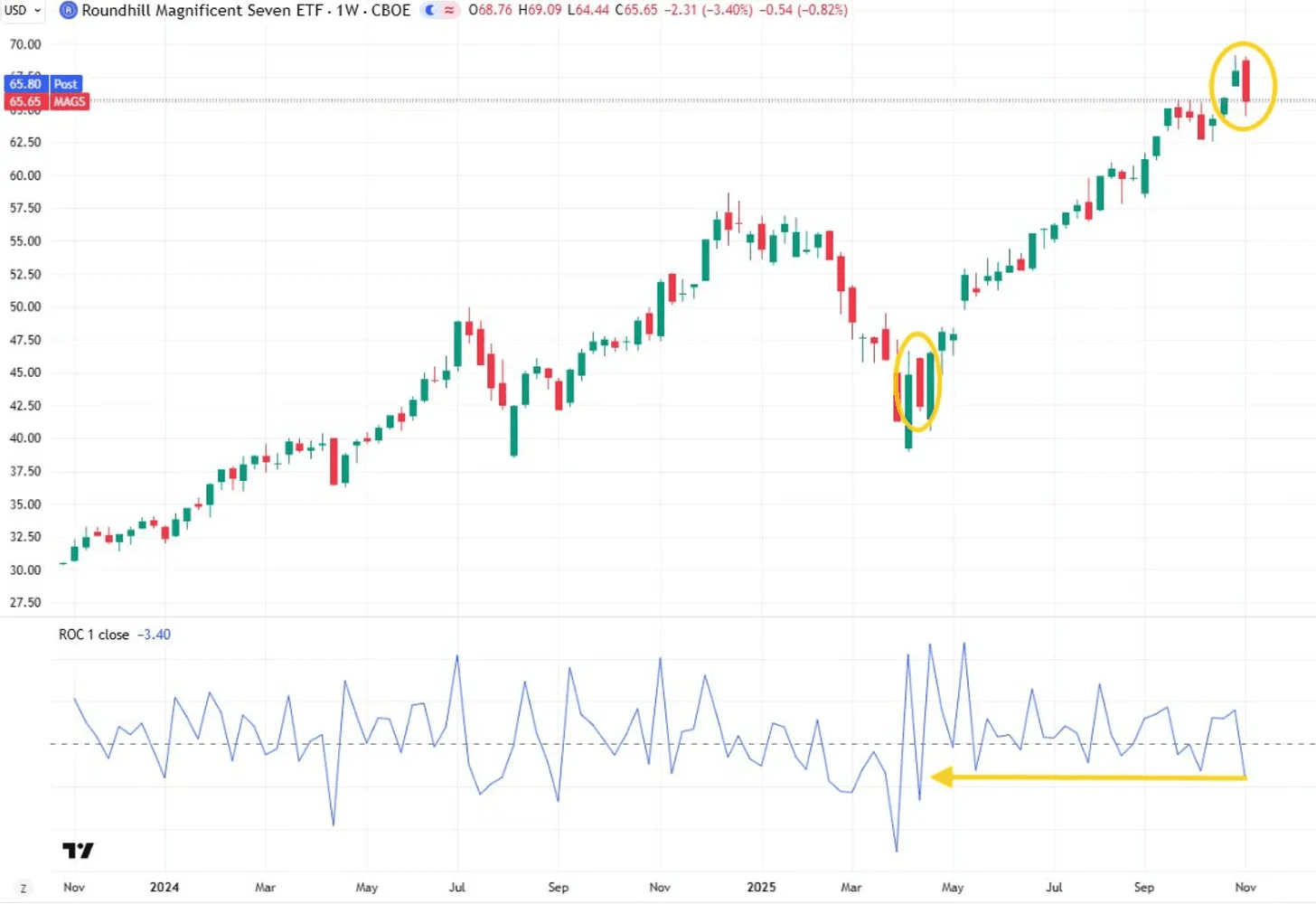

But when the market depends too much on just a few big stocks, the whole market becomes fragile. Those big names are basically holding everything up. So if they start to fall, the rest of the market usually follows. The Mag 7 just had their weakest week since April, falling more than 3%.

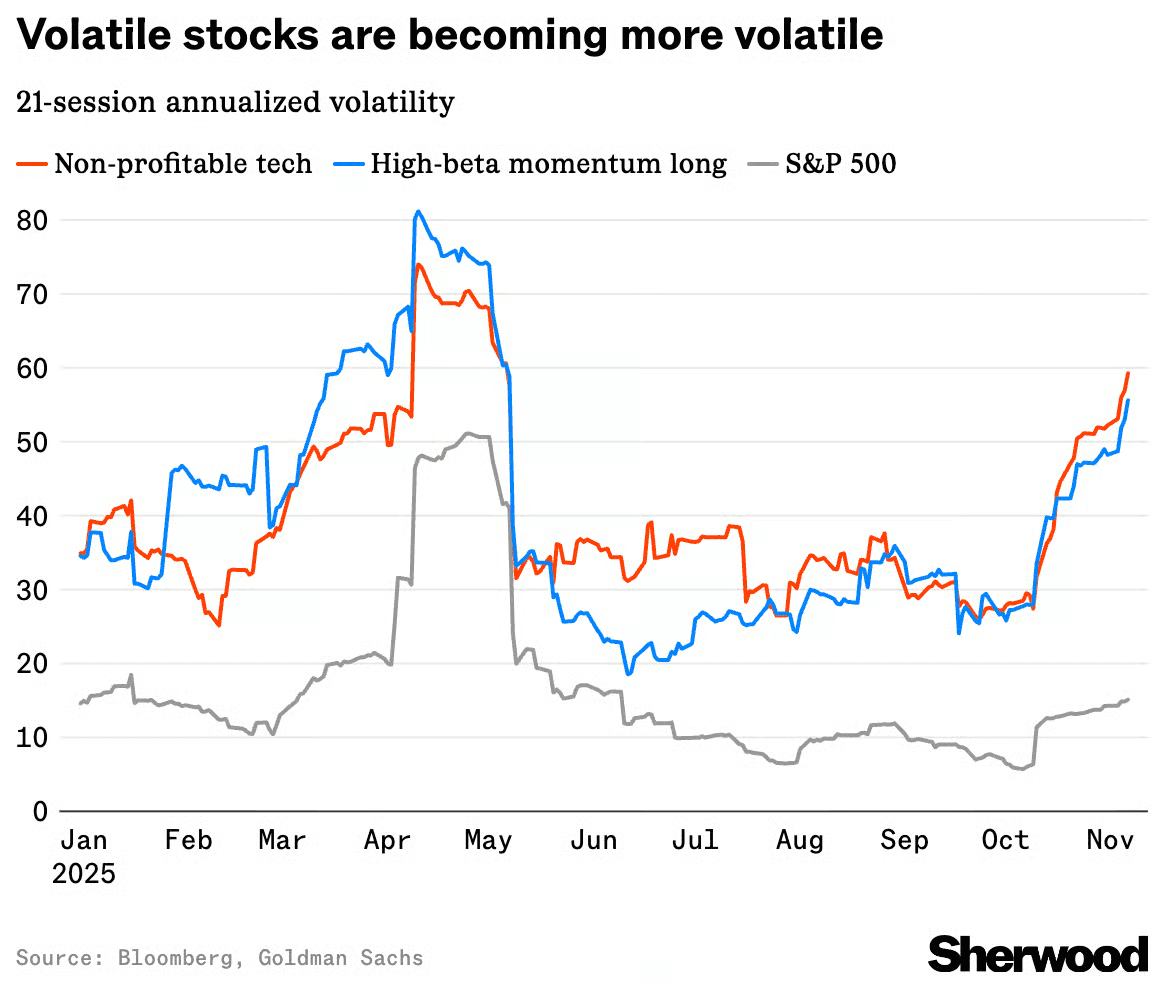

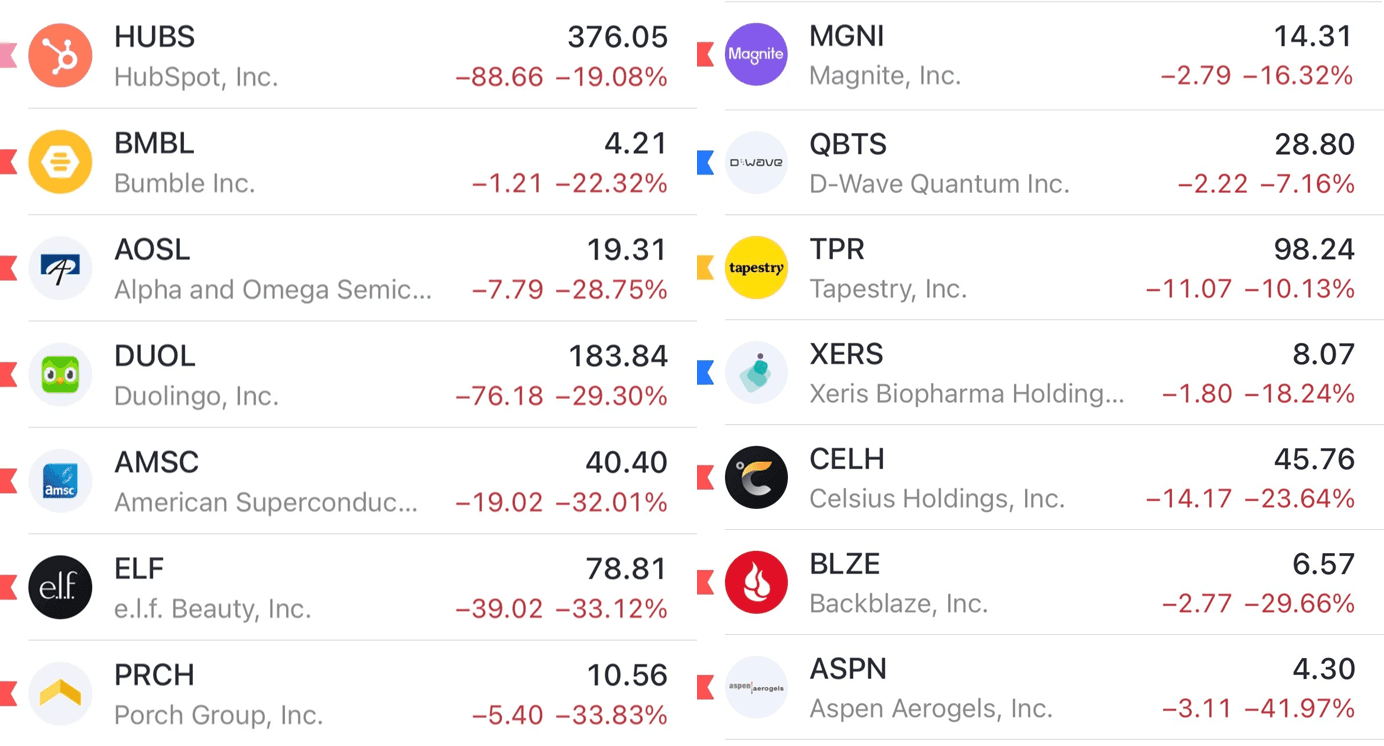

High beta and unprofitable tech stocks were hit even harder than the broad market. These are the names that tend to move the most when sentiment shifts, and this time was no different. Volatility in this group has jumped back to levels we last saw during the tariff shock years, because investors always pull back from the highest-risk areas first.

For many of these stocks, the declines have been sharp. It’s not unusual to see individual names down 15%, 20%, or even 30% in a matter of weeks or even days.

Bitcoin has been weak. It fell below its 200-day moving average and is now more than 20% below its recent peak. Bitcoin often moves first when investors become more or less willing to take risk, so this drop suggests risk appetite has cooled.

A big part of the decline came from…

Lin

Nov 6, 2025

Market Update: Earnings Carnage

Earnings season has been severely unforgiving. Strong results haven’t been rewarded, while even minor misses have resulted in sharp sell-offs. The market is clearly prioritizing risk reduction over upside right now.

It’s been an absolute bloodbath in many growth stocks.

I’ve highlighted this a while ago but it doesn’t hurt to repeat.

This is not a supportive environment for growth stocks.

It doesn’t mean it’s time to sell everything or short the market. This bull market still has room to run. But it might be wise to take a few chips off the table, lock in some profits, get rid of weaker positions, and slightly reduce exposure. This isn’t about perfectly timing the market. That’s impossible. It’s about managing risk.

De-risking the portfolio after a strong rally helps limit drawdowns, smooth out volatility, and be able to take advantage of new opportunities.

Hence, I’ve reduced my exposure a bit to adjust to current market conditions. The environment is a lot less predictable, and I’d rather stay flexible as things evolve.

Most people think you have to pick a side. Either you’re bullish or you’re bearish. But that kind of all-or-nothing mindset will get you into trouble eventually.

Instead, think of your portfolio like a dimmer switch.

When the market conditions are good, you turn the exposure up. When they deteriorate, you turn it down. There's no reason to go from 0 to 100 or vice versa.

Yes, you’ll miss a bit of upside sometimes. That’s fine.

Missing upside doesn’t kill you.

Big drawdowns do.

The goal is to stay in the game.

There will always be opportunities to make money in the markets. But you have to survive to take advantage of them.